Ethereum’s price has been following Bitcoin, dropping lower since the beginning of March. Yet, things might be about to change soon.

Technical Analysis

By TradingRage

The Daily Chart

On the daily timeframe, the price has been making constant lower highs and lows inside a descending channel pattern. Yet, with the 200-day moving average and the $2,750 support level nearby, the market seems likely to rebound soon. Currently, the price is approaching the $3,000 resistance level.

A bullish breakout above this level would be a probable scenario and could lead to a rise toward the higher boundary of the channel and the $3,600 resistance zone.

The 4-Hour Chart

Looking at the 4-hour chart, the price has been hovering around the $3,000 level over the recent weeks. Yet, the market has broken a bearish trendline to the upside. If the price keeps above the trendline and breaks through the $3,000 level, a rally toward the higher boundary of the channel will become more likely.

With the RSI approaching 50%, it seems that the market momentum is in equilibrium, but the short-term fate can be decided as soon as today.

Sentiment Analysis

By TradingRage

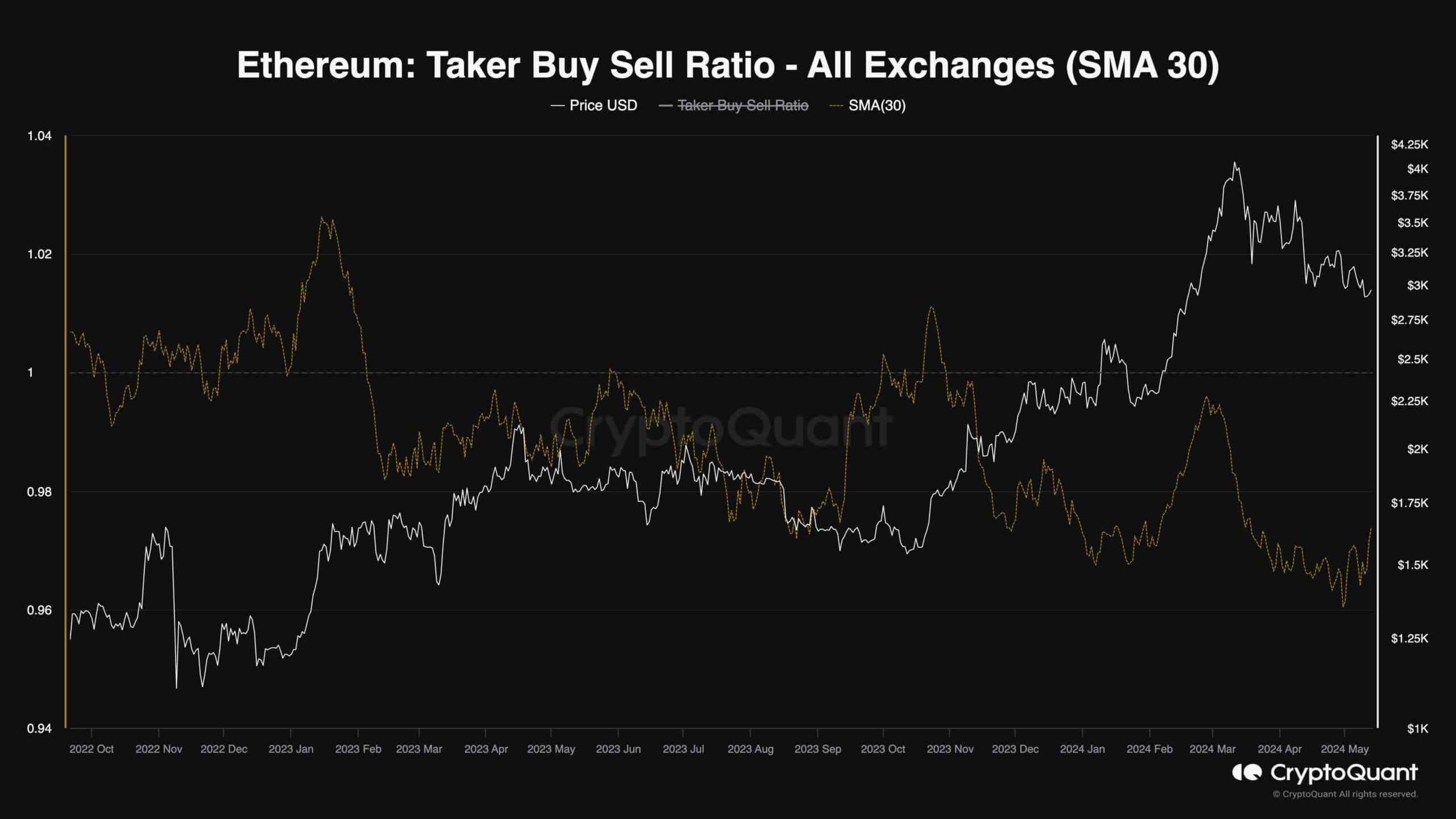

Taker Buy Sell Ratio (30-Day SMA)

The perpetual futures market has been one of the key driving factors for crypto prices over the recent years. Therefore, analyzing this market’s metrics can provide useful information for anticipating future price movements.

This chart displays the 30-day moving average of the Taker Buy Sell Ratio, which measures whether the buyers or sellers are executing more market orders on aggregate. As market orders are the ones moving the price, this metric can provide crucial insight.

The Taker Buy Sell Ratio has been trending below 1 over the last few months, indicating that most futures traders have been selling BTC aggressively. This can either be for speculation or hedging spot portfolios. Yet, the metric is showing sings of recovery at the moment, and its rise could lead to a market rally as the aggressive supply would shrink. Therefore, with enough demand from the spot market, a new uptrend could begin soon.

Read the full article here