What’s behind Bitcoin’s historic rise to $108,000? From Trump’s speech to ETFs and MicroStrategy’s massive buys, could a major institutional supply squeeze be underway?

Bitcoin soars to new highs

Bitcoin (BTC) has once again stolen the spotlight. On Dec. 17, BTC climbed to an all-time high of $108,260, pushing its post-U.S. election gains to over 50%. As of this writing. 17, it is trading around $106,663 levels.

BTC’s rally follows President-elect Donald Trump’s proposal to establish a U.S. Bitcoin strategic reserve, a concept that has sparked widespread excitement across markets.

Trump’s announcement, made during his speech at the New York Stock Exchange on December 12, aims to position the U.S. ahead of global competitors in the digital asset space. He pointed to the need for America to “do something great with crypto” and to build reserves similar to its existing strategic oil stockpile.

The idea of a Bitcoin reserve isn’t entirely new. It was first introduced through the BITCOIN Act, championed by Republican Senator Cynthia Lummis, which envisions the U.S. acquiring 1 million BTC over the next five years to help address the growing $35 trillion national debt.

Another major factor driving this surge has been institutional activity, particularly from MicroStrategy, a firm synonymous with aggressive Bitcoin accumulation.

In the past week alone, MicroStrategy announced it had purchased $1.5 billion worth of BTC at an average price of $100,386 per coin. This recent acquisition brings its total Bitcoin holdings to 439,000 BTC, valued at around $47 billion.

The company’s Bitcoin strategy has paid off immensely, catapulting its market cap from $1.1 billion in 2020 to nearly $100 billion today.

Moreover, MicroStrategy’s inclusion in the Nasdaq 100 index, effective next week, is also expected to boost further demand for its stock as funds and ETFs rebalance their portfolios.

Meanwhile, Ethereum (ETH) hasn’t been left behind in this crypto frenzy. After a period of stagnation, ETH showed strong signs of life, climbing to a seven-day high of $4,106 on December 16—a 6% weekly gain.

While Ethereum has faced some minor retracement due to profit booking, it remains steady around the $3,950 mark as of this writing.

Let’s dive deeper into the key developments driving Bitcoin and Ethereum, analyze the macroeconomic indicators shaping this bull run, and see what experts believe could happen in the days to come.

Institutional powerplay

Bitcoin and Ethereum are both showing strong momentum, but the underlying story becomes clearer when we look at ETF inflows, liquidations, and futures open interest.

Spot Bitcoin ETFs have been on a tear this month. Since December began, they’ve seen consistent inflows every single day, adding over $5.16 billion as of Dec. 16.

These inflows have pushed the total assets under management for Bitcoin ETFs to $123 billion — a strong signal of confidence, especially from institutional investors.

Ethereum ETFs, however, tell a different story. Between their launch on Jul. 23 and Dec. 3, inflows were modest, reaching just $733.6 million. Compared to Bitcoin’s performance, this figure looks miniscule. But momentum has clearly shifted.

Since Dec. 4, Ethereum ETFs have seen consistent inflows, adding $1.58 billion in a matter of days, suggesting that investors are warming up to Ethereum, likely encouraged by its price performance and Bitcoin’s strong market lead.

