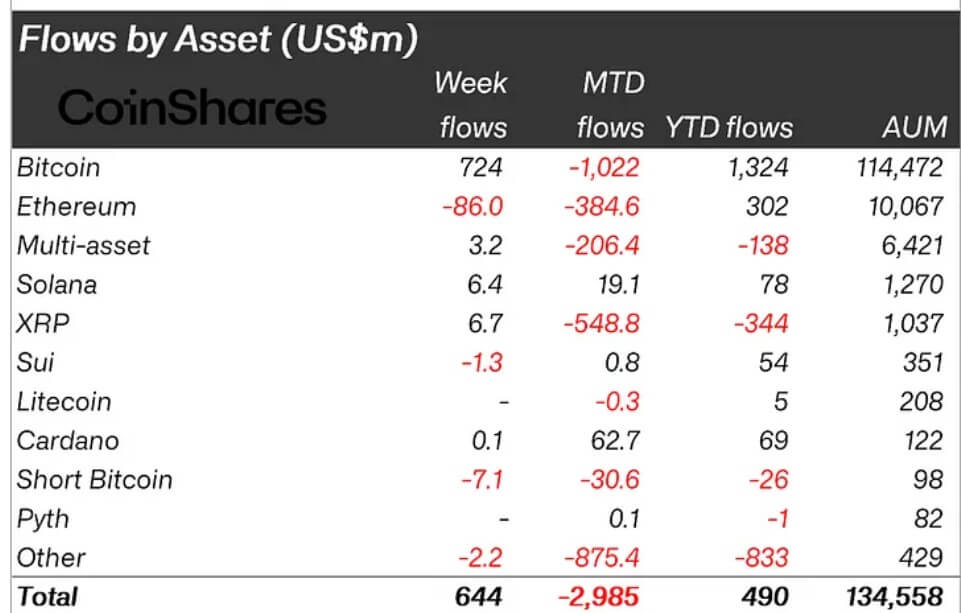

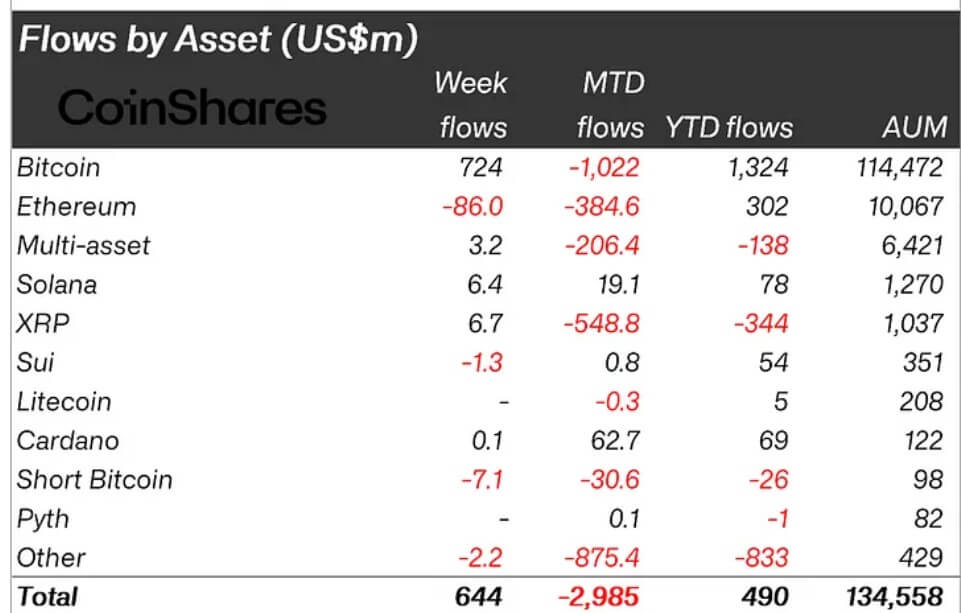

Crypto-related exchange-traded products (ETPs) ended their five-week outflow streak, recording strong weekly inflows of $644 million, according to CoinShares’ latest report.

James Butterfill, Head of Research at CoinShares, noted that the trend reversal reflects a marked improvement in investor sentiment across the digital asset sector.

According to him, crypto ETPs saw inflows every day last week, following a 17-day streak of outflows. The renewed inflows have pushed total assets under management (AUM) up by 6.3% from the March 10 low, reaching $134.5 billion.

Bitcoin leads recovery

The report showed that Bitcoin played the most significant role in this rebound, pulling in $724 million in fresh capital. That marks the end of its $5.4 billion outflow streak over the previous five weeks.

Much of the activity came from US-listed spot Bitcoin ETFs. BlackRock’s iShares Bitcoin Trust (IBIT) led the charge with $464 million in inflows. Fidelity’s FBTC followed with $136 million, while ARK 21Shares brought in $75 million.

At the same time, short-Bitcoin products saw outflows of $7.1 million, reinforcing the bullish mood.

In total, US-based products accounted for $632 million in inflows. But this renewed optimism extended beyond American markets as Switzerland added $15.9 million, Germany saw $13.9 million, and Hong Kong posted $1.2 million.

XRP rises, Ethereum struggles

Outside of Bitcoin, XRP led altcoin inflows with $6.7 million.

The token benefited from renewed optimism following the US Securities and Exchange Commission (SEC) decision to drop its long-standing lawsuit against Ripple Labs.

Solana nearly matched XRP’s inflows with inflows of $6.4 million despite the waning interest in memecoin activity on the network.

Meanwhile, Polygon and Chainlink also recorded gains, though more modest, at $400,000 million and $200,000, respectively.

In contrast, Ethereum saw the sharpest decline, with $86 million in outflows.

Other altcoins facing redemptions included Sui and Polkadot, each worth $1.3 million, Tron, with $950,000, and Algorand, with inflows of $820,000.

Mentioned in this article

Read the full article here