Ethereum price opened trading at $2,928 on Monday, May 13, recording a 4% surge over the weekend, but recent ETH 2.0 staking trends suggest more downside ahead.

Ethereum Crosses 1 Million Node Validators 1-Year After Shappella Upgrade.

Ethereum recorded another major milestone in May 2024 as the number of node validators staking coins on the network hit the 1 million mark.

Ethereum completed its transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus with the Shappella upgrade executed on April 12 2023, allowing ETH holders to earn passive income and secure the network by stake their coins.

Since then, Ethereum 2.0 staking trends have been highly influential in ETH price action.

Ethereum Node Validators vs Staked ETH | Beaconchain

According to the latest data from Ethereum’s Beacon chain, there are now 1,015,570 active node validators as of May 13, 2024, who have jointly staked a total of 32.5 million ETH staked (~$96 billion).

Centralization of staking power among a few affluent investors was one of the major risks identified when ahead of Ethereum’s PoS transition in 2023. Hence, Ethereum reaching a milestone of 1 million unique stakers significantly eases those concerns, clearing the coast for edgy investors to commit to the ETH project’s long-term prospects.

However, in the short-term, things could pan out slightly differently. A closer look at the another critical metric shows that ETH has been struggling to attract new stakers since the Bitcoin halving.

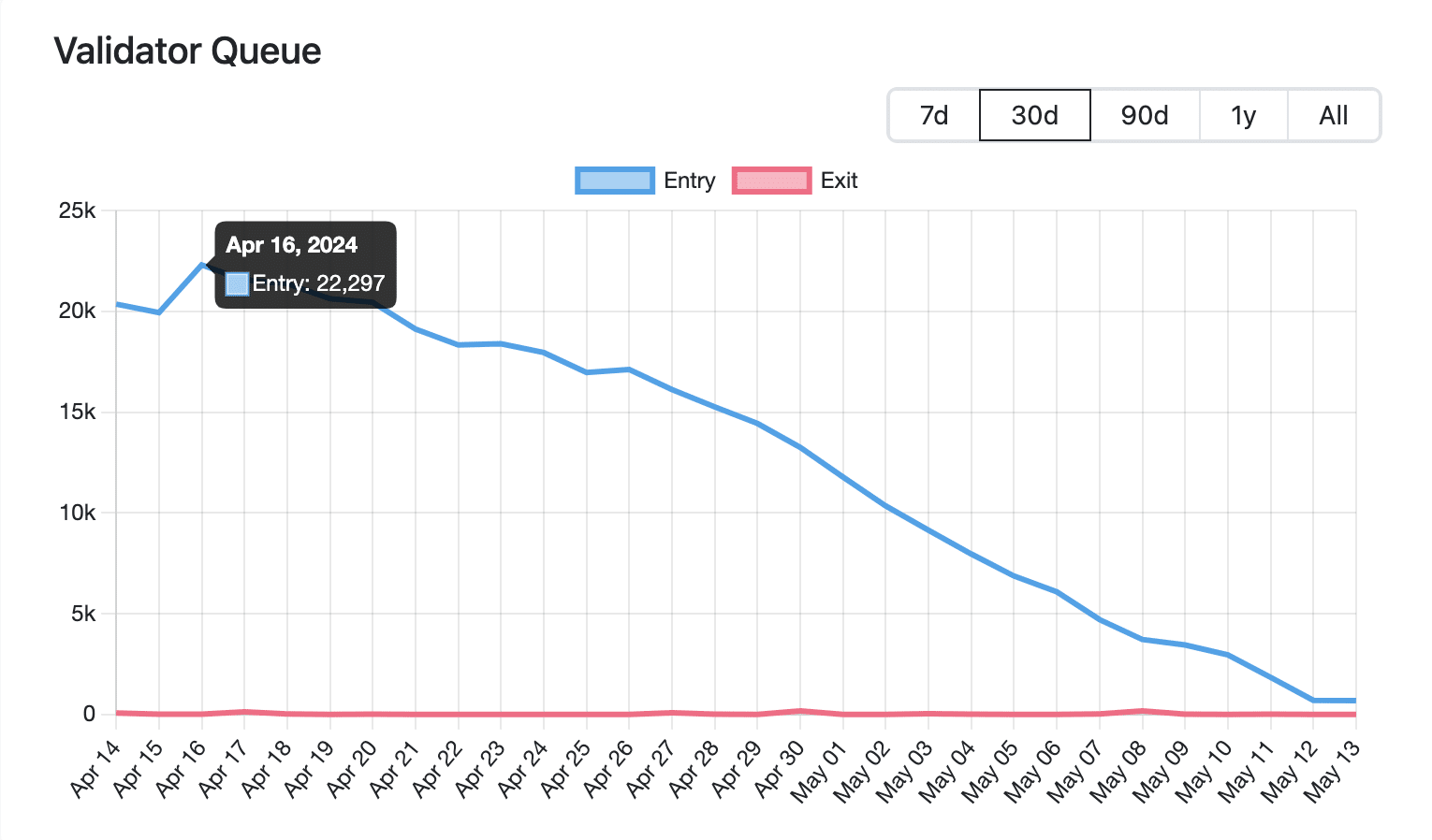

The chart below shows the number of stakers that enter the Ethereum validator queue on a given day, in contrast to those exiting and withdrawing their staked ETH.

