An analyst who nailed Bitcoin’s pre-halving correction last year says a key indicator is flashing a bullish signal for BTC.

The analyst pseudonymously known as Rekt Capital tells his 107,000 YouTube subscribers that the Relative Strength Index (RSI) indicator is breaking out of a months-long downtrend, suggesting Bitcoin may soon soar to the upside.

The RSI is a momentum oscillator used to determine whether an asset is oversold or overbought. The RSI’s values range from zero to 100 with the level between 70 to 100 indicating that an asset is overbought while the zero to 30 level indicates that an asset is oversold.

“What’s interesting about this entire period right now is that this has been a downtrend on the RSI, a daily downtrend dating back to really mid-November 2024. So breaking this downtrend is pretty pivotal, because it means that the RSI doesn’t want to be trending downwards anymore.

And this is actually very likely a hidden sign of emerging strength in Bitcoin’s price action, because now the RSI wants to enter a new macro uptrend after downtrending for effectively some five months or so, and now we are seeing the RSI try to confirm this breakout and breach of the downtrend so that it can rally higher. And this comes on the heels of really just price action building a bullish divergence.”

He also says Bitcoin may soon break through resistance at $88,500.

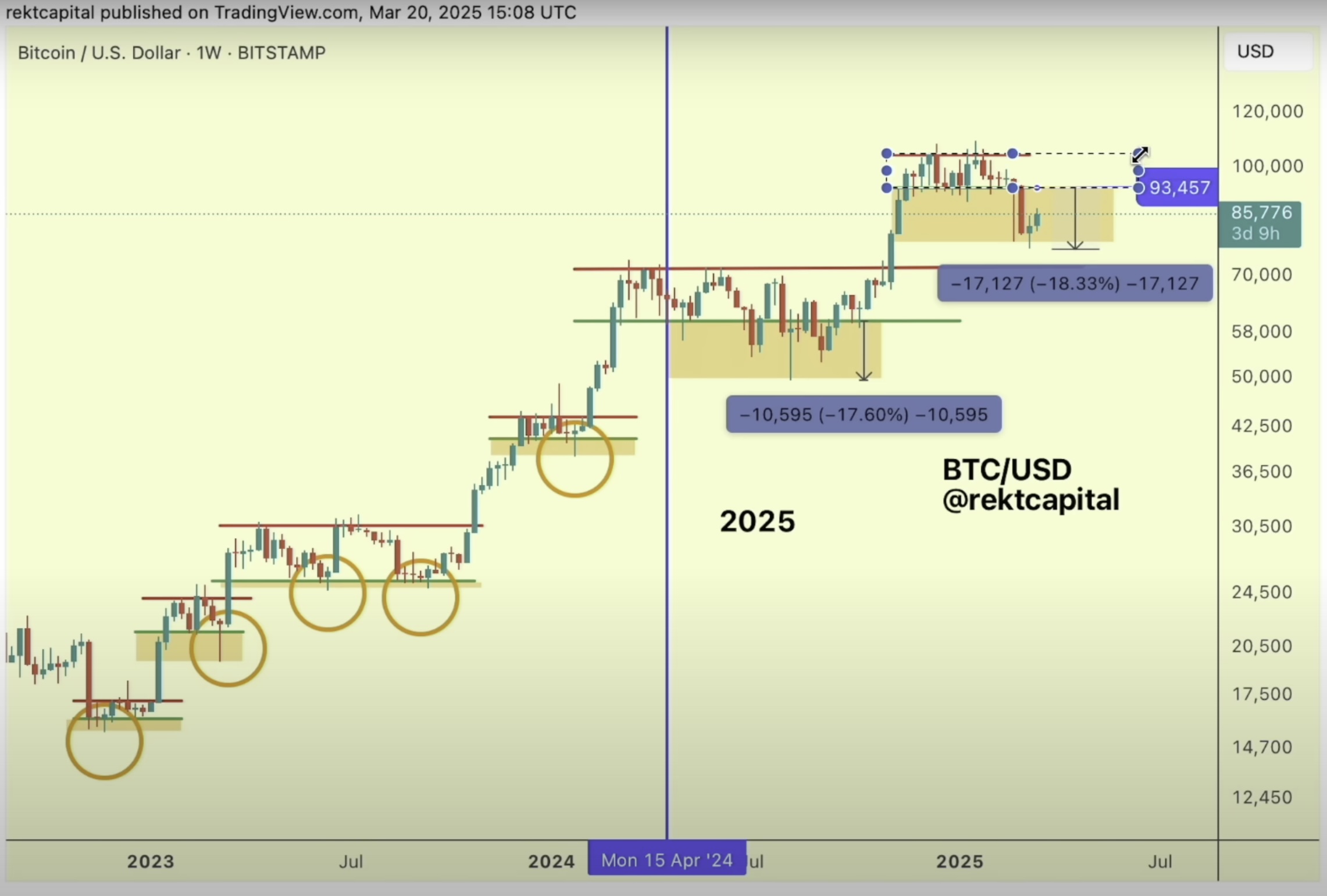

“We need to watch out for further continuation, which is going to be reclaiming $88,500 to get us back closer and closer to reclaiming this re-accumulation range [around $100,000]. And many people have been talking about this being a bear market, but it does look like it is a downside deviation period very similar to what we’ve seen back in the past.”

Bitcoin is trading at $83,998 at time of writing, down 2.3% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Generated Image: Midjourney

Read the full article here