Quick Take

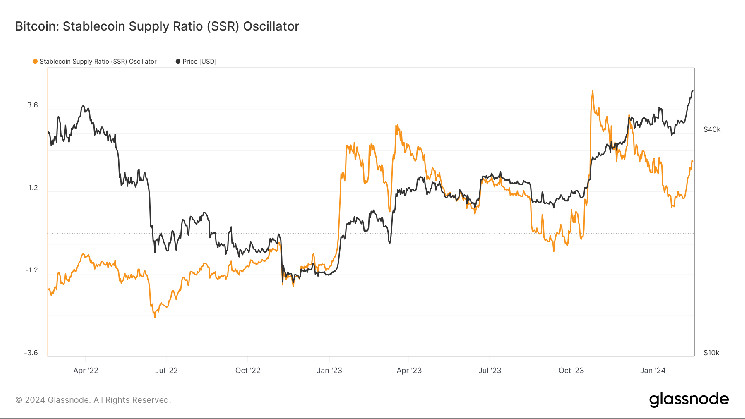

The Stablecoin Supply Ratio (SSR), a key metric that quantifies the supply forces between Bitcoin and various stablecoins, has been signaling increased “buying power” for Bitcoin in the past ten days.

Glassnode defines the SSR as the ratio of Bitcoin’s market cap to that of stablecoins denoted in Bitcoin, which serves as a proxy for the demand-supply mechanics of BTC versus USD. When the SSR dips, it implies a heightened buying power for the current stablecoin supply to purchase Bitcoin.

Three weeks ago, CryptoSlate observed a subtle upsurge in the SSR, from 0.74 to 1.04, corresponding to an increase in Bitcoin’s value to $42,000. Back then, the SSR was at 1.04, and it is now at 2.04. The upward movement started on Feb. 8 and coincided with the rise in Bitcoin price to $52,000.

This suggests that the demand for Bitcoin is driven by ETF interest and stablecoin liquidity entering the Bitcoin market.

Read the full article here