Following its recent growth trend, Bitcoin (BTC) has surpassed the threshold of $34,000 and has overachieved its price forecast for the end of October, which was set at around $30,000.

Starting at $27,000 at the beginning of the previous month, the last third of October has seen a notable rise in the valuation of BTC, which peaked at almost $35,000.

With the continuing evolution of the crypto traders market and the tools they use, Finbold has turned to advanced machine learning algorithms, which are tasked with predicting prices for cryptocurrencies. PricePredictions brings us this month’s Bitcoin price prediction for the end of November.

Data retrieved on November 1 by Finbold signals that the BTC price will break the $35,000 threshold early on and will experience a gradual ascent with minor upside fluctuations as the month progresses, peaking at $36,987 by the end of November.

Notably, this prediction is formulated by using several key technical indicators, including the moving average convergence divergence (MACD), relative strength index (RSI), Bollinger Bands (BB), and more.

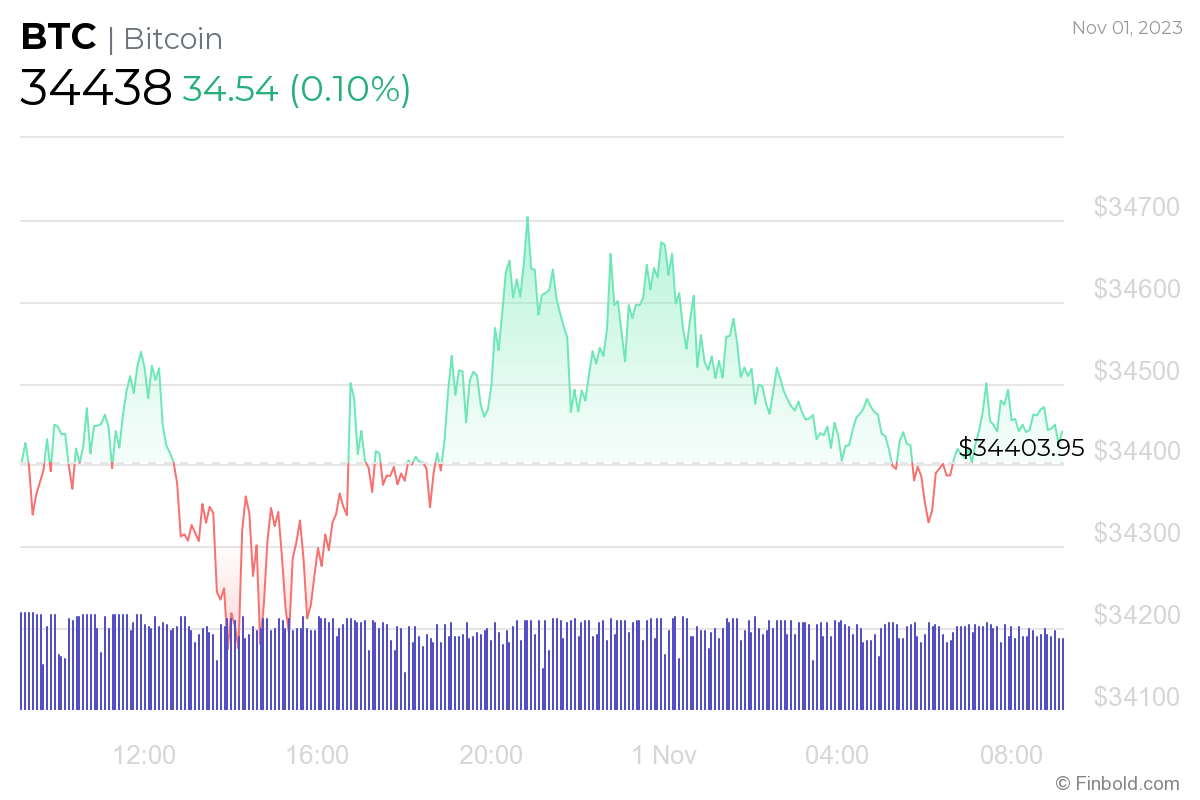

BTC price analysis

Bitcoin is currently trading at $34,443 at the time of writing, with a minor surge of 0.10% over the last 24 hours, which capped a small increase over the previous 7-day period, which amounted to 1.53%

Following a bullish pattern that has emerged over the last months, fundamental and technical analysis suggests that BTC is set to continue the upward trending motion for the rest of November.

With the rumored news of the near completion of a potential spot Bitcoin ETF deal, this trend looks likely to continue as BTC receives confidence and backing from an increased number of investors who possess large quantities of this cryptocurrency.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here