Bitcoin’s rally past the $34,000 mark has also triggered a similar rally in the DeFi sector. Almost all coins have witnessed a notable price increase and growing activity since Bitcoin’s rally, with Solana experiencing a significant resurgence. Recognized for its efficient transaction speeds, Solana has emerged as a pivotal player in the DeFi market.

Data from DefiLlama showed a significant surge in Solana’s TVL. On Oct. 1, the TVL stood at $324.27 million, which rose to $410.12 million by Nov. 1, marking a 26.5% increase.

Total value locked (TVL) refers to the total amount of assets currently being held in a blockchain protocol. It’s a metric that indicates the liquidity and popularity of a DeFi platform. Put simply, a higher TVL means more people are using that particular platform, demonstrating utility.

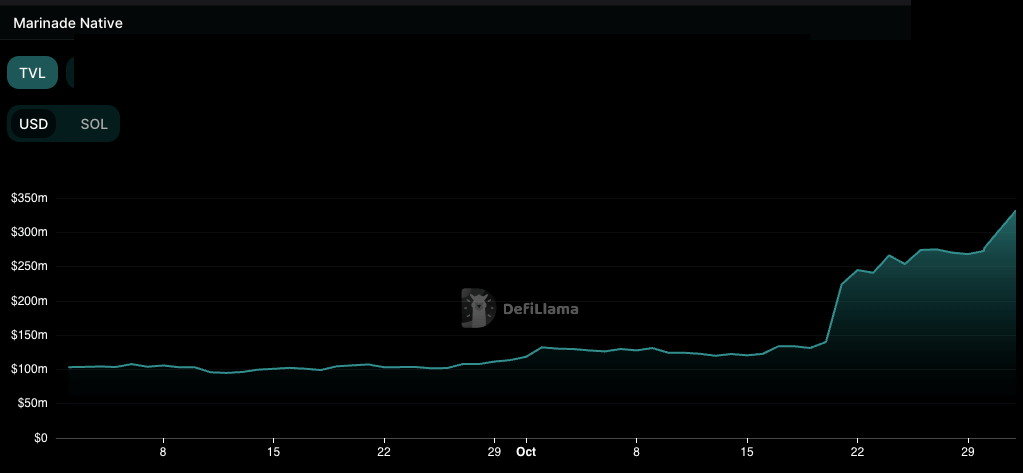

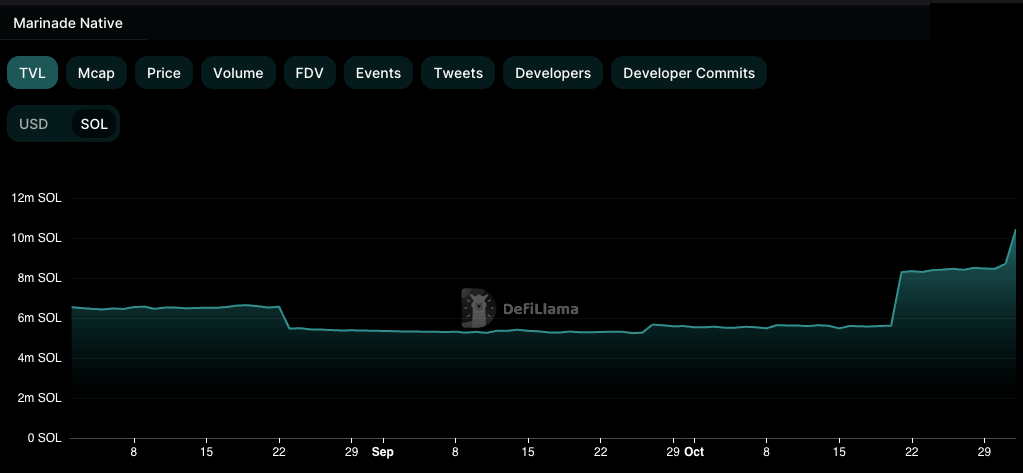

Much of this TVL growth can be attributed to Marinade Finance, a staking protocol launched earlier this year on Solana. Marinade saw a 180% increase in TVL in October, growing from $118.47 million on Oct. 1 to $331.8 million on Nov. 1.

