As the cryptocurrency market anticipates a potential bull market, investors may consider accumulating Bitcoin (BTC) in preparation for it.

A eminent analyst in the cryptocurrency industry suggests that the window for Bitcoin investors to increase their holdings below the $40,000 mark is closing.

In a recent post on X, the creator of the stock-to-flow BTC price models – PlanB, suggested that the current price levels may not persist for an extended period.

“Sorry, I am not in th ‘Picking Up Pennies In Front Of A Steamroller’ game. I expect $100k-$1m bitcoin average in 2024-2028 halving cycle, so at least 3x from here”, wrote PlanB in the comments of his post.

“Enjoy sub-$40k Bitcoin … while it lasts“

According to PlanB, Bitcoin is poised to reach levels well beyond its recent 18-month highs of 37.883, and the clock is ticking for investors to increase their Bitcoin exposure while the price is below $40.000.

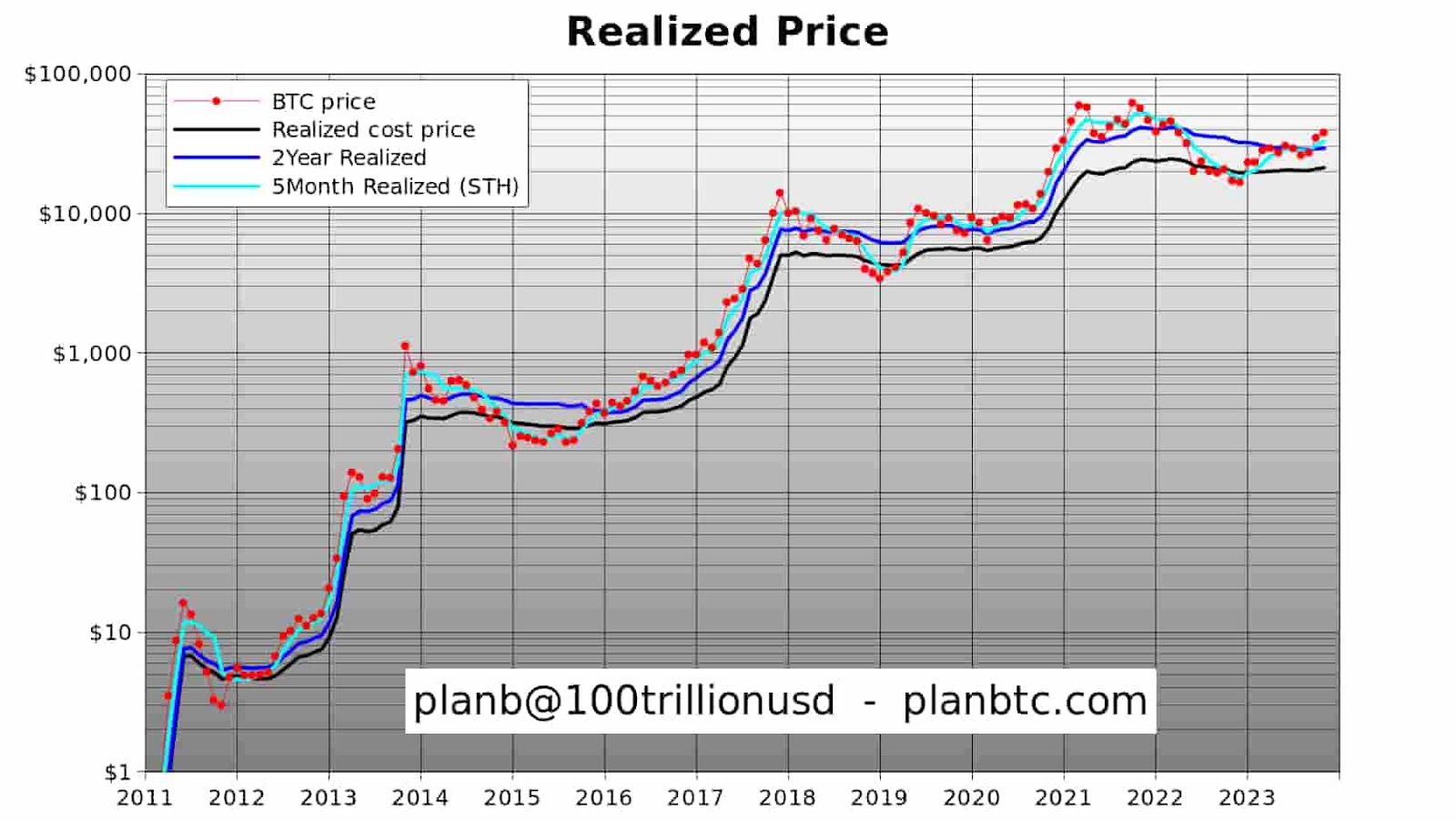

The analyst, known for his optimistic outlook on Bitcoin’s long-term price growth, referenced realized price data to support the bullish case.

The realized price is calculated by dividing Bitcoin’s realized cap, the total price at which all BTC last move, by the current supply, and it currently stands just below $21.000.

PlanB highlighted that bear market bottoms for Bitcoin typically occur when the spot price falls below the realized price. Conversely, bull markets tend to commence when the spot price surpasses the realized price levels for coins that last moved within the last two years or the last five months, indicating “younger” coins.

Currently, BTC/USD is once again above all three realized price iterations. PlanB accompanied the chart with a comment: “Enjoy sub-$40k bitcoin… while it lasts.”

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here