Non-fungible tokens (NFTs), once hailed as the future of digital collectibles, experienced a sharp downturn in June. According to the crypto analytics platform Artemis, the NFT sector recorded the worst performance among 21 sectors, with a staggering 51.5% decline.

This trend raises concerns about the sustainability of the NFT market.

Sales Slump Across Major Blockchains: Can NFTs Bounce Back?

The decline is further evidenced by data from CryptoSlam, which shows a 46.03% decrease in NFT sales volume, amounting to $480 million over the past 30 days. Major blockchains like Ethereum, Bitcoin, and Solana saw NFT sales plummet by 38% to 50%. This significant drop has led to speculations about the causes behind the fading enthusiasm for NFTs.

Read more: How To Start NFT Trading: A Step-by-Step Guide

Crypto Sectors Performance. Source: Artemis

Several factors contribute to the current state of the NFT market. Paul Thomas, Founder and CEO of Somnia, noted that the initial hype around NFTs has diminished.

“Utility is becoming more important than ever for NFTs. […] One of the big problems with NFTs is that everyone just tries to repeat and copy what was previously successful. […] For projects to really make an impact, they need to be doing something exciting and original instead of just following the hype,” Thomas said.

Adding to the challenges, the floor price of prominent NFT collections like Bored Ape Yacht Club (BAYC) fell below 10 ETH earlier in June. This dip was exacerbated by notable figures such as Mark Cuban offloading multiple NFTs from their collections. These actions sparked further concerns about the long-term viability of the NFT market.

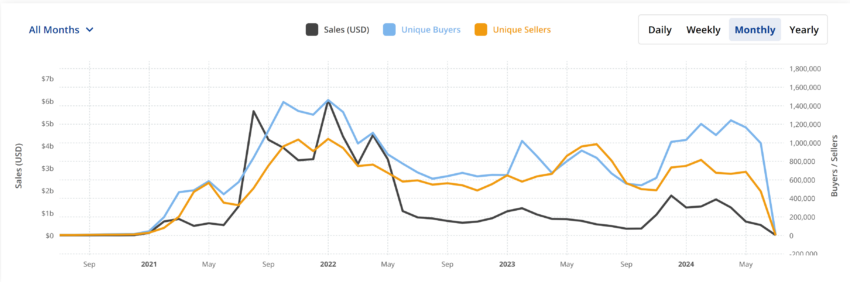

NFT Sales Volume. Source: CryptoSlam

Despite the downturn, the NFT sector is not all bleak. Some collections, such as Pudgy Penguins and Milady Maker, recorded significant sales volume increases. Additionally, the Ronin blockchain saw a notable rise in NFT sales, indicating that certain niches within the market are still thriving.

Taha Abbasi, CTO of Ferrum Labs, also believes that the NFT sector will likely regain attention as the industry evolves. He believes that some of the key innovators in the NFT industry, like Yuga Labs and Igloo, are strategizing on ways to re-emerge.

“Perhaps the days of overhyped pixelated NFTs are over, and some other media integration or innovation might soon place digital collectibles in the limelight. NFT innovators need to do something drastic that would help the niche stay afloat,” he told BeInCrypto.

Read more: 7 Best NFT Marketplaces You Should Know in 2024

This insight and the resilience of certain collections and platforms offer hope. Although the broader market may struggle, these dynamics suggest that specific projects and platforms could still attract interest and investment.

Read the full article here