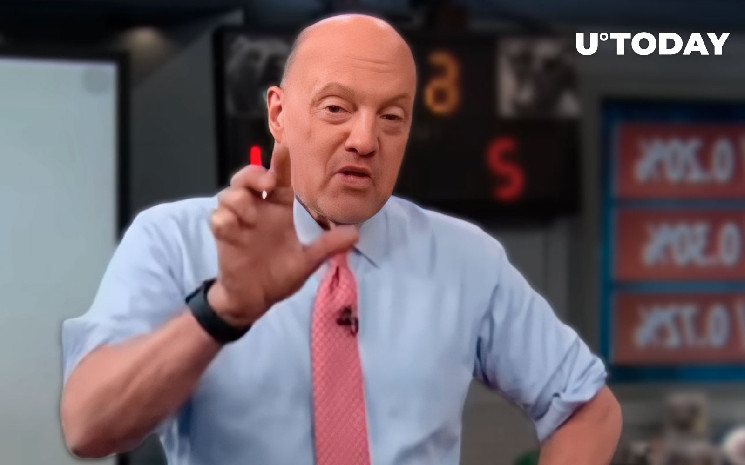

Renowned market analyst and television host Jim Cramer expressed optimism about the future of Ethereum exchange-traded funds (ETFs), predicting a bright future akin to the success seen with Bitcoin ETFs.

This prediction comes after the ETH price surpassed the $3,400 mark.

Spot Ethereum ETFs promoted by Coinbase

Coinbase, a leading digital currency exchange, has taken significant steps by formally requesting the Securities and Exchange Commission (SEC) to approve the listing and trading of the Grayscale Ethereum Trust on NYSE Arca.

This request aligns with the broader industry push, involving major financial institutions like Fidelity and BlackRock, towards the establishment of Ethereum ETFs.

The potential approval of Ethereum ETFs has sparked considerable speculation about the digital currency’s market value. Standard Chartered, a prominent financial institution, predicts a significant surge in Ethereum’s price, potentially reaching $4,000, contingent upon the SEC’s approval expected in May.

This forecast is based on the anticipated increase in accessibility and investment in Ethereum, should ETFs be approved, marking a pivotal moment for cryptocurrency investment.

Will an Ethereum ETF be approved this year?

The sentiment around the approval of Ethereum ETFs is increasingly positive, with industry leaders like Grayscale’s Sonneshein expressing confidence in the inevitability of such financial products being greenlit in 2024.

ETF expert James Seyffart also expects an ETF product to be approved this year.

This consensus among market analysts and financial leaders indicates a growing belief in the maturation and acceptance of cryptocurrency within mainstream investment vehicles.

Read the full article here