Marinade Finance offers an attractive staking Annual Percentage Yield (APY) of 8.81%. APY is the real rate of return earned on an investment, considering the effect of compounding interest. It represents the potential earnings a user can expect over a year from staking their assets. Furthermore, Marinade’s growing popularity is evident, with 74,873 accounts using its services as of Nov. 1.

In terms of SOL denomination, Marinade’s TVL experienced a remarkable surge in October, escalating from 5.54 million SOL on Oct. 1 to 10.45 million SOL by Nov. 1, nearly doubling its value.

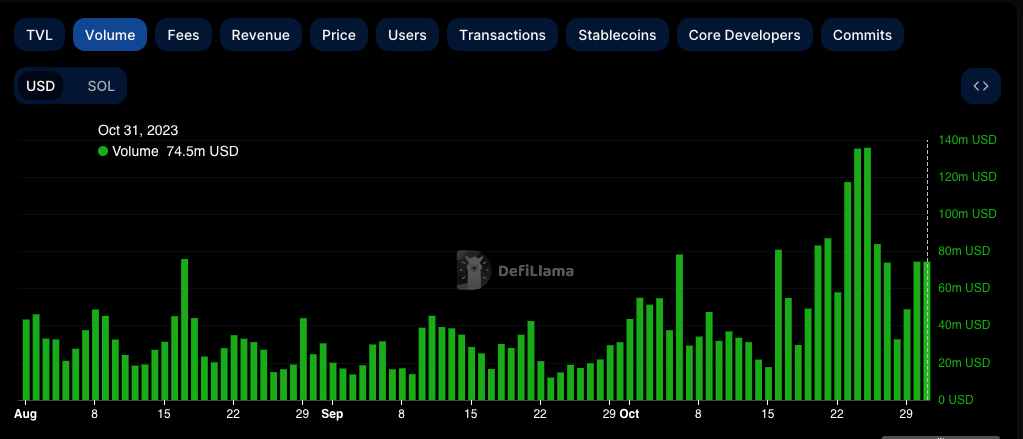

Regarding trading volume, Solana saw a substantial rise from $43.6 million on Oct. 1 to $135.8 million on Oct. 25, marking a 211% increase. This was the 4th highest volume since the beginning of the year.

Solana’s native token, SOL, also witnessed impressive growth. The price of SOL increased from $21.4 on Oct. 1 to $38.5 by Nov. 1, marking an 80% increase. This price was the highest since the collapse of FTX and the highest it has been in 2023.

Furthermore, Solana saw $24 million in inflows in the last week of October. This inflow was significantly higher than other altcoins and Ethereum, emphasizing the growing trust and investment in Solana’s ecosystem.

While the data showcases Solana’s impressive strides in the DeFi landscape, it’s crucial to approach these figures with a degree of skepticism. The significant growth in TVL, mainly driven by Marinade Finance, does highlight Solana’s potential, but it also raises questions about the platform’s reliance on a few major protocols.

The swift increase in TVL denominated in SOL within a month is noteworthy, yet such rapid ascents often warrant scrutiny for sustainability in the volatile world of crypto. The rise in trading volume and SOL’s price does reflect growing interest, but whether this is a sign of long-term confidence or a short-lived trend remains to be seen.

While Bitcoin’s rally has undoubtedly boosted the entire DeFi sector, including Solana, it’s essential to discern between genuine growth and mere market euphoria. As the DeFi narrative unfolds, Solana’s true position and lasting impact will be determined by its ability to innovate, adapt, and respond to market challenges.

The post Unpacking Solana’s surge in the shadow of Bitcoin rally appeared first on CryptoSlate.

Read the full article here