Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

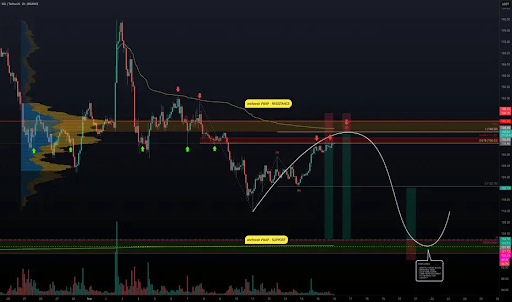

Crypto analyst SiDec has raised the possibility of the Solana price dropping to double digits. The analyst revealed major levels to watch for entries as market participants brace up for this massive crash.

Major Levels To Watch As Solana Price Risks Drop To Double Digits

In a TradingView post, SiDec highlighted the range between $136 and $143 as the major resistance zone for the Solana price. Meanwhile, he stated that between $102 and $98 is the next major support zone, indicating that SOL risks dropping to double digits soon if it fails to hold this support zone.

Related Reading

The analyst noted that the Solana price has been in a slow uptrend over the past five days, after hitting the low at $112. He added that the current price action looks like an ABC corrective pattern, which could mean that SOL is setting up for lower prices. While alluding to the key levels to watch for entries, he SiDec noted that placing orders at key levels helps increase the chances of catching the right move without overcommitting too early.

He then discussed the resistance zone between $136 and $143. The crypto analyst remarked that the Solana price will likely struggle in that range, as the area contains multiple technical confluences suggesting a potential reversal or strong reaction. As such, SiDec stated that this range is a prime area to consider for short positions, especially if the price starts showing weakness.

On the other hand, SiDec revealed that a major demand zone is forming between $102.1 and $98.50 on the downside for the Solana price. He stated that this zone has multiple technical confluences, making it a high-probability long entry area. The analyst added that this zone presents a solid long opportunity for gradual scaling into positions as price moves deeper into support.

Market Outlook For SOL

SiDec remarked that there is a short bias until the Solana price reclaims $143.80, with this level a strong resistance zone for potential short trades. For market participants looking to enter a short position, the analyst remarked that laddering into the resistance zone ensures better risk management and higher entry efficiency.

Related Reading

Meanwhile, for a long setup, the analyst stated that starting small at $112 and increasing position size down to $98.50 ensures strong positioning in a high-confluence demand zone. He added that scaling into trades rather than committing at a single price increases flexibility, improves trade execution, and helps market participants adapt better to price movements.

Further discussing the Solana price action, SiDec noted that the $100 target coincides with the 200 Exponential Moving Average (EMA) on the weekly timeframe, adding confluence to this strong support.

The analyst also mentioned that if the Solana price decisively breaks above $144, it would invalidate the short thesis and suggest a potential move higher toward $150. Meanwhile, a strong rejection from the resistance zone would likely accelerate the move toward $112 to test demand at swing low.

At the time of writing, the Solana price is trading at around $128, down over 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image from iStock, chart from Tradingview.com

Read the full article here