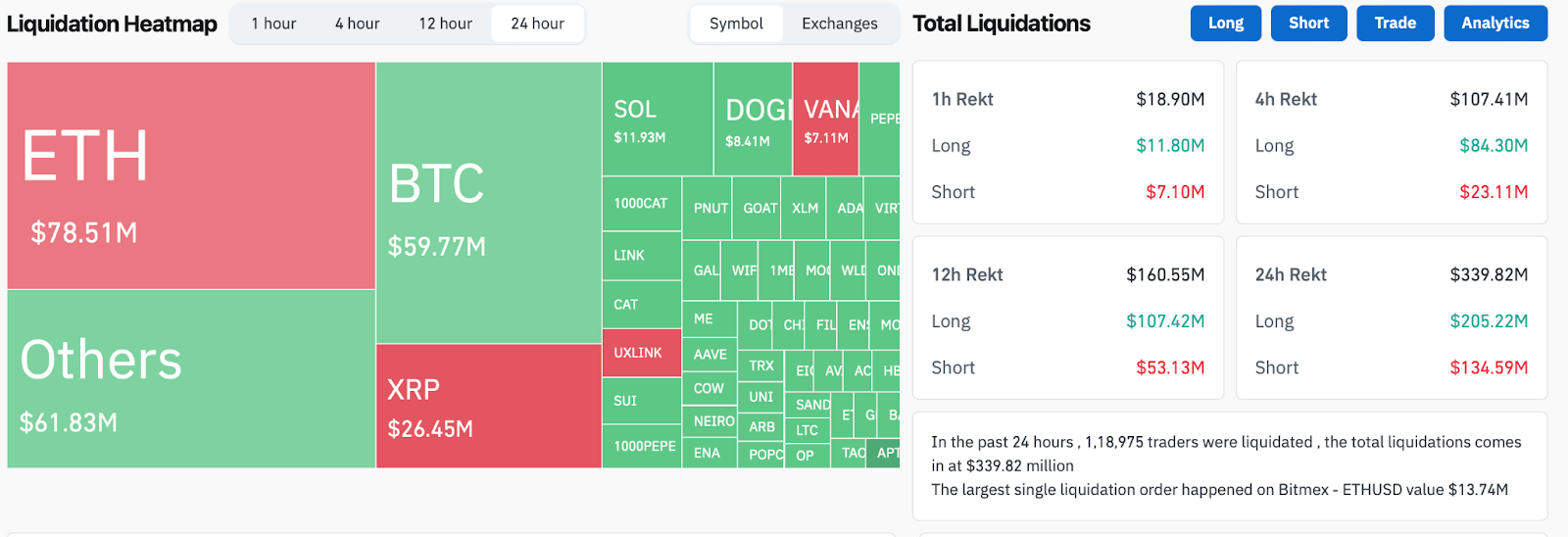

Liquidation data adds more context to what’s happening in the market. Over the last 24 hours, as of Dec. 17, $339 million worth of positions were liquidated across the crypto market, with $205 million in longs and $134 million in shorts wiped out.

For Bitcoin, total liquidations have been around $60 million, with short positions making up the majority at $30 million, compared to $29 million from longs, suggesting that many traders betting against Bitcoin’s rally were forced out of their positions as BTC climbed past $108,000.

Ethereum saw even heavier liquidations, totaling $78.5 million, with shorts again taking a larger hit at $52 million, again reflecting how ETH’s recent price push to $4,100 surprised many bearish traders.

Meanwhile, Bitcoin’s futures open interest — the total value of outstanding futures contracts — has seen monumental growth. Back in early October, open interest sat at $32 billion.

Following Trump’s election victory and the resulting bullish sentiment, that figure grew rapidly, reaching $55 billion by mid-November. Since then, open interest has continued to climb, hitting a massive $70 billion as of December 17.

Rising open interest paired with increasing prices is a bullish signal, as it shows new money flowing into the market and traders placing bets on further upside.

Put simply, Bitcoin’s rally isn’t running on fumes. ETF inflows are strong, futures activity is rising, and short sellers are being squeezed out of their positions.

Ethereum, while slower to catch up, is now benefiting from the same momentum, with growing ETF inflows and shorts being liquidated.

Both assets appear to have solid footing for their current uptrends, with institutional money and futures markets aligning to paint a bullish picture.

Macroeconomic crosswinds

The broader macroeconomic environment is currently a mixed bag, with a weakening U.S. Dollar, rate cut expectations, and political turbulence in Europe creating uncertainty across global markets.

The USD, which had been gaining strength for a while, is now stalling. The November Retail Sales figure came in at 0.7%, beating expectations of 0.5%, but it wasn’t enough to inspire confidence. Excluding cars and transportation, growth was a weak 0.2%, below the forecasted 0.4%.

Add to that the downward revisions for previous months, and it suggests consumer spending — the engine of the U.S. economy — is slowing.

