Este artículo también está disponible en español.

Solana (SOL) is now trading at a critical juncture following last week’s market surge. The token has climbed over 20% from its recent local lows, now testing a crucial supply level around $150.

Related Reading

This resistance zone has drawn the attention of analysts and investors, with many believing Solana is on the verge of a rally to higher price levels. Among those who are bullish on SOL is prominent analyst Carl Runefelt, who recently shared a detailed analysis, predicting that Solana could reach new highs within days if the current momentum continues.

As the broader market continues to gain strength, investors are eagerly awaiting Solana’s next move. A successful breakout above $150 could signal a confirmed uptrend, paving the way for a potential rally. However, the coming days will be pivotal for SOL as it approaches this key level, with the market closely watching whether it will reclaim higher ground or face renewed resistance.

Solana Bullish Pattern About To Break

Solana (SOL) is currently testing crucial supply levels that could pave the way for a significant rally to higher prices. After days of consolidation, the altcoin looks ready to break out and confirm a daily uptrend.

Many analysts and investors are closely watching for the next move. This potential shift comes as the entire crypto market has turned from fear to optimism, spurred by the Federal Reserve’s recent decision to cut interest rates, which has breathed new life into the market.

Analyst Carl Runefelt, one of the prominent voices in the crypto space, has shared his technical analysis on X, revealing that Solana has formed a symmetrical pattern. According to Runefelt, if SOL breaks out of this pattern, it could trigger a substantial upward move, with price targets around $160.

The symmetrical triangle, a key technical formation, typically signals a strong price movement after a prolonged period of consolidation.

Related Reading: Crypto Analyst Predicts Dogecoin Will Surge 1,000% Past ATH – Price Targets Revealed

As Solana hovers near this critical level, the market eagerly awaits confirmation of a breakout. Investors expect a move above $150, confirming the uptrend and likely leading to higher price levels in the coming weeks. For now, all eyes remain on Solana’s ability to break through this resistance and potentially rally to new heights.

SOL Technical Analysis: Price Levels To Watch

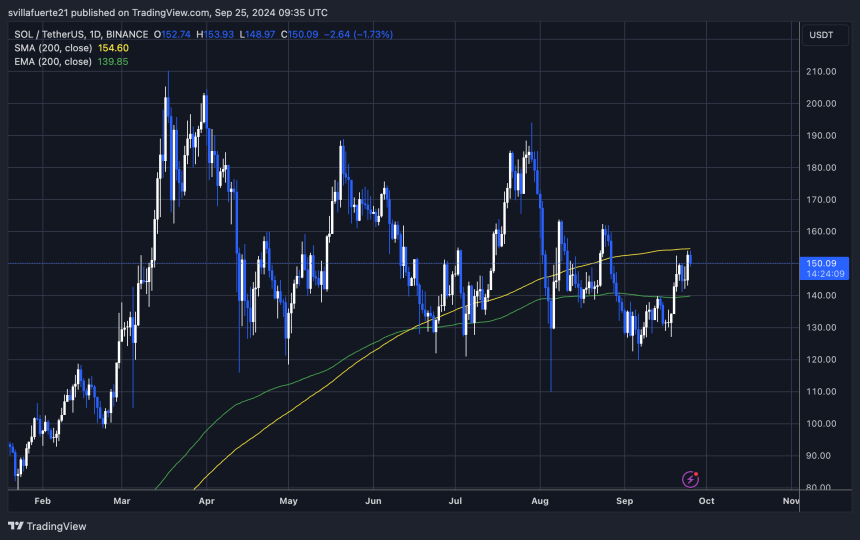

Solana (SOL) is currently trading at $150 after testing the daily 200 moving average (MA) at $154 as resistance. This key technical level has kept the price in check, and SOL is now entering a consolidation phase. Investors are optimistic, and rising demand could soon trigger a breakout from this consolidation.

To keep momentum, SOL must reclaim the 1D 200 MA and target new highs beyond $164. This price has worked as a crucial resistance; if broken, it would confirm the continuation of a daily uptrend. A successful breakout at this level could push SOL toward even higher prices, potentially setting the stage for a run to challenge its all-time highs.

Related Reading

However, failure to break above the daily 200 MA could signal a shift in sentiment. In this case, SOL could retrace to key support levels, with potential targets around $140 or even lower. This would indicate a short-term correction before another attempt at reclaiming higher price levels. Investors are closely watching SOL’s next moves to determine the coin’s near-term direction.

Featured image from Dall-E, chart from TradingView

Read the full article here