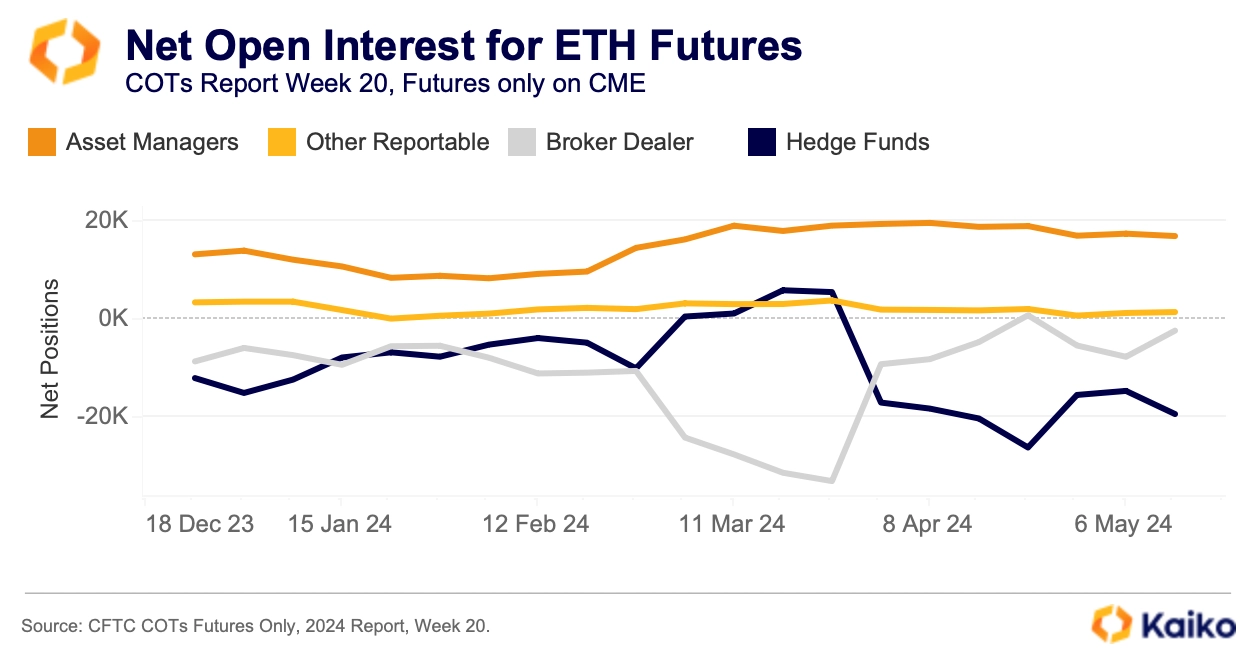

New data from market intelligence firm Kaiko Analytics shows that hedge funds are net short on Bitcoin (BTC) and Ethereum (ETH) on the Chicago Mercantile Exchange (CME).

In a new research article, the crypto analytics platform says that while hedge funds are net short on both BTC and ETH on the CME, it does not mean the funds are bearish on crypto, but rather, that they are engaging in basis trades, a type of arbitrage strategy.

Net short means that the hedge funds have accumulated more short positions than long positions in the crypto derivatives markets.

Says Kaiko Analytics,

“This doesn’t necessarily mean these funds are bearish on crypto, it’s more likely they’re engaging in one of crypto’s most popular trades, the basis trade.

The basis trade is a type of arbitrage strategy that exploits the price difference between two similar assets. In this case between an BTC or ETH spot and futures. Hedge funds are likely ‘long basis’ at present. This means they are selling futures short while holding spot BTC or ETH.

This protects against price moves and guarantees a specific sale price in the event of volatility in the underlying asset. The long basis trade works best when prices are in a state of contango, which means futures prices are above spot prices. The two prices will trend towards one another as expiration nears.

While we don’t have the data to say with certainty that this is why hedge funds are net short, it’s the most likely explanation for the massive short positions held by these sophisticated traders, who would rarely short without hedging.”

Bitcoin is trading for $69,251 at time of writing while ETH is worth $3,750.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/nullplus

Read the full article here