XRP (XRP) price fell 22% between March 19 and March 31, potentially forming a local bottom at $2.02. The price then increased by 9% to $2.20 before retracing to the current levels.

Has the popular altcoin finally bottomed out, or is there a deeper retracement in the cards?

XRP bullish divergence on multiple timeframes

The XRP relative strength index (RSI) displays bullish divergence conditions in lower timeframes, according to popular analyst CasiTrades.

A bullish divergence is when the asset’s price prints lower lows, whereas the RSI produces higher lows, indicating that downward momentum is waning.

“After reaching the 0.786 retrace at $2.05, XRP is printing bullish divergences from the 15-min all the way up to the 4-hour chart,” the analyst said in a March 31 post on X.

CasiTrades notes that these signals are a positive indicator both for short-term bounces and potential macro recovery.

“That’s the kind of signal we want to see for both short-term bottom and macro! -the bounce is holding so far!”

XRP/USD hourly chart. Source: CasiTrades

She added that $2.25 remains a key resistance level to watch, as breaching this level with strong momentum would signal a convincing bullish breakout.

“If we break above $2.25 with strong momentum, that would invalidate the need for another support retest—a very bullish sign,” CasiTrades said, adding that the demand zone between “$2.00 and $2.01 remains a support if the $2.05 doesn’t hold.”

The analyst projects a bullish month for XRP in April, with targets of $2.70 and $3.70 in the short term.

“Once the price reaches its target, I expect a large impulse to the upside! Key resistance aligning to $2.70 and $3.80.”

Related: XRP funding rate flips negative — Will smart traders flip long or short?

Is the XRP local bottom in?

Despite XRP’s recent recovery from local lows, the risk of a deeper correction remains, according to veteran trader Peter Brandit.

Last week, Brandt said the presence of a “textbook” head-and-shoulders pattern (H&S) could see XRP price as low as $1.07.

This potential H&S pattern is still in play on the daily chart (see below) and will be completed on a break and close below the neckline at $1.90.

If the price stays below the neckline, the pair could plummet to $1.50 and then to the pattern’s target of $1.07.

Brandt said:

“Below $1.9, I would not want to own it. H&S projects to $1.07. Don’t shoot the messenger.”

XRP/USD daily chart with H&S pattern. Source: Cointelegraph/TradingView

Brandt states this bearish chart pattern will be invalidated if buyers push and maintain the price above $3.00.

Meanwhile, macroeconomic headwinds from US tariffs on April 2 could spook traders, pulling the XRP price toward $1.31.

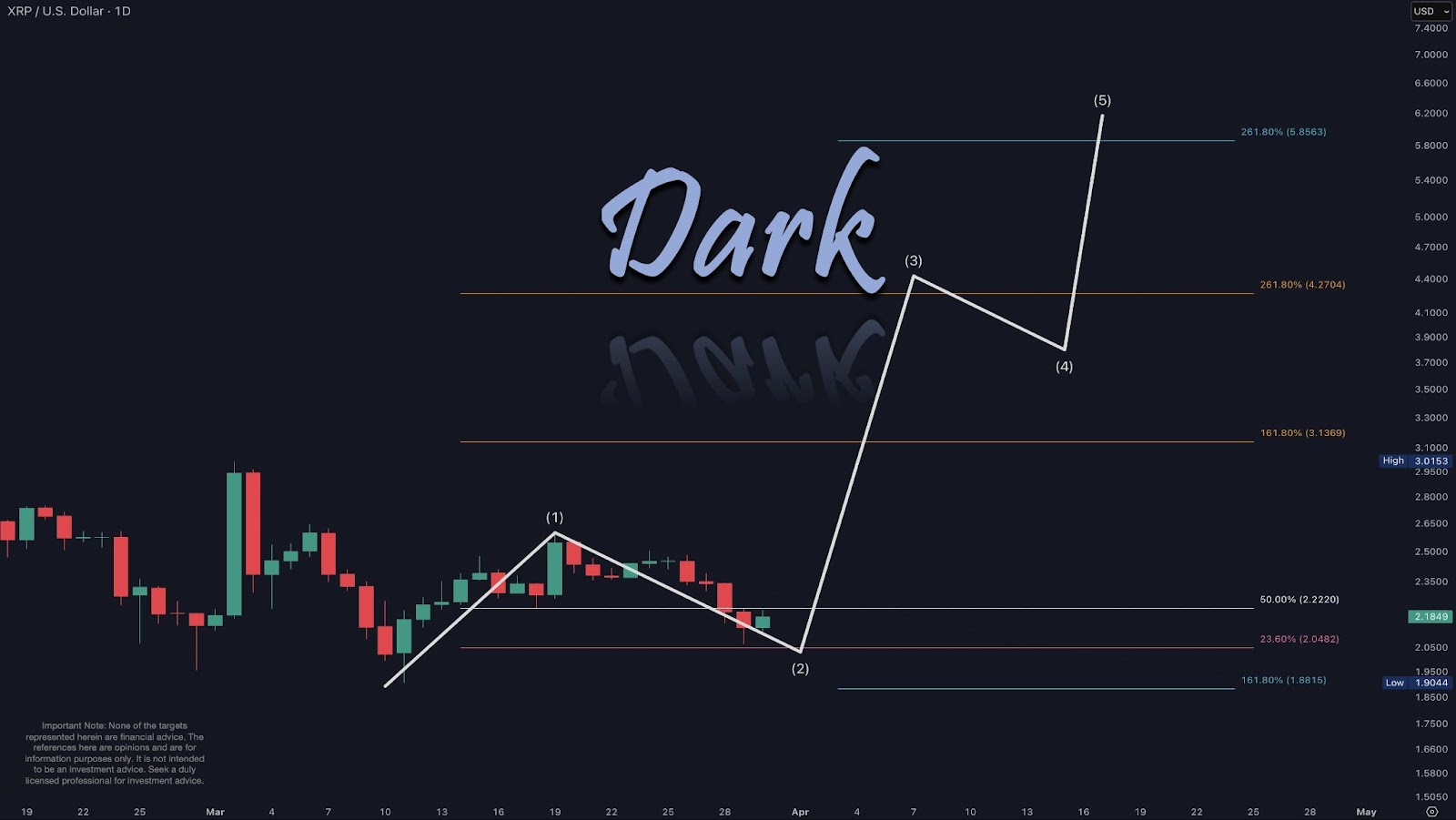

But not everyone agrees. Popular analyst Dark Defender, for example, shared a positive outlook, saying that XRP price is likely to revisit the last Fibonacci level at $2.04 before bouncing back again.

According to the analyst, a key resistance level for XRP is $2.22, which “should be broken” to ensure a sustained recovery toward the Wave 5 target at $8.

“April-May will be hot, and our targets of Wave 5 stand at $5-8 levels, as expected.”

XRP/USD daily chart. Source: Dark Defender

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here