While Ethereum (ETH) has been affected by the same rally as much of the rest of the crypto market in recent weeks, its upward momentum has been somewhat less decisive than that of other major cryptocurrencies.

Still, considering that it is, at the time of publication, well above its October highs, we decided to consult AI on what the future has in store for the end of November.

Based on the data available on November 2, the algorithms of PricePredictions – a cryptocurrency analytics and forecasts platform – estimate that Ethereum will be worth $1,903 on November 30.

The estimate, reached using multiple important technical analysis (TA) indicators like moving average convergence divergence (MACD), relative strength indicator (RSI), Bollinger Bands (BB), and average true range (ATR), points toward a continuing rally for the cryptocurrency.

Still, the expected rise in the price of ETH throughout November is significantly more modest than what was seen in the latter half of October.

This is in line with a recent development favoring Ethereum bears. On November 2, reports came out revealing the launch of ‘ProShares Short Ether Strategy’ – an Ether futures exchange-traded fund (ETF) created to give the inverse of the daily performance of the Standard & Poor’s CME Ether Futures Index.

On the other hand, the algorithms of CoinCodex predicted in October that Ethereum would finish 2023 significantly in the green. The artificial intelligence estimated at the time that ETH’s price will stand as high as $2,553 on December 31.

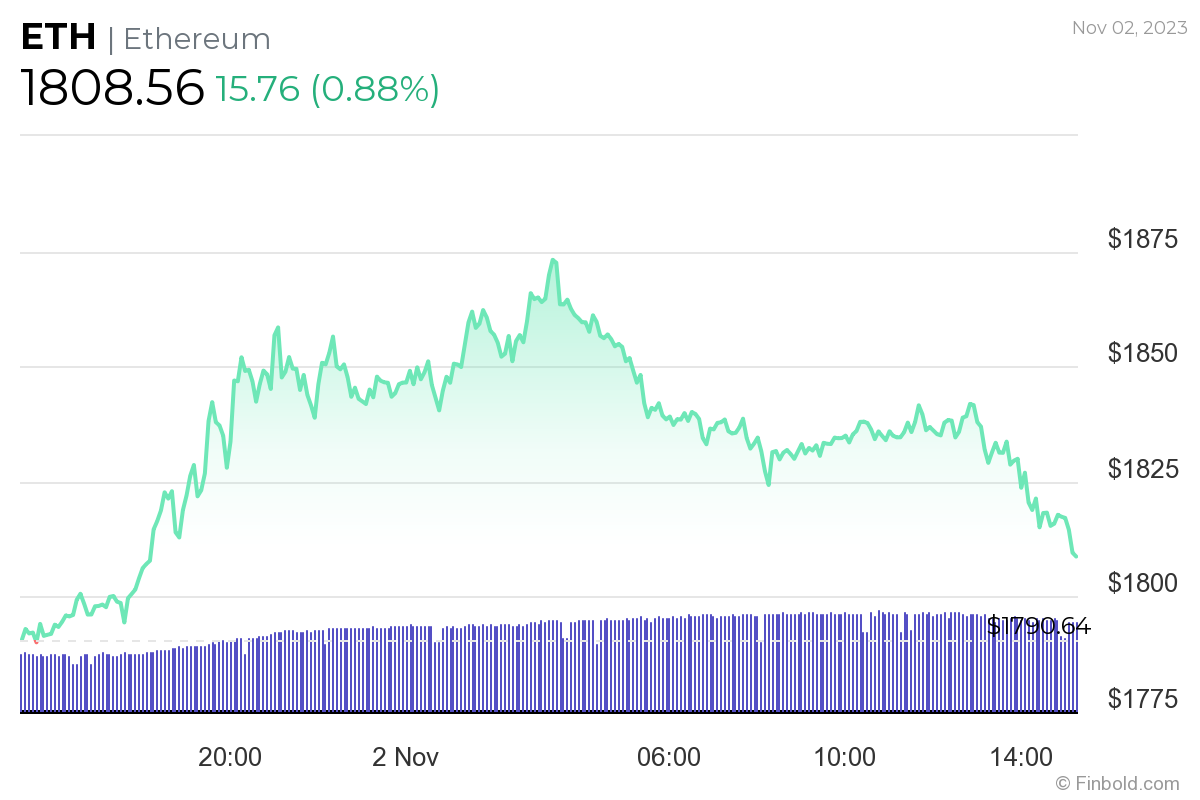

ETH price chart analysis

Whatever the future may have in store, ETH’s price stands at $1,808.56 at the time of publication, meaning it has undergone a slight rise of 0.88% over the previous 24 hours.

Additionally, its performance throughout the second half of October has been strong and saw it rise more than 5% over the course of the month.

On the other hand, it is noteworthy that ETH hasn’t managed to rise as high above its values for the rest of 2023 as many other cryptocurrencies have despite it going through several important upgrades – including the highly-anticipated ‘Shapella” upgrade – this year.

For example, both Bitcoin (BTC) and Solana (SOL) are hovering very close to their year-to-date highs at the time of publication on November 2.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here