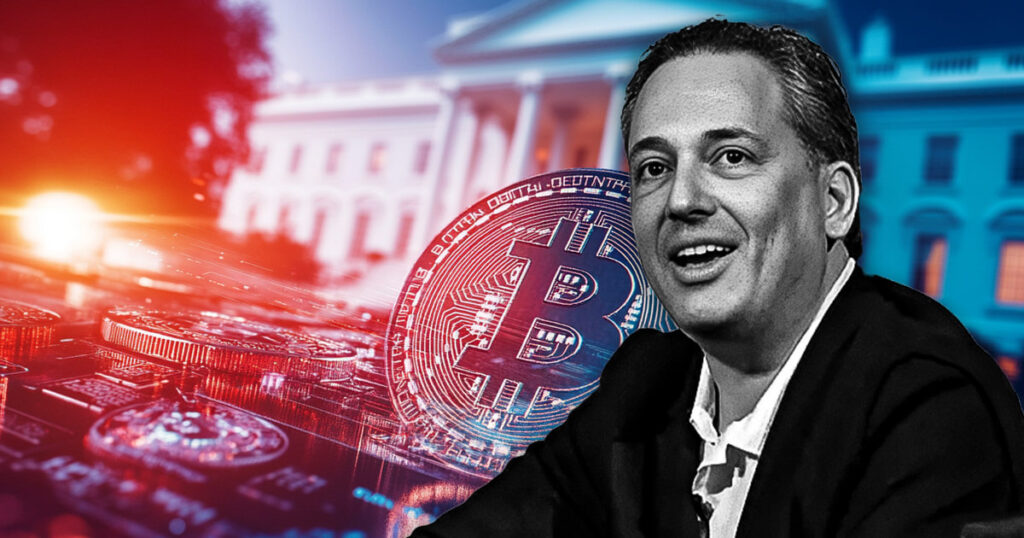

White House AI and crypto advisor David Sacks criticized claims that he “dumped” his crypto holdings and clarified that, after being appointed by President Donald Trump, he was required to divest due to government ethics rules.

In a March 19 social media post, Sacks addressed recent reports suggesting he had sold off his Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) investments, stating that the characterization was misleading.

“I did not ‘dump’ my cryptocurrency; I divested it. Obviously, I would have preferred not to, but government ethics rules required it. It’s an honor to serve President Trump and the American people.”

According to a White House memo, Sacks liquidated more than $200 million in digital assets before Trump took office. His firm, Craft Ventures, also exited positions in crypto-related stocks, including Coinbase (COIN), Robinhood (HOOD), and the Bitwise 10 Crypto Index Fund.

The move came amid scrutiny over Sacks’ role in the administration, with some speculating that his influence played a part in discussions about incorporating certain cryptocurrencies into a potential US digital asset reserve.

Media coverage sparks debate

Sacks’ clarification reignited discussions about how crypto is portrayed in the media. Some industry figures argue that skepticism about digital assets influences how news outlets frame stories.

Bankless HQ co-founder David Hoffman suggested that negative headlines reflect broader public sentiment rather than deliberate bias.

Hoffman wrote in response to Sacks’ post:

“Most people are crypto-less and don’t want crypto to do well because they don’t want to hold cognitive dissonance about making any wealth in crypto. Media is titling headlines to cater to this need.”

Binance founder Changpeng ‘CZ’ Zhao echoed the sentiment and said media outlets prioritize engagement over accuracy.

CZ wrote:

“The media only sells clicks, not ethics.”

He also criticized a recent Wall Street Journal report alleging that the Trump family considered acquiring a stake in Binance US in exchange for a pardon, calling the story baseless.

Mentioned in this article

Read the full article here