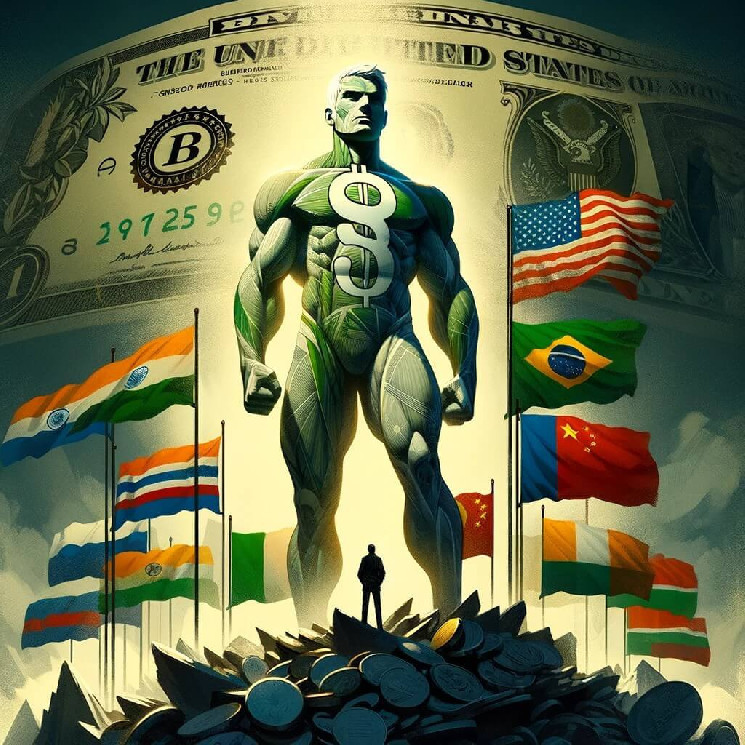

As the curtain falls on 2023, the U.S. economy embarks on its journey towards recovery, bolstered by a slowdown in interest rate hikes. The Federal Reserve maintains a hopeful stance, anticipating rate cuts next year as the inflationary pressure on the U.S. dollar shows signs of easing. Amidst this economic upturn, the BRICS bloc – a coalition of emerging economies – continues its mission towards de-dollarization. However, a leading American financial giant, Bank of America, stands firm in its belief that the U.S. dollar will hold its ground against these challenges.

The Resilience of the U.S. Dollar

Bank of America’s optimism isn’t just a shot in the dark; it’s rooted in concrete economic trends and the robust performance of the U.S. dollar. In September, the bank’s CEO, Brian Moynihan, expressed confidence in a soft landing for the U.S. economy, a sentiment echoed by many financial strategists. This optimism has only been reinforced as inflation begins to wane.

The BRICS nations, despite their growing influence and concerted efforts to shift away from the U.S. dollar, face an uphill battle. The U.S. dollar has been the linchpin of global trade for nearly a century, and its dominance isn’t waning anytime soon. Even as more countries express interest in moving away from the dollar, the greenback’s strength continues to assert itself on the global stage. This is particularly evident in the face of BRICS’ expansion and their push to elevate local currencies in international trade.

In September 2023, the U.S. economy outperformed expectations despite the challenges posed by BRICS against the dollar. The resilience of the greenback against BRICS currencies has exerted pressure on their trade sectors. Contrary to the recession forecasts, the U.S. is witnessing a gradual economic rebound.

Economic Indicators and the Road Ahead

The recent job reports exceeded expectations, bolstering the U.S. dollar in the foreign exchange markets. This positive turn in the American economy has led Moynihan to reiterate his prediction of a soft landing, rather than a recession. This belief is supported by robust consumer spending and increased customer savings observed at Bank of America, indicative of a strong job market.

However, it’s not all smooth sailing. Moynihan cautions that the U.S. economy isn’t out of the woods yet. Inflation remains a significant concern, with the potential to derail the economic recovery. The key to sustaining this upturn lies in controlling inflation and maintaining it around the Federal Reserve’s 2% target.

As for the BRICS alliance, their ambitious goal to replace the U.S. dollar with local currencies in global trade continues to be a distant target. The U.S. dollar’s entrenched position as the world’s reserve currency, coupled with the American economy’s resilience, poses a formidable challenge to BRICS’ aspirations.

Bottomline is Bank of America’s outlook for the U.S. dollar remains bullish, despite the ongoing efforts of BRICS nations to undermine its global supremacy. The greenback, riding on the back of a recovering U.S. economy and its century-long dominance in global finance, seems well-positioned to maintain its status. BRICS, on the other hand, while making strides, still has a long way to go in its quest to dethrone the U.S. dollar. For now, the dollar reigns supreme, a testament to the enduring strength of the U.S. economy and its financial institutions.

Read the full article here