With Christmas on the horizon, astute investors redirect their focus to the cryptocurrency market to pursue opportunities that promise substantial returns. Among the notable cryptocurrencies, Ethereum (ETH) emerges as a top contender for holiday investments.

Why is this the case? ETH offers a distinctive combination of popularity and potential, making it particularly enticing during the festive season.

Given these dynamics, Finbold has leveraged PricePredictions for its AI advanced machine learning algorithms. These algorithms meticulously assess the ever-changing market conditions and analyze relevant indicators to estimate the likelihood of Ethereum experiencing gains by Christmas day.

The algorithms project that ETH will increase to $2,040 by the end of the month, representing a 0.54% increase from the current asset price at the time of publication.

The computation is based on a broad range of technical indicators, encompassing moving average convergence divergence (MACD), relative strength index (RSI), Bollinger Bands (BB), and various others.

Ethereum price analysis

The Ethereum price has been undergoing a consolidative trend spanning several months, forming an ascending triangle setup. While this technical pattern is inherently bullish, confirmation only comes with a successful breakout. Up until now, ETH has yet to demonstrate any clear breakouts.

The ascending triangle configuration consists of highs that are equal and lows that are progressively higher, connected by trend lines. This arrangement indicates a growing bullish sentiment among investors, with an increasing tendency to buy dips.

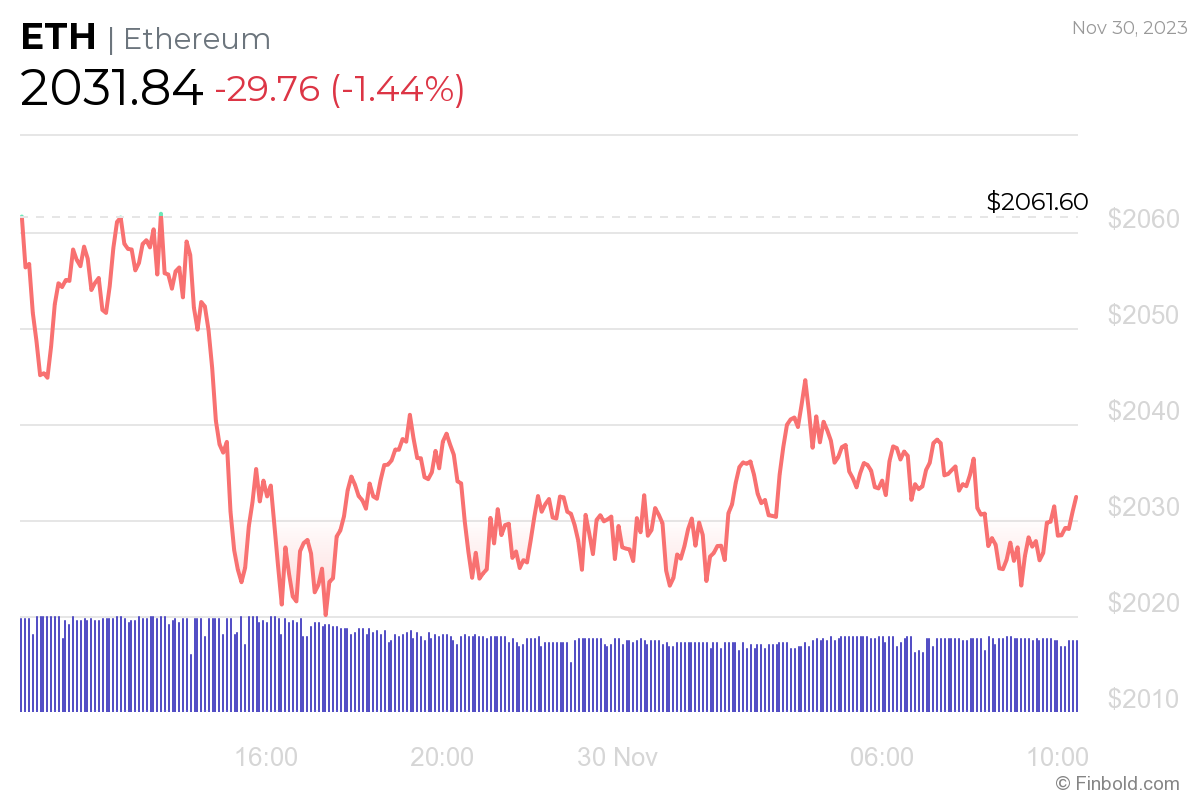

At the time of press, ETH was trading at $2,031, representing a decrease of -1.44% in the previous 24 hours. These losses come after a week when this crypto lost 2.38% of its value, contrary to a 12.67% increase over the 30 days.

In the last year, ETH price has increased by 61%, allowing it to outperform 69% of the top 100 crypto assets in this period.

This crypto trades above its 200-day simple moving average while experiencing 18 green days in the last 30 days.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here