Ether (ETH) is trading higher on Dec. 1, despite its inability to breach the $2,100 resistance. This level has prompted several rejections in the past three weeks, which is especially concerning given Ether’s 16.2% gains in November.

However, the current positive momentum is supported by several factors, including applications for spot ETFs and the expansion of Ethereum’s ecosystem, driven by layer-2 solutions.

ETH benefits from ETF expectations and negative news related to competing blockchains

A pivotal development occurred on Nov. 30, with the U.S. Securities and Exchange Commission (SEC) initiating the review process for Fidelity’s spot Ether ETF proposal, filed on Nov. 17. This move, along with similar applications from firms like BlackRock, awaits regulatory green light. If approved, these ETFs would bolster Ether’s status as a digital commodity, reducing the likelihood of it being treated as a security.

Despite analysts predicting the SEC might delay its decision to early 2024, interim deadlines for applications by VanEck and ARK 21Shares on Dec. 25 and Dec. 26, respectively, have kept the market engaged. The mounting interest from large mutual funds in Ether products is creating a favorable impact on its price.

The Ethereum network’s growth, especially in transaction activity and layer-2 development, is noteworthy. The Ethereum layer-2 ecosystem has become increasingly important as the average transaction fee held above $4 for the last couple of months. These layer-2 solutions offer more cost-effective and flexible options than the base layer.

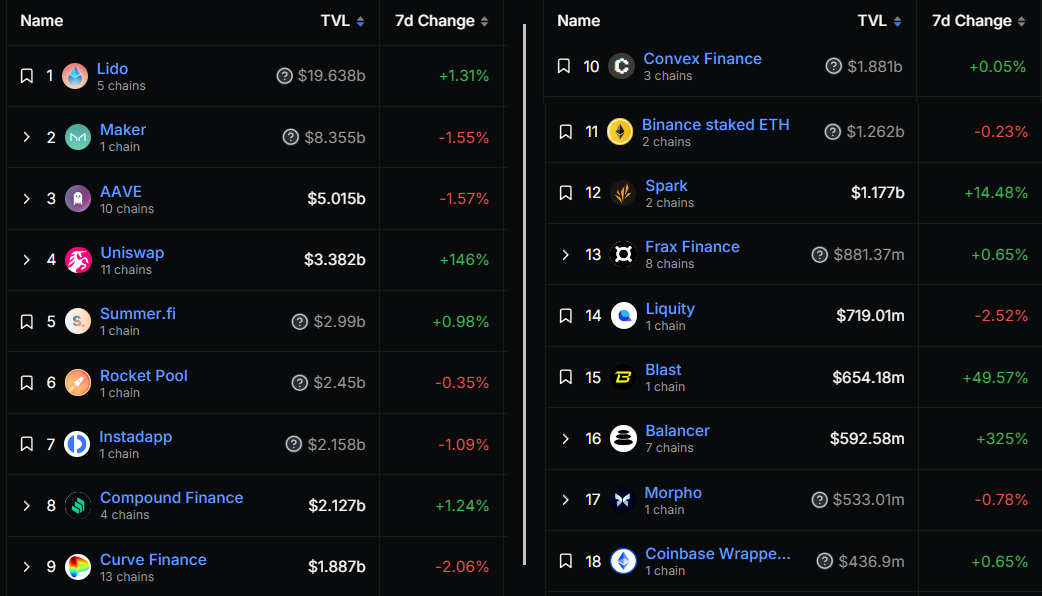

This growth is reflected in Ethereum’s total value locked (TVL), which recently hit a two-month high of 13 million ETH, spurred by a 13% weekly gain in Spark and a 60% increase in Blast user deposits.

In contrast, Tron, another leading blockchain in TVL terms, witnessed a 12% decline over the past ten days. Recent high-profile hacks linked to Tron’s founder Justin Sunhave also swayed investor confidence toward Ethereum.

TVL growth is based on Ethereum layer-2 innovations

Blast, an Ethereum layer-2 project, has impressively accumulated $647 million in TVL, a testament to the vibrant development within this space. Despite facing criticism over centralization issues and smart contract flexibility, Blast’s self-promoted features like auto-compounding and stablecoin yields are attracting significant attention. On the flip side, Blast has suffered criticism for centralization and the flexibility to upgrade its smart contracts.

Notably, Blast is just one part of a larger ecosystem. Ethereum’s leading scaling solutions, Arbitrum and Optimism, hold a combined TVL of $2.94 billion. In the context of TVL, it’s insightful to compare Ethereum’s robust layer-2 ecosystem with other blockchains. Although these solutions are still subject to significant base layer settlement fees, there’s no denying the impressive growth and increased activity they’ve experienced over time.

Related: Why is the crypto market up today?

Take Solana (SOL) as an example: its entire TVL, encompassing projects like Marinade Finance, Jito, marginfi, Solend, and Orca, is currently valued at $671 million. This stark contrast highlights the edge Ethereum’s layer-2 solutions have over its competitors, such as Cardano (ADA), BSC Chain (BNB), and Avalanche (AVAX), blockchains primarily focused on native scaling solutions. However, Ethereum’s approach, leveraging layer-2 technologies, seems to have gained more traction and user trust, as evidenced by its growing activity.

In essence, Ether’s recent push towards the $2,100 resistance level is largely influenced by the anticipated approval of spot ETFs in the U.S. and the increased market share in decentralized applications.

The ongoing evolution and appeal of Ethereum’s layer-2 solutions, which mitigate high transaction costs, are also playing a crucial role in attracting users and sustaining Ether’s positive market trajectory.

Read the full article here