During the recovery of the altcoin market, Ethereum, the second-largest cryptocurrency globally, has surged by 4%, pushing the ETH price beyond the $2,000 mark once again.

Ethereum Whale Accumulation Continues

On-chain data provider Santiment said that as the Ethereum network growth shoots, the largest wallet addresses have accumulated more than 30% of the total ETH supply over the last year.

In a recent development in the Ethereum space, the top 200 Ethereum wallets collectively possess 62.76 million ETH, valued at approximately $124.1 billion. Notably, these wallets have accrued 30.3% more coins since November 21, 2022. Furthermore, a surge in Ethereum wallet activity was observed, with a remarkable 94.7 thousand new ETH wallets created yesterday—the most substantial increase since July.

Courtesy: Santiment

On the other hand, the demand for Ethereum derivatives is also on the rise. Maarten Regterschot, an analyst contributing to CryptoQuant, has highlighted a noteworthy trend in the Ethereum (ETH) market. His analysis points to a pattern of “systemic buying” in Ethereum futures, characterized by a substantial rise in open interest. Notably, Ethereum futures have experienced an influx of $700 million, suggesting a deliberate accumulation of assets over a specific timeframe.

Someone(s) are TWAP-buying on Ethereum futures

This linear growth in open interest indicates systematic buying over a certain period. There is $700 million added so far. pic.twitter.com/GCXK8u5yLL

— Maartunn (@JA_Maartun) November 22, 2023

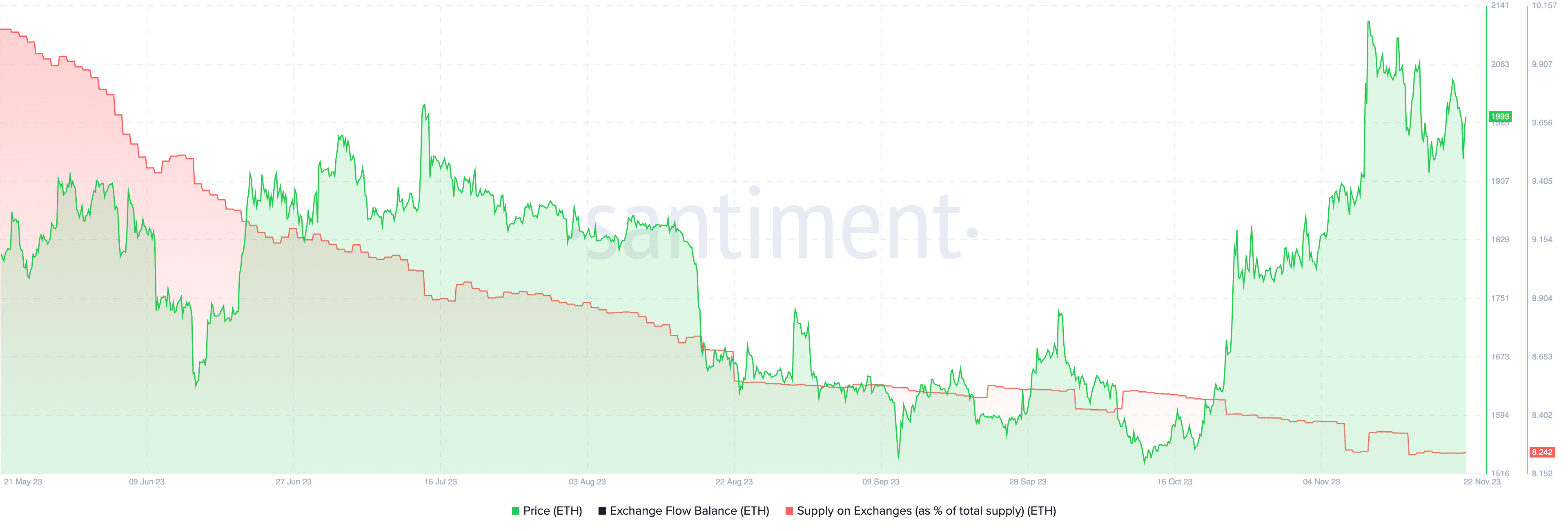

ETH Exchange Supply Declines

Santiment data reveals that the supply of ETH tokens on exchanges has decreased by nearly 20% over the last six months. This decline in ETH supply on exchanges is at its lowest point in half a year, indicating a positive outlook for potential price increases in the altcoin. The reduced selling pressure on ETH suggests favorable conditions for upward movements.

Courtesy: Santiment

Concurrently, there is an uptick in activity from ETH wallets, a metric that gauges the demand for Ethereum among market participants and overall network engagement. Increased activity and the creation of new wallets during a price uptrend are often viewed as bullish indicators for the asset.

ETH Price to $3,000?

Ethereum’s price has gained momentum, surpassing the $2,000 support level and instilling confidence in traders with a bullish outlook. The recent rise from $1,930 signals a positive trajectory, hinting at a potential breakout towards the coveted $3,000 mark.

Supporting the optimistic sentiment are golden cross patterns, with the 50-day Exponential Moving Average (EMA) crossing above both the 100-day EMA and the 200-EMA around two weeks ago. To sustain the uptrend, Ethereum’s price faces crucial challenges at $2,130, where weakening resistance needs to be overcome, and $2,000, which must hold as a robust support level.

The successful breach of the $2,130 hurdle is pivotal for signaling increasing momentum and ensuring the continuation of the upward trend. Such a move could also negate the sell signal indicated by the Moving Average Convergence Divergence (MACD) indicator, potentially leading to another bullish breakout.

Read the full article here