According to Lookonchain, a whale has been accumulating Ethereum (ETH), and borrowing more while opening a long ETH position in the process. According to the post, the whale had withdrawn 39,900 ETH from Binance, Bybit, Bitfinex, and OKX since February 1.

Later, the whale borrowed 56.8 million DAI from the lending platform ‘Spark’ and changed the decentralized stablecoin to ETH.

A whale is accumulating $ETH and going long $ETH by revolving loans on #Spark!

The whale has withdrawn 39.9K $ETH($99.5M) from #Binance, #Bybit, #OKEx and #Bitfinex since Feb 1 at an average price of $2,492, and borrowed 56.8M $DAI from #Spark.https://t.co/9EQSrwHnJD pic.twitter.com/6CydURt2pc

— Lookonchain (@lookonchain) February 13, 2024

ETH Looks Ready for a Blast

Accumulating ETH of this magnitude and borrowing more implies that the participant was confident of a significant price increase. ETH’s price at press time was $2,661—a 14.35% increase in the last seven days.

This price increase indicates that the whale has made some unrealized profits on some of the ETH accumulated earlier. Between February 9 and 12, ETH traded between $2,483 and $2,540. However, bulls were able to push the price above the $2,600 resistance.

Looking at the 4-hour chart, ETH could face another resistance of around $2,720. A clear move above it could send ETH rising as high as $3,000. But if the altcoin fails to clear the path, it could dump to the next support near the $0.786 Fibonacci retracement level.

If this is the case, ETH might drop to $2,355. However, indications from the Moving Average Convergence Divergence (MACD) showed that a price plunge was unlikely in the short term. This was because the MACD had a positive reading.

ETH/USD 4-Hour Chart (Source: TradingView)

Furthermore, the 12-day EMA (blue) had crossed over the 26-day EMA (orange), suggesting bulls had neutralized bears out of the way. Should this position stay the same, ETH’s price might climb further while helping the altcoin push past the $2,720 resistance.

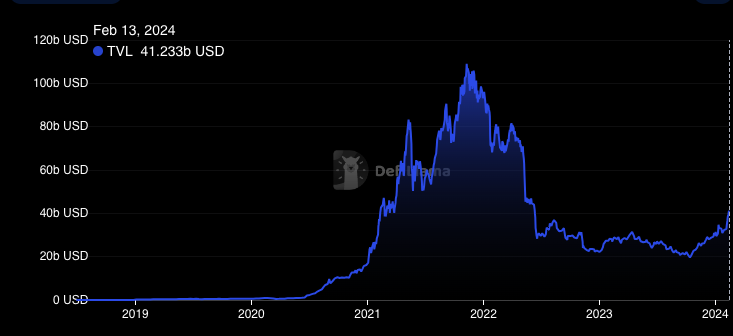

Ethereum TVL Hits Yearly High

From an on-chain perspective, Ethereum’s Total Value Locked (TVL) also aligned with a price increase for ETH. According to DeFiLlama, Ethereum TVL has increased to $41.23 billion, indicating a Year-To-Date (YTD) high for the protocol.

The TVL is a metric that indicates the overall health of a network. When it decreases, it means fewer assets are staked or locked. If this was the case, it would have also implied that participants do not trust Ethereum to produce enough yield.

Ethereum TVL (Source: DeFiLlama)

However, the recent increase in TVL suggests a surge in assets staked and locked on the blockchain. Since this indicates high network utility, ETH’s price might be positively affected.

In the short term, ETH might try to test $3,000. If this is successful, the price could head towards $3,500. In addition, a new All-Time High (ATH) for the cryptocurrency might appear before 2024 ends.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here