HodlX Guest Post Submit Your Post

Sucking up to politicians and the powers that be is the last thing crypto needs. It defeats the industry’s purpose and foundational vision of grassroots empowerment.

It’s supposed to make users autonomous, self-sovereign entities. Only a true meritocracy powered by cutting-edge tech and user-centric innovations can ensure this.

For most parts, political patrons won’t serve such interests, despite high-ringing claims during public campaigns.

Source: Against choosing your political allegiances based on who is ‘pro-crypto’ by Vitalik Buterin

Disrupting governance is among crypto’s main value propositions. It enables fairer and more efficient decision-making within systems that no single entity can hijack or manipulate for self-interest.

DAOs (decentralized autonomous organizations), for example, support a bottoms-up framework for community members and their ‘delegates’ to actively participate in decision-making.

This is a key shift from the top-down model of legacy organizations and nations.

For crypto to succeed long-term, builders in this industry must improve its core strengths, rather than waiting on external authorities to grant legitimacy.

It’s about freedom and freedom must be taken not given.

The flip side of political attention

Politics has its own logic. Politicians have their own reasons. And neither usually aligns with the average citizen or end user’s interests as centuries of experience has proven.

There might be one or two or three good even great policies or schemes here and there, but that’s mostly it.

Little has come by the way of traditional decision-making and governance that ensures the holistic growth of communities.

But finally, we have the tools to solve this and bring forth genuine meritocracy where action and active contribution trumps merely handed-down legacy.

It would be a disaster to underutilize them due to confirmation bias or simply blind political allegiances.

Crypto has been getting lots of political attention recently. Especially as it became a hot election agenda in the US with both factions trying to woo crypto voters.

Former US President Donald Trump and Senator Cynthia Lummis spoke at the Bitcoin Conference 2024.

They promised to sack Gary Gensler, use BTC as a ‘strategic asset‘ to offset the over $35 trillion US national debt, and so on.

Source: Official post by The Bitcoin Conference on X/Twitter

Likewise, Democrat Senator Chuck Schumer promised “pro-crypto legislation by the end of the year” if Kamala Harris becomes president.

Source: Cointelegraph’s post on X/Twitter

Yet, it’s naive to forget or overlook how Republicans and even Donald Trump consistently made negative comments on crypto to the extent of calling Bitcoin “a scam against the dollar.”

The current majority administration as well has remained largely anti-crypto all these years.

And even recently, they moved to ban ‘political betting markets’ like Polymarket, which has emerged as crypto’s strongest product-market-fit at this point.

There’s no valid reason to believe that these inherent contradictions and conflicts will magically go away.

While political attention can be good for short-term adoption and hype, it’s not the endgame.

Crypto for crypto’s sake

It might have been a different story if crypto wasn’t capable of standing on its own. But that’s not the case at all.

On the contrary, it has the tools and frameworks to invent and build systems and processes that benefit every stakeholder users, businesses and regulators.

Returning to the governance example from above, it’s now possible to implement alternative models that incentivize the masses not a tiny elite to actively make their voices heard.

This is a huge breakthrough vis-à-vis the status quo where those in power and their ‘expert’ friends are the only ones speaking most of the time.

In a progressive and meritocratic governance paradigm, even individuals on the fringes can contribute to a network, protocol or platform’s future nd get rewarded in real monetary terms for doing so.

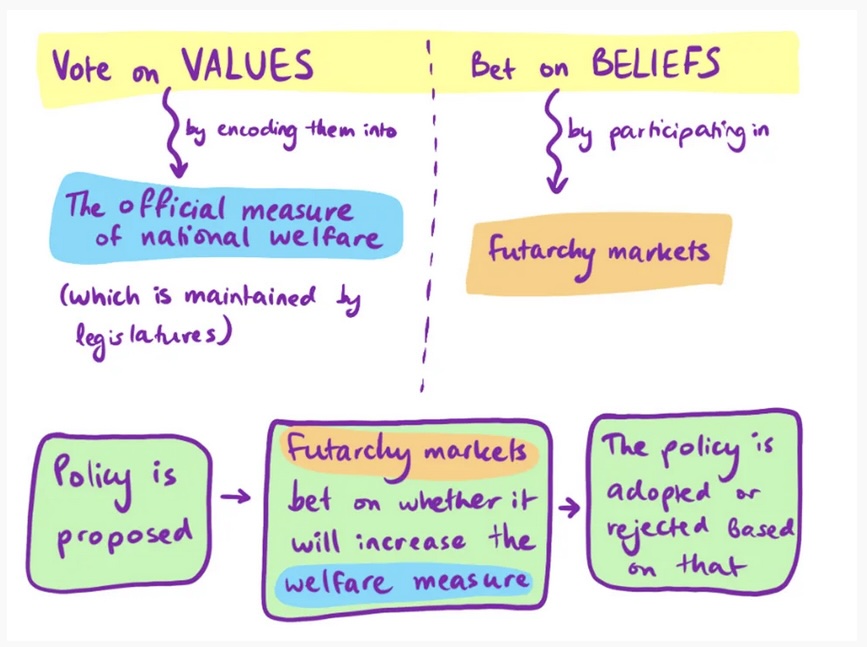

This novel approach can even scale to nations if governance system builders leverage advanced tooling in sync with promising concepts like Futarchy.

Though too radical for most people, it’s possible nevertheless and will emerge in some form sooner or later.

Source: Visual representation of Futarchy by Fadai Mammadov

The point is that crypto has more to give to the legacy world than take from it. Fair participation models with adequate incentives are a critical missing link for a better world.

Everyone o matter who or where they are an shine and succeed based on their hard work, dedication and tested knowledge.

Satoshi Nakamoto invented Bitcoin as freedom money. Vitalik and his peers built Ethereum to liberate app builders and blockchain developers. Both fostered open and boundless creations based on math and code.

Crypto has the power to generate truly zero-to-one outcomes that legacy entities can adopt, benefit from and propagate but not control.

To respect and fulfill its founders’ visions, the industry must also recognize what it’s worth and how the technology can shine in its own light.

Ultimately, it does come down to the “build great stuff, they’ll come” maxim.

Serhii Kravchenko, CEO of DeXe, is a seasoned technology enthusiast and entrepreneur with a robust background in IT management and business administration. DeXe is the ultimate solution for creating and governing DAOs, projects, tokens and NFTs through a seamless, no-code interface with a TVL (total value locked) of over $375 million.

Generated Image: Midjourney

Read the full article here