The following is a guest article from Vincent Maliepaard, Marketing Director at IntoTheBlock.

Economic risks have led to nearly $60 billion in losses across DeFi protocols. While this number may seem high, it only reflects losses at the protocol level. The actual total is likely much larger when factoring in individual user losses due to various economic risk factors. These personal losses often arise from volatile market conditions, complex inter-protocol dependencies, and unexpected liquidations.

Understanding Economic Risk in DeFi

Economic risk in DeFi refers to the potential financial loss due to adverse movements in market conditions, liquidity crises, flawed protocol design, or external economic events. These risks are multi-faceted and can stem from various sources:

- Market Risk: Volatility in the value of assets can lead to significant losses. For example, sudden price drops in collateralized assets can cause liquidation events, leading to a cascade of forced selling and further price drops.

- Liquidity Risk: The inability to quickly buy or sell assets without causing a significant impact on the price. In DeFi, this can manifest during a market sell-off when liquidity pools dry up, exacerbating losses.

- Protocol Risk: This risk arises from flaws or inefficiencies in the design of DeFi protocols. Impermanent loss, oracle manipulation, and governance attacks are examples of how protocol-specific risks can materialize.

- External Risk: Factors outside the protocol such as actions by large market players or changes in macro rates and conditions, can introduce significant risks that are often beyond the control of users or a protocol.

The Layers Within Economic Risk

In DeFi, economic risks are pervasive, but they can be understood on two distinct levels: protocol-level risks and user-level risks. Distinguishing between the two helps users better define the risks that affect their strategies and monitor key signals to take preventative action.

Protocol Level Risks

Protocols implement safeguards through variable parameters designed to limit exposure to economic losses. A common example is the lending and borrowing parameters set by lending protocols, which are tested and calibrated to prevent bad debt from accumulating. These measures are generally utilitarian, aiming to protect the protocol from economic risks on a broad scale, benefiting the largest number of users.

While managing economic risks is becoming increasingly important for preventing large-scale losses at the protocol level, the focus is narrow—on the protocol itself. They don’t address the risks that individual users may introduce by making economically risky decisions within their own strategies.

User Level Risks

User-level risks are often reduced to the amount of leverage an individual takes in long or short positions, but this only scratches the surface. Users face a range of additional risks, such as liquidations, impermanent loss, slippage, and the potential for locked lending liquidity. These individual risks don’t usually fall under the scope of protocol risk management, but can have a significant financial impact on individual users.

The good news is that these user-level economic risks are highly actionable. By understanding their own risk profile, users can actively manage and mitigate the risks specific to their strategy. This personalized approach to risk management remains one of the most underutilized tools available to DeFi participants today.

The interconnected nature of risks across DeFi protocols

Economic risk management is essential when addressing risks that span multiple DeFi protocols. While protocol audits and risk parameters strengthen individual protocols, DeFi users often engage with multiple protocols in their strategies. This makes user-level risk management crucial.

Each additional protocol or asset introduces new risk factors, not only from that new protocol but also from how these protocols interact. Even if each protocol is secure on its own, risks can emerge from how your strategy combines these different protocols.

