Cardano gained strong bullish momentum for the first time in seven months as Bitcoin keeps hitting new all-time highs.

Cardano (ADA) emerged as the top gainer among the leading 100 cryptocurrencies in the past 24 hours, with a 33% rally. The asset reached $0.594 earlier today—a level last seen in April—and is trading at $0.57 at the time of writing.

Cardano’s market cap reached the $20 billion mark, making it the ninth-largest digital currency. Its daily trading volume also surpassed the $2 billion zone.

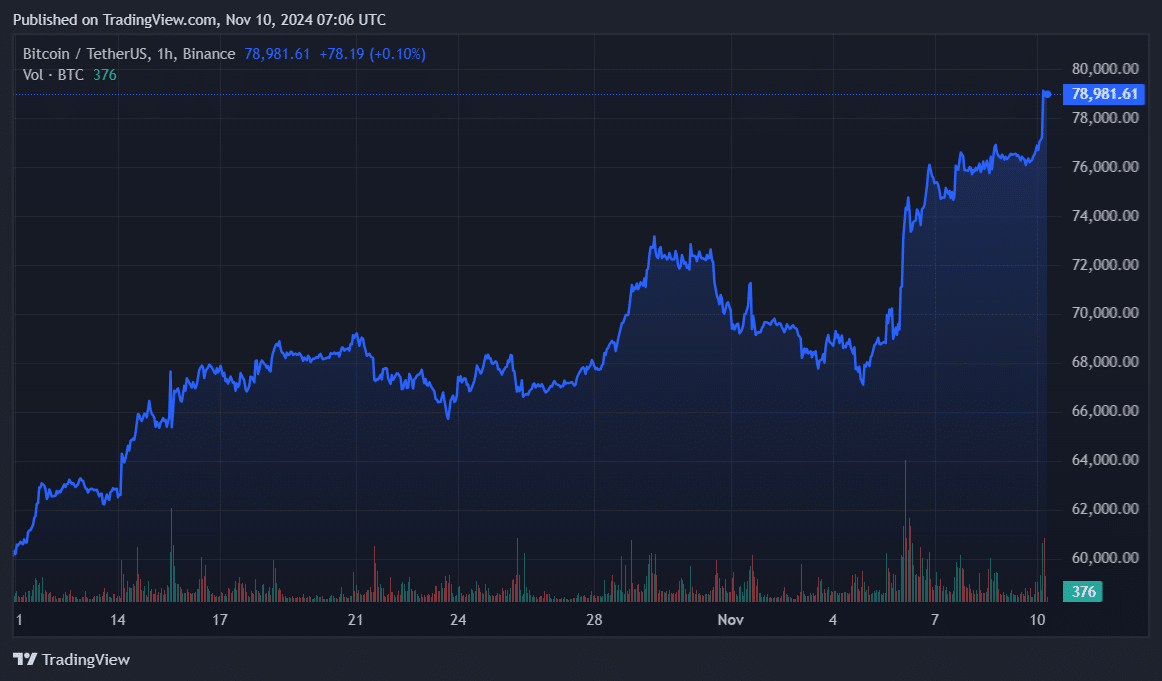

Bitcoin

Bitcoin (BTC) spiked after Donald Trump won the popular vote and the electoral college on Nov. 5. The leading cryptocurrency reached an all-time high of $79,780 at 05:43 UTC today. It also saw its market cap reach $1.58 trillion with a circulating supply of 19.78 million coins.

Bitcoin is trading at $79,000 as some investors have already started profiting.

According to data provided by CoinGecko, the global crypto market capitalization is currently at $2.85 trillion, up $420 billion over the past week. The total crypto trading volume reached $172 billion in the past 24 hours.

What’s pushing crypto?

Trump’s win triggered an upward trajectory in the crypto market as many called him the “first pro-crypto president.” Bitcoin reached an ATH of $75,000 after Trump’s electoral votes surpassed 270 on Nov. 6.

Spot BTC exchange-traded funds in the U.S. also witnessed a record net inflow of $1.37 billion on Nov. 7, adding to the industry’s positive sentiment. Total net inflows surpassed the $25 billion mark.

Following the latest push, total crypto liquidations increased by 68% in the past 24 hours, reaching $384 million, according to data from Coinglass. Bitcoin registered $102 million in liquidations—$13 million long and $89 million shorts.

Usually, short liquidations trigger upward momentum.

ADA also saw $7.3 million in liquidations—$1.6 million longs and $5.7 million shorts—per Coinglass.

It’s important to note that high trading volume and liquidations would lead to high volatility. The start of long liquidations and profit-taking from short-term traders would potentially hint at a market-wide correction.

Read the full article here