February 6, 2024

After a period of tranquility, the Ethereum ecosystem is gradually regaining momentum with the rise of the restaking. As seasoned DeFi participants, DeSyn has consistently focused on developing the Ethereum network.

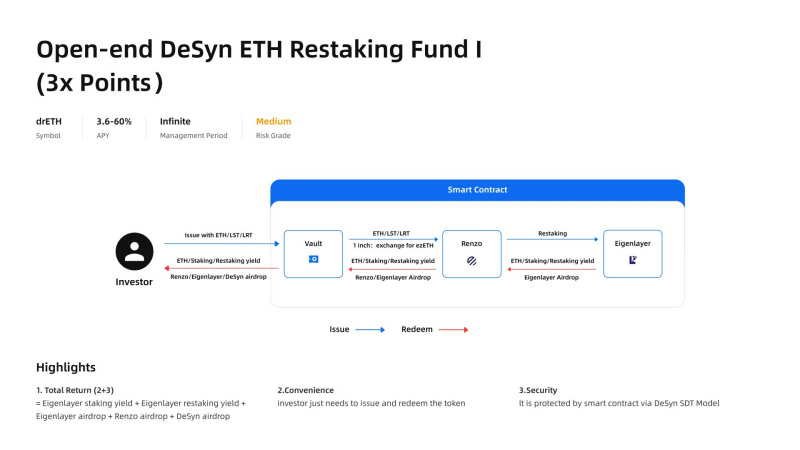

Previously, DeSyn initiated the launch of the triple points ETH leveraged ETF based on sharp market insights, aiming to promote diversity in Ethereum network products and assist users in maximizing their returns within the Ethereum ecosystem.

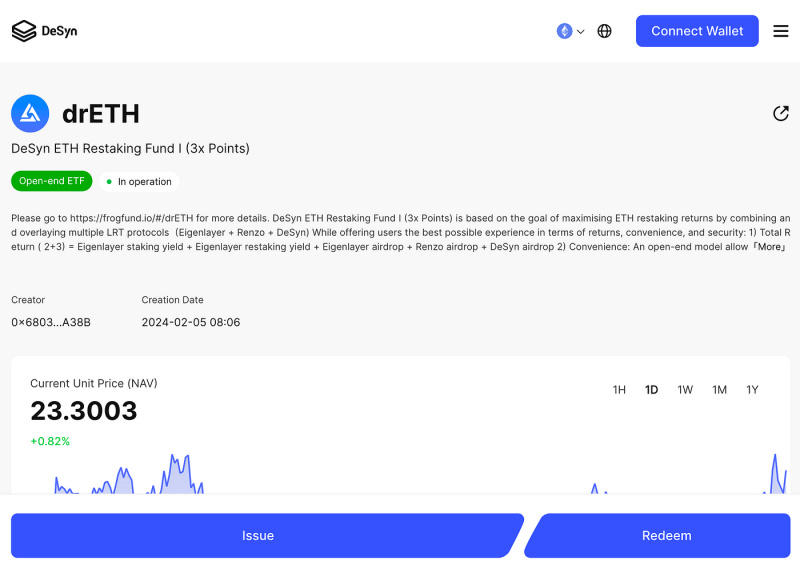

Today, DeSyn announces the launching of the drETH (DeSyn ETH restaking fund I points), dedicated to participating in this industry revolution alongside ecosystems such as Eigenlayer and Renzo, collectively shaping the future of DeFi.

The DrETH is an open-end fund product introduced by Little Frog, a professional decentralized asset management DAO organization based on the infrastructure of the DeSyn platform.

This product integrates DeSyn and two other highly acclaimed restaking platforms, Eigenlayer and Renzo. Users can stake ETH, stETH, wETH and ezETH through the DeSyn platform.

The fund supports on-demand withdrawals and offers the existing APY from LST and LRT and the triple yield expectations from Eigenlayer, Renzo and DeSyn.

Currently, this fund’s APY ranges from 3.6% to 60%. In terms of security, DeSyn solemnly declares that all contract codes have undergone security audits to ensure the safety of user assets.

How to restake

Users can navigate to DeSyn’s website and select the ‘restaking’ option to access the DeSyn ETH restaking fund I (triple points) issue.

Upon selection, users have the opportunity to acquire drETH, associated with the potential of triple returns.

Enhanced incentives through triple-point staking with DeSyn

As mentioned earlier, opting for the fund not only grants potentially basic LST and LRT returns but also yields triple points from Eigenlayer, Renzo and DeSyn.

DeSyn is committed to maximizing incentives for staking users.

Starting from February 6, 2024, any user participating in this fund can earn corresponding points, dependent on the staking amount and duration.

- DeSyn points formula DeSyn points = amount of LST multiplied by number of staked days multiplied by 10,000

- Eigenlayer points guide can be found here.

- Renzo points guide can be found here.

EigenLayer levating Ethereum security through restaking

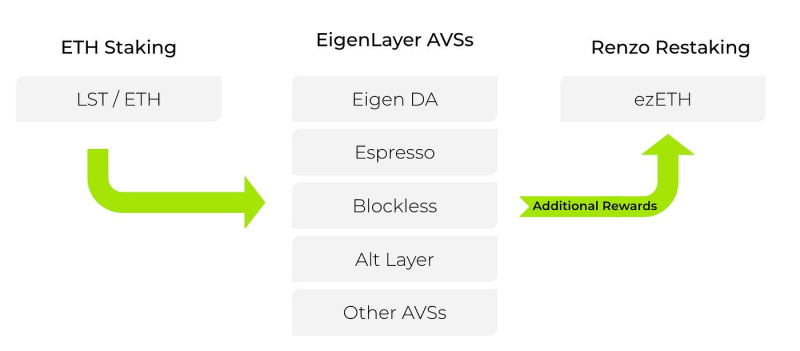

EigenLayer is a protocol built on Ethereum that introduces restaking, a new primitive in crypto economic security. This primitive enables the reuse of ETH on the consensus layer.

Users that stake ETH natively or with an LST (liquid staking token) can opt-in to EigenLayer smart contracts to restake their ETH or LST and extend crypto economic security to additional applications on the network to earn additional rewards.

Users can learn more by visiting EigenLayer’s official website.

Renzo ioneering restaking on the EigenLayer mainnet

Renzo is the first native restaking protocol to launch on the EigenLayer mainnet.

Although EigenLayer will not begin securing AVSs (actively validated services) .e., EigenDA until mid-2024 they have been accepting deposits.

Deposits for LSTs are capped. However, native ETH deposits remain uncapped but very difficult for most users to access.

They require a user to have 32 ETH and run an Ethereum node that is integrated with EigenLayer to run EigenPods.

Users can learn more by visiting Renzo’s official website.

About DeSyn

DeSyn Protocol is an innovative decentralized asset management infrastructure on Web 3.0, empowering users to securely and transparently create and manage customized pool-based portfolios with various on-chain assets tokens, NFTs, derivatives, etc. via smart contract.

For more information, users can visit DeSyn’s social links below.

Website | X | Telegram | Discord | YouTube

Contact

DeSyn Protocol

Read the full article here