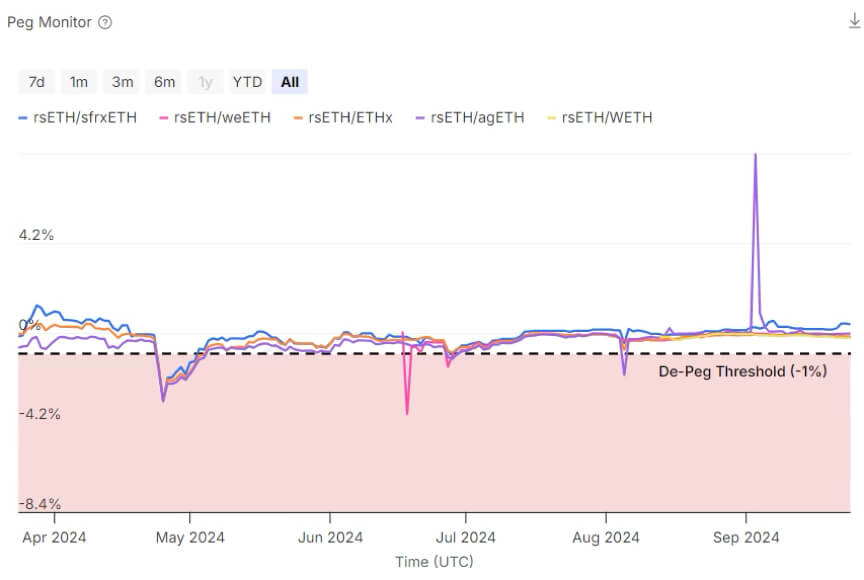

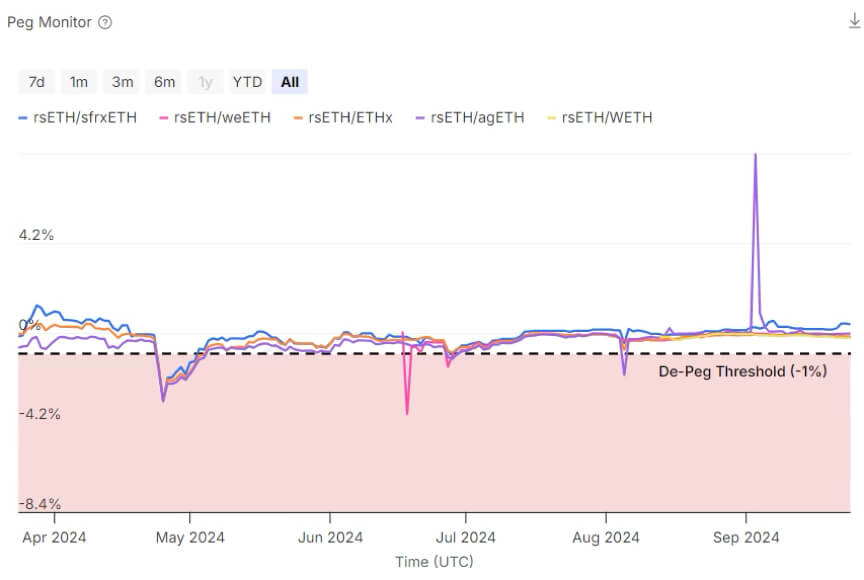

For example, imagine a scenario where a user utilizes a Liquid Restaking Token (LRT) as collateral to borrow an asset, which is then deployed in a liquidity pool (LP) on an external automated market maker (AMM). The primary concern might be the leveraged borrowing position, but there are additional risks. The stability of the LRT’s peg could impact liquidation in the lending protocol, while the composition of the LP could affect slippage and exit fees, potentially causing capital loss when repaying the loan. These interconnected risks don’t fall under any single protocol’s control and are therefore best managed by the user.

Steps to Understand and Manage Economic Risk

Managing economic risk in DeFi requires a well-thought-out approach, as the complexity of multi-protocol strategies can introduce unforeseen vulnerabilities.

- Deep Dive into Protocol Mechanics: Understanding the underlying mechanics of a protocol is the first step in identifying potential economic risks. Investors and developers should scrutinize the economic models, assumptions, and dependencies within the protocol.

