Brazilian judges have been authorized to seize cryptocurrency assets from debtors who owe money and are behind on their payments, signaling a growing recognition that digital assets can be both a form of payment and a store of value.

According to local media reports, the Third Panel of Brazil’s Superior Court of Justice unanimously authorized judges to send letters to cryptocurrency brokers informing them about their intent to seize an account holder’s assets to repay creditors.

The report was confirmed by the Superior Court of Justice, which issued a notice on its website.

The decision was reached unanimously by the Third Panel, which reviewed a case brought forward by a creditor.

“Although they are not legal tender, crypto assets can be used as a form of payment and as a store of value,” a translated version of the Superior Court of Justice’s memo read.

Source: STJnoticias

Under existing rules, Brazilian judges are allowed to freeze bank accounts and order fund withdrawals, even without a debtor’s knowledge, should they rule that a creditor is owed money.

Following the recent decision, crypto assets now fall under the same purview.

Minister Ricardo Villas Bôas Cueva, who voted in the five-person panel, said cryptocurrencies still lack formal regulation in Brazil but noted certain bills have recognized the asset class as “a digital representation of value.”

Related: Brazil’s data watchdog upholds ban on World crypto payments

Despite regulatory uncertainty, Brazil is a major hub for crypto

Although Brazil still lacks an overarching framework for digital assets, with the country’s central bank divvying up the regulatory processes into phases, crypto adoption is surging across the country.

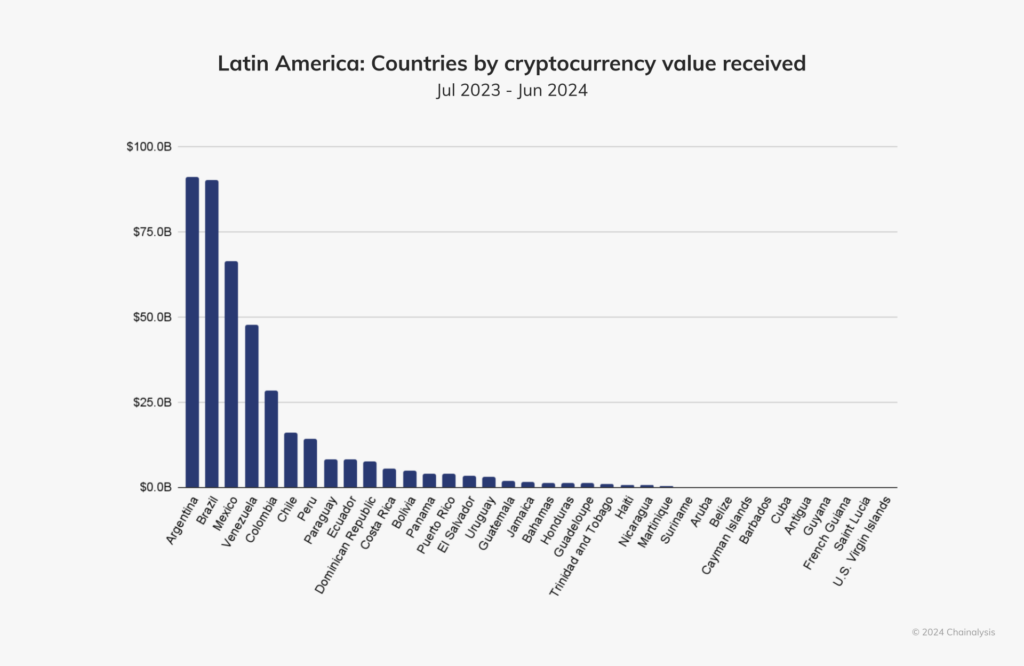

Brazil ranks second among all Latin American countries in terms of “crypto value received,” which is a key benchmark for adoption, according to an October report by Chainalysis.

In Latin America, only Argentina has higher crypto penetration in terms of value received as of June 2024. Source: Chainalysis

Earlier this year, crypto exchange Binance was granted approval to operate in the country after it acquired a São Paulo-based investment company.

A Binance executive told Cointelegraph at the time that Brazil was making “significant strides” in regulating the industry and expects a comprehensive framework to be finalized “by mid-year.”

Nevertheless, not all of Brazil’s regulatory proposals have been favorable for the industry.

In December, the country’s central bank proposed banning stablecoin transactions on self-custodial wallets at a time when more locals were using dollar-pegged tokens to hedge against the devaluation of the Brazilian real.

Industry observers told Cointelegraph at the time that such a ban would be difficult to enforce.

“Governments can regulate centralized exchanges, but P2P transactions and decentralized platforms are much harder to control, which means the ban would likely only affect part of the ecosystem,” said Lucien Bourdon, an analyst with Trezor.

Related: Brazilian lawmaker introduces bill to regulate Bitcoin salaries

Read the full article here