The Ethereum staking narrative and momentum have continued to strengthen despite relatively lackluster price action for the underlying asset. As a result, the amount of ETH staked is now a quarter of the circulating supply.

On February 8, liquid staking platform Lido shared the data that 25% of the entire supply of Ethereum has been staked.

Ethereum Staking Milestone

While the figures vary slightly depending on the analytics platform, most signal that Ethereum staking has hit this milestone.

Lido sourced a Dune Analytics screenshot claiming that 25% of the ETH supply is now staked. According to the platform, just over 30 million ETH has now been staked. Lido is the market leader, with a 31.5% share of that total.

Moreover, the total amount staked is valued at around $73 billion at current Ethereum prices. It also reports that there are 940,563 validators securing the network.

Ethereum staking stats. Source: Dune Analytics

Furthermore, there has been a significant increase in staking flow deposits over the past two weeks.

Blockchain analytics firm Nansen has posted similar data with 30 million ETH staked, representing 25% of the total 120 million ETH supply.

Additionally, it reports that the unstaking queue has virtually diminished, signaling that there are no large amounts of ETH pending withdrawal. It was reported that there were 176,686 ETH in the pending withdrawal queue, which represents less than 0.6% of the total.

Read more: Top 7 High-Yield Liquid Staking Platforms To Watch in 2023

Ultrasound.Money has slightly more conservative figures, with 29.7 million ETH reportedly staked.

The platform also reports that the Ethereum supply has decreased by 344,960 since the Merge in September 2022. At current prices, this works out at a supply deflation of almost $840 million.

The current rate of Ethereum inflation over a daily period is -0.57% per year. Around 4,288 ETH has been burnt over the past 24 hours, worth around $10 million.

ETH Price Upswing

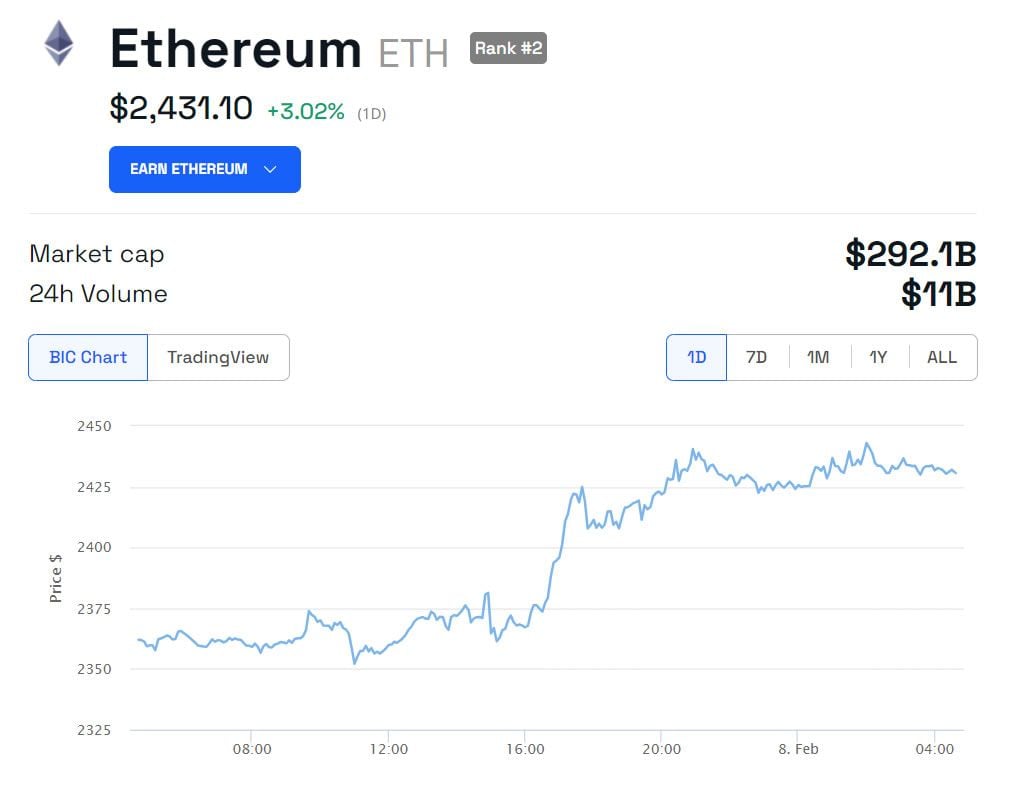

ETH prices have ticked up 3% over the past 24 hours to reach $2,431 during the Thursday morning Asian trading session.

ETH/USD 24 hours. Source: BeInCrypto

The smart contract network asset is currently trading up 7.8% over the past week. However, it is fast approaching resistance levels and is still down from its 2024 high of $2,700 on January 12.

At current prices, Ethereum is exactly 50% down from its all-time high in November 2021. Ethereum restaking narratives could reduce that gap soon, however.

Ethereum restaking is a process allowing users to stake the same ETH on multiple protocols, enhancing network security and leveraging Ethereum’s established trust system. CoinGecko’s new restaking token category, with a market capitalization of around $300 million, highlights this growing trend, as evidenced by significant price surges in leading restaking tokens like Pendle Finance and Picasso and the success of restaking platforms such as EigenLayer.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here