This ties directly to the Federal Reserve. The market expects a 25-basis-point rate cut on Dec. 18 with almost certainty. However, the Fed’s tone has been cautious about 2025.

Expectations of aggressive rate cuts in the future are being dialed back, which has kept the Dollar from falling further.

A stronger Dollar generally puts downward pressure on riskier assets, including Bitcoin, because investors often see USD as a safer bet. But now that the Dollar’s rally is pausing, it gives crypto some breathing room.

At the same time, U.S. industrial production contracted by 0.1% in November when analysts expected growth of 0.3%, which signals that certain sectors of the economy are struggling.

Combine that with sluggish equity markets — Asian and European stocks are down, and U.S. futures are sliding by around 1% — and we see a general lack of enthusiasm for traditional investments.

Historically, when traditional assets underperform, and inflation remains under control, capital starts flowing into alternatives like Bitcoin. However, an overall bearish outlook can add choppiness and halt the bullish sentiments.

Meanwhile, political instability in Germany — where Chancellor Olaf Scholz lost a confidence vote — and lingering economic troubles in France are weakening the Euro.

Since the Euro makes up 58% of the U.S. Dollar Index, this directly supports the Dollar. However, global uncertainty often drives investors to look for assets that are independent of governments and central banks, like Bitcoin.

Amid this, the U.S. 10-year Treasury yield has pulled back slightly to 4.38%, down from its recent high of 4.43%. If yields continue to fall and rate cuts accelerate, it becomes cheaper to borrow money, and investors will start looking for higher returns elsewhere.

Bitcoin and Ethereum could likely benefit in these scenarios because they’re seen as high-return alternatives, especially when confidence in traditional markets is shaky. However, nothing is guaranteed.

What do experts think?

The ongoing Bitcoin and Ethereum rallies are creating the kind of setup that has historically led to explosive price movements. While the momentum is strong, there are signals investors should watch closely.

One of the most key observations is Bitcoin’s tightening supply dynamics. As Quinten pointed out, “BlackRock eating up 9x daily mining supply,” — a clear indication that institutional investors are snapping up Bitcoin faster than it can be mined.

With spot Bitcoin ETFs now giving institutions easy access to BTC, the supply shock narrative is gaining traction. If institutions continue to accumulate at this rate, a supply squeeze could amplify BTC’s next leg up.

Meanwhile, Ethereum is showing its own signs of structural strength. According to Ali Martinez, in previous bull cycles, Ethereum’s parabolic runs occurred when long-term holders shifted from the belief phase into “greed mode.”

Right now, Ethereum is still in the early stages of belief, suggesting that the big move for ETH may still be ahead, aligning with Ethereum’s recent price performance, as it quietly climbed toward $4,000 after months of stagnation.

Adding to this picture is Bitcoin’s MVRV ratio — a widely followed valuation tool. The MVRV ratio compares Bitcoin’s market value (its current market cap) to its realized value (average acquisition price based on on-chain data). Historical patterns show that BTC’s MVRV ratio peaked at 4.7x in 2017 and 4x in 2021.

As Presto Research outlines, applying a conservative 3.5x multiple to Bitcoin’s projected realized value of $1.2 trillion by Q3 2025 could put BTC’s network value at $4.2 trillion — or about $210,000 per Bitcoin.

However, the path to these price levels won’t be smooth. As Michaël van de Poppe noted, the Federal Reserve’s upcoming meeting introduces a key wildcard.

While a rate cut is expected, the Fed’s commentary could trigger volatility. Bitcoin has often responded sharply to central bank decisions, as monetary policy directly impacts liquidity in financial markets.

In Poppe’s words, “I won’t be surprised we’ll see $110K and $95K in the same week.”

If Bitcoin’s rally extends further and investor confidence spreads, Ethereum’s historical tendency to lag behind and then catch up could play out again.

To put it all together, the current rally has strong foundations: institutional demand, shrinking supply, and improving market sentiment.

However, volatility remains a given, especially with the Fed’s decisions looming and macro uncertainties still in play. While the data points to a bullish path, managing risk is key as we move deeper into this cycle. Always remember the golden rule: never invest more than you can afford to lose.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Read the full article here