Ethereum ETH Staking Validator Queue

22,297 unique wallets who fulfilled the 32 ETH requirement moved to join the Ethereum staking network on April 16.

But as depicted above, it has been downhill since then. The latest data shows only 704 unique addresses opted to join the Ethereum staking queue on May 12, reflecting a 98% decline from the local peak recorded on April 16.

The timing suggests that fears of a crypto market crash after the April 20 Bitcoin halving has spooked prospective investors into cutting down on their ETH investment. Also, since April 16, ETH price succumbed to a 13% dip.

Undoubtedly, Ethereum reaching 1 million validators is a major milestone for future viability and decentralization of the network. But, this prolonged decline in the number of new entrants could soon begin have a bearish impact on ETH short-term price action.

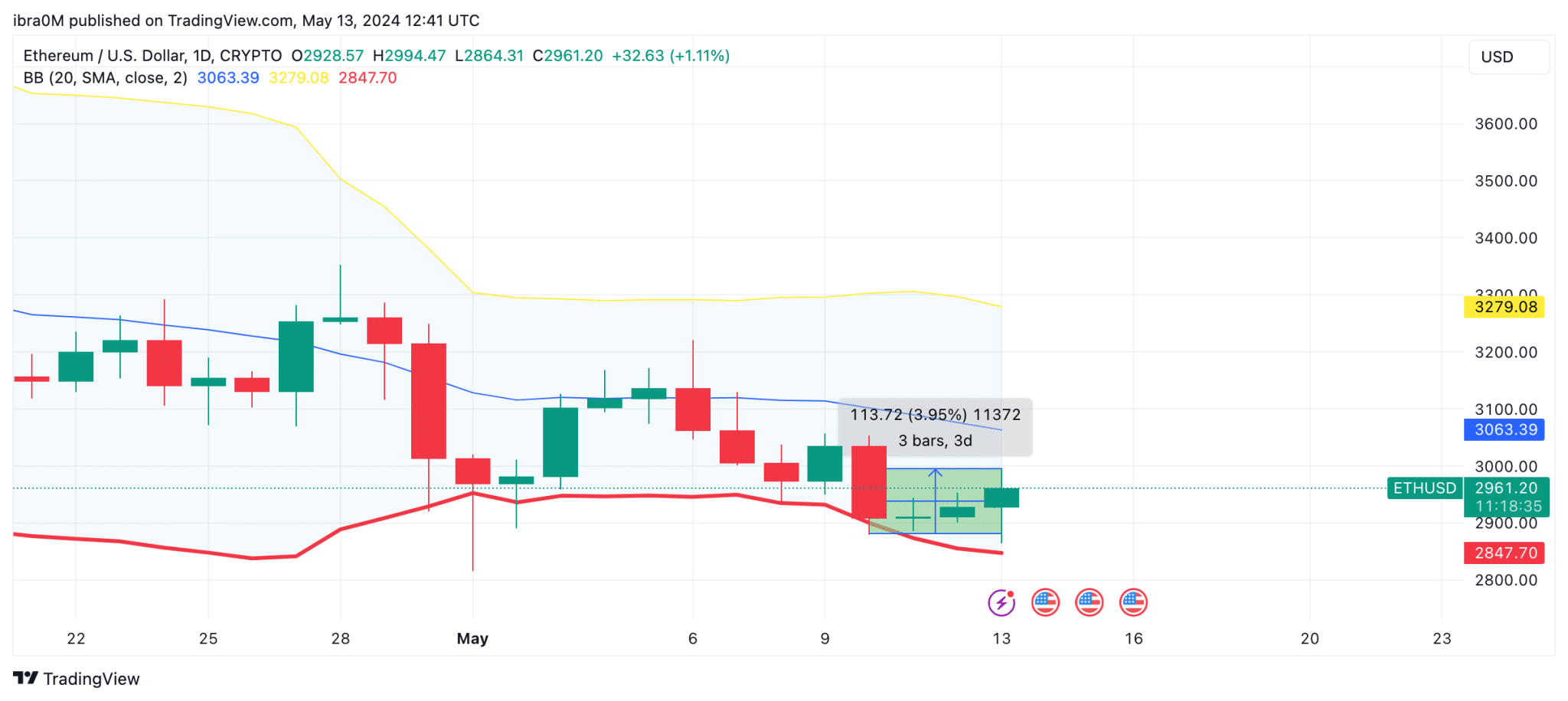

ETH Price Forecast: $2,800 Support at Risk

Ethereum’s price is trading at around $2,960 at the time of writing on May 13. However, the 98% drop-off in new staking inflows puts ETH price at risk of a breakdown below $2,900 level in the near-term.

Looking at the lower-limit Bollinger band technical indicator, the Ethereum bulls could mount an initial support buy-wall at the $2,847 territory.

Ethereum ETH Price Forecast

But if that vital support level fails to hold, a breakdown below $2,800 could be on the cards as predicted.

On the contrary, if the market sentiment turns positive on the upcoming US CPI and PPI inflation reports expected to be published this week, bulls could eye a rebound toward $3,200. But still, the looming sell-well at $3,063 level poses a major roadblock in the short-term.

Read the full article here