Ethereum continued its freefall against Bitcoin, falling to its lowest level since April 2021. It has dropped by over 55% from its highest point in 2021.

Ether’s sell-off is accelerating

Ethereum (ETH) was trading at 0.039 BTC, down by 24% this year and by 35% from the year-to-date high. It has also dropped against other cryptocurrencies like Solana (SOL), Binance Coin (BNB), and Tron (TRX).

The same has occurred in US dollar terms, with the coin dropping for four consecutive months, now trading near $2,300 which is its lowest point since February.

Ethereum’s sell-off is likely due to the weak response from institutional investors, who have largely avoided spot ETFs. Data shows that Ether ETFs have had net outflows of over $581 million. They currently hold $6.62 billion in assets, much lower than spot Bitcoin funds, which have over $54 billion and have had net inflows of $18 billion.

Ether has also declined due to recent liquidations by the Ethereum Foundation and Vitalik Buterin. Buterin has sold tokens worth $2.2 million, while the foundation has sold 350,000 coins.

Most importantly, there are concerns that Ethereum is losing market share to layer-2 networks like Base, Arbitrum, Polygon, and Blast, which are known for faster speeds and lower transaction costs than Ethereum.

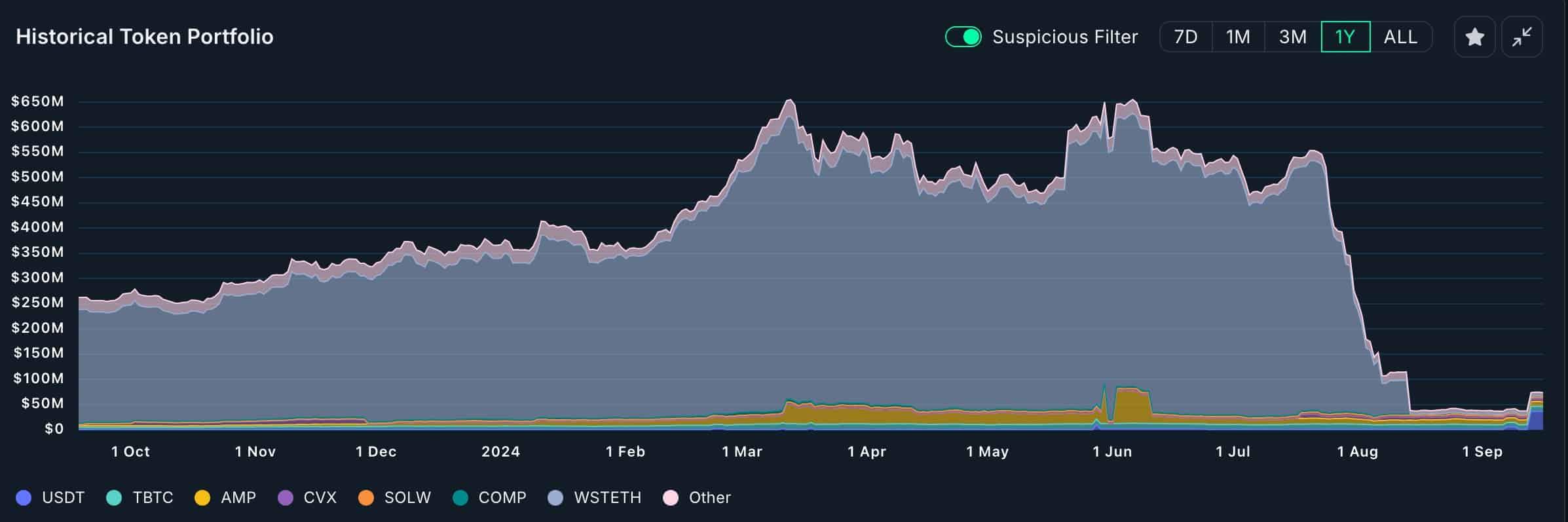

Additionally, there are signs that many smart money investors are selling the coin. For example, one investor sold ETH worth almost $10 million in the last 24 hours, as shown below.

Another top entity that sold its Ethereum assets was Jump Trading, one of the top players in the crypto industry. According to Nansen, its total Ether holdings dropped from over $531 million in July to zero.

