The FLEX token has registered significant gains in the past 24 hours while data suggests the asset might be manipulated by large whales.

FLEX is up by 360% in the past 24 hours and is trading at $2.26 at the time of writing. Following the recent rally, the asset’s market cap rose to $222 million. However, FLEX’s daily trading volume witnessed a 7% decline and is currently standing at around $81,000.

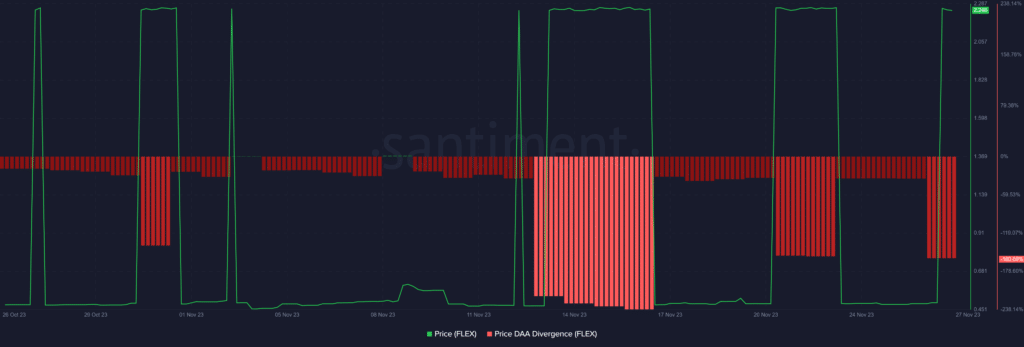

Data shows that FLEX has been constantly moving between $2.25 and $0.45, with sudden movements, since it dropped from its all-time high (ATH) over the past four months of $8.16 set on Aug. 10.

According to data provided by the market intelligence platform Santiment, FLEX didn’t witness any withdrawals over the past two days. This could indicate the anticipation of a token swap on exchanges.

Santiment data also shows that FLEX’s social volume recorded a 75% decline over the past 24 hours.

Moreover, the asset’s price-daily active addresses (DAA) divergence shows a strong sell signal, currently standing at negative 160%, per Santiment. The price DAA divergence indicates that FLEX’s price movements could have been manipulated by big whales.

According to Santiment, the number of active FLEX addresses has been consistently declining since Nov. 19 — taking a deep dive from 205 active wallets to four addresses.

When the price increases with the accumulation of big whales, sudden market movements are usually expected.

Read the full article here