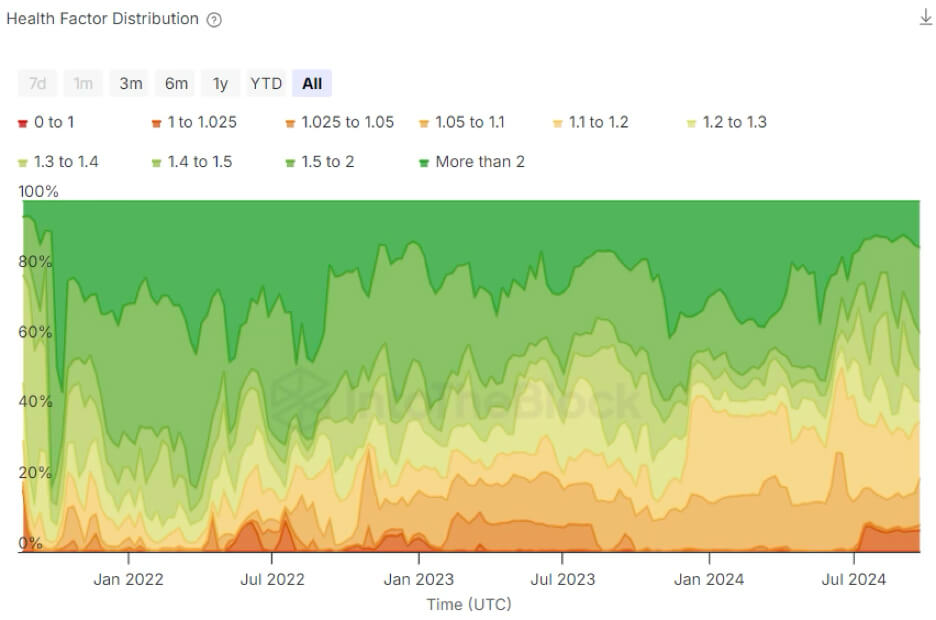

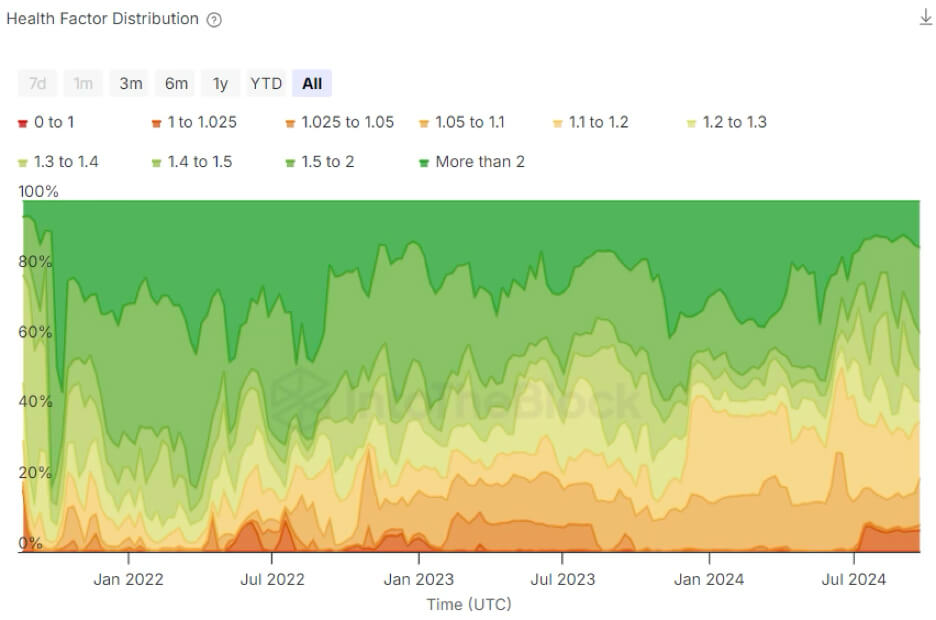

- Monitor Market Indicators: Keeping an eye on market signals, such as asset volatility, liquidity, and overall sentiment, is essential. Analyzing on-chain data specific to the protocols you’re using is a practical way to stay informed. For instance, if you’re engaging with a lending strategy on Benqi, monitoring the health factor of loans on the platform is crucial. This provides insights into how stable your lending position is and helps you anticipate potential issues before they escalate.

- Create a holistic risk profile: Understanding how interconnected risks may impact your overall strategy is key to effective risk management. While individual strategies vary, risk analytics can assist in identifying areas of concern. For example, if you’re using a Liquid Restaking Token (LRT) as collateral to borrow assets, monitoring the stability of the LRT’s peg is essential to avoid unexpected liquidations. Sudden spikes or volatility in the peg could signal a need to take precautionary measures, such as reducing exposure or increasing collateral.

In summary, managing economic risk in DeFi is about being proactive. By understanding protocol mechanics, keeping a close watch on market indicators, and building a holistic view of potential risks, users can better navigate the challenges of multi-protocol strategies and protect their positions.

Read the full article here