Lido DAO recorded a strong bull run as positive sentiment surrounds the crypto market. Data shows increased whale accumulation around the asset.

Lido DAO (LDO) is up 33% in the past 24 hours and is trading at $1.40 at the time of writing. Its market cap is currently sitting at $1.26 billion with a daily trading volume of over $300 million.

LDO’s bullish momentum started after Bitcoin (BTC) reached a new all-time high of above $75,000 after Donald Trump’s victory in the U.S. presidential elections on Wednesday, Nov. 6.

Despite the price hike, LDO is still down by 92% from its ATH of $18.6 in November 2021.

Notably, data shows that Lido DAO’s Relative Strength Index surpassed the 80 mark. The indicator suggests that the asset has entered the overbought zone at this point.

Rally triggered by whales

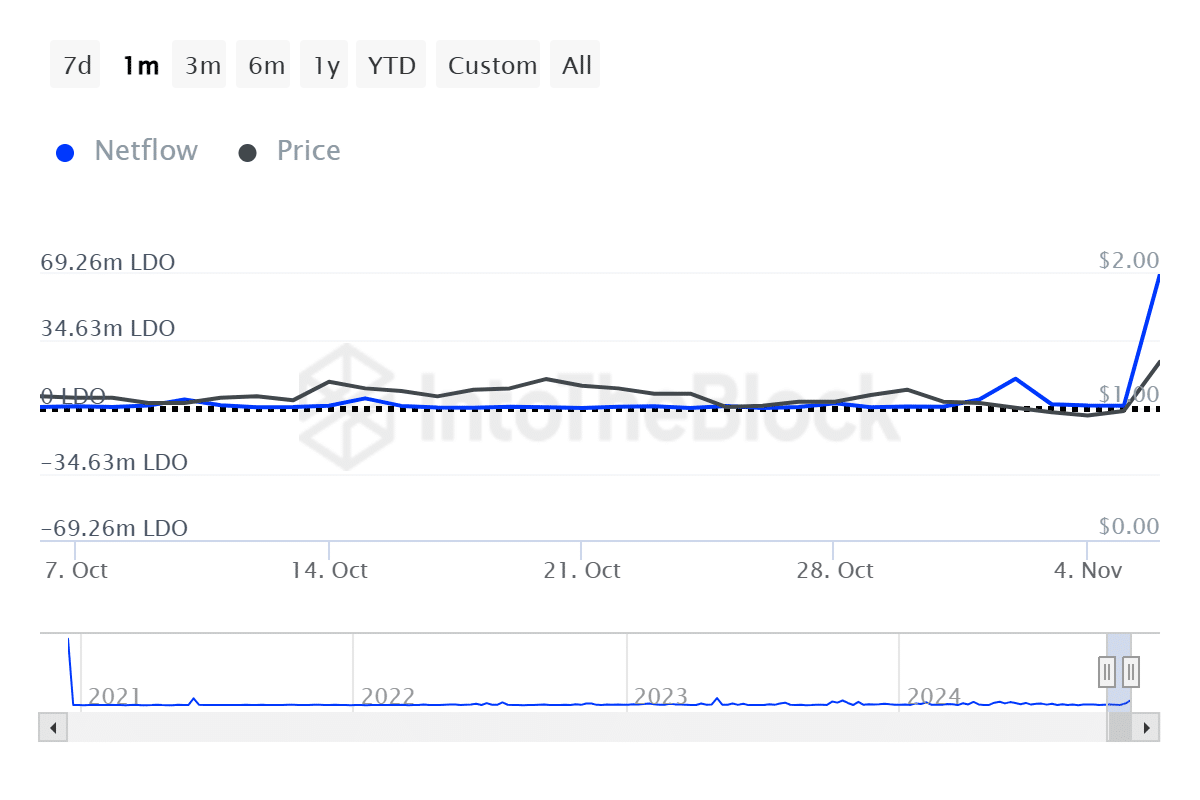

On-chain data shows increased whale activity happened around LDO before its price skyrocketed. According to data provided by IntoTheBlock, the token’s large holder net inflow increased from 645,000 LDO to 69.26 million LDO yesterday.

This is the highest level of LDO whale net inflows since May 2023, when the asset was hovering close to the $2 mark.

The movements show whales’ strong accumulation and interest in LDO. Usually, rising large holder inflows could trigger the fear of missing out, also known as FOMO, among investors.

Considering that over 60% of Lido DAO’s supply is sitting in large whale addresses, the sudden price surge could lead to massive price fluctuations, per ITB. The market-wide FOMO could also add to LDO’s price volatility.

Read the full article here