stake.link, a leading delegated staking protocol for the Chainlink ecosystem, has announced its availability on the Layer 2 scaling network Arbitrum. By going cross-chain, stakeholders can now stake their on in a more gas-efficient environment.

Meanwhile, the decentralized Oracle network Chainlink has seen massive growth over the past year as more and more DeFi protocols rely on its price feeds and real-world data to build next-generation Web3 applications. With this increased adoption comes greater demand for staking the network’s LINK token to provide security guarantees and earn rewards. However, doing so directly on Ethereum has become prohibitively expensive due to high gas fees. The aim is to solve this problem.

What is Chainlink?

How stake.link Works

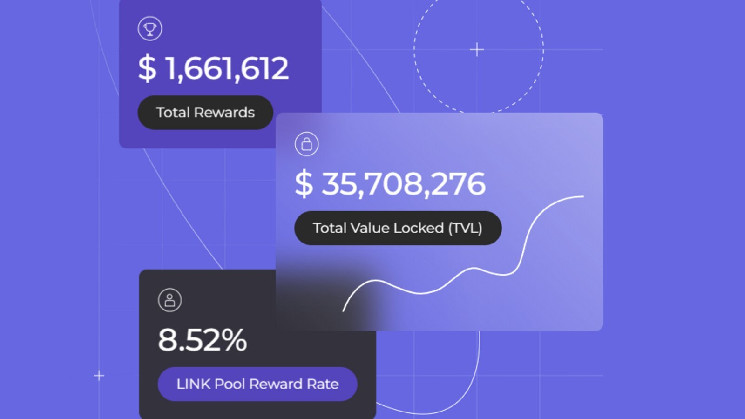

stake.link automates the delegation process, allowing token holders to earn staking rewards from top node operators without locking up their coins or running infrastructure. Users receive stLINK ERC-20 tokens representing their staked LINK, which can also be used in DeFi protocols for additional yield.

The Chainlink governance council approved the move to Arbitrum following votes from the community. Staking on the lower-fee network enhances security for the ETH-USD price feed, which currently has 45 million LINK protecting it.

CoinCodex to Launch a Chainlink Node

Arbitrum is by far the most adopted Layer 2 scaling solution, providing Ethereum compatibility with significantly lower fees. It has seen rapid growth as projects across DeFi, NFTs, and more deploy on it.

Opportunities for stake.link

For stake.link, Arbitrum unlocks additional opportunities. Users can stake their native SDL governance token, receive NFT rewards, and bridge stLINK tokens over. The protocol also plans to utilize Arbitrum’s developer grants and incentives.

While Chainlink’s own staking protocol recently updated to version 0.2, allowing the unstaking of previously locked tokens, this triggered increased activity as users participated, contributing to congestion and high gas on Ethereum. Arbitrum provides a viable alternative to avoid this.

Therefore, as Chainlink continues cementing itself as the industry-standard oracle solution powering DeFi and Web3 apps, robust staking mechanisms are essential. The network’s services secure billions of dollars in smart contract value.

Developing Adoption and Improving User Experience

stake.link believes its cross-chain expansion will drive further adoption of LINK staking while providing a better experience for users. The protocol takes care of the technical aspects so token holders can earn rewards in a gas-efficient way.

With Arbitrum now an option, staking LINK becomes accessible to a wider audience. Stake.link plans to utilize the flexibility of a multi-chain approach to grow the Chainlink ecosystem further.

Conclusion

stake.link’s strategic expansion to Arbitrum represents a significant milestone in the evolution of staking within the Chainlink ecosystem. It is addressing the critical challenge of high gas fees on Ethereum that’s smothering the network. stake.link enhances the user experience and also opens up new avenues for growth and adoption. This move that is supported by the Chainlink governance council and community underscores the protocol’s commitment to innovation and its role in securing the backbone of DeFi and Web3 applications. stake.link continues to evolve and adapt to the needs of the Chainlink community. Its integration with Arbitrum is poised to foster a more accessible, secure, and rewarding staking environment for LINK token holders.

Read the full article here