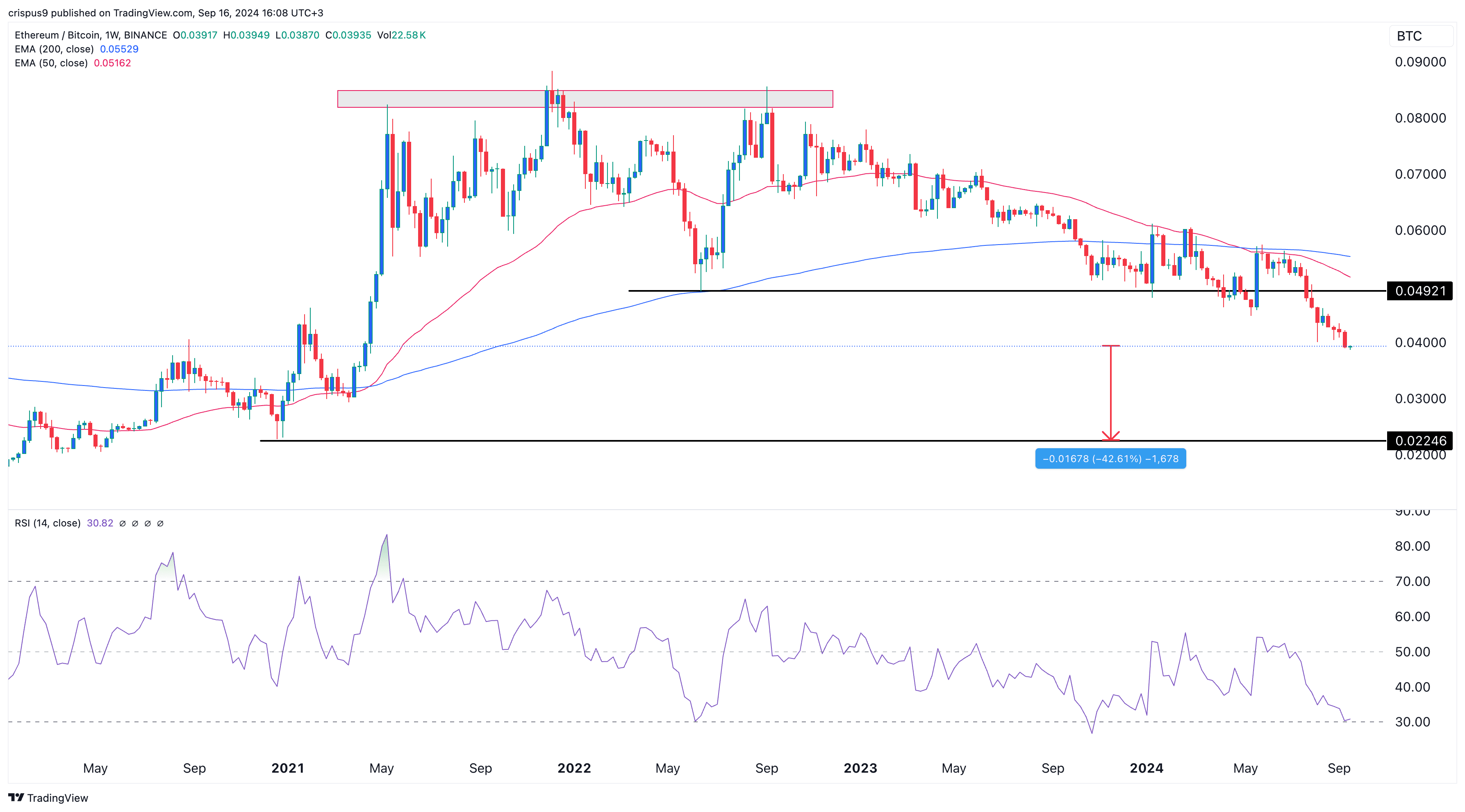

Ethereum has more downside in BTC terms

The ongoing Ether sell-off began after it formed a triple-top chart pattern around the 0.088 level between May 2021 and September 2021. The coin then dropped below the pattern’s neckline at 0.049 on May 20 of this year.

It also formed a death cross pattern in April, as the 50-week and 200-week moving averages crossed each other.

The Relative Strength Index has retreated and retested the oversold level of 30, signaling strong downward momentum. Therefore, the path of least resistance for Ether is downward, with the next reference point being 0.0224, which would represent a 42% drop from the current level.

Read the full article here