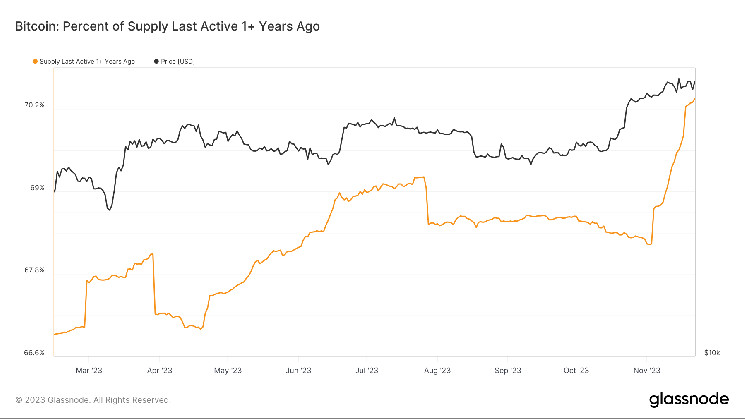

The percentage of Bitcoin’s (BTC) circulating supply that was last active on-chain at least a year ago has reached a record high of 70.35%, surpassing the previous peak of 69.35% in July, according to data tracked by blockchain analytics firm Glassnode.

The new lifetime high reflects “a strong belief from bitcoin’s holder base in the wake of crypto-wide contagion and macro headwinds after its all-time highs in 2021,” according to Reflexivity Research.

The percentage of supply that has not moved on-chain in two, three, and five years is also at their respective lifetime highs. It shows long-term investors are in no mood to sell even after bitcoin has more than doubled to $37,000 this year.

“While higher prices will ultimately incentivize new sellers, with Bitcoin up over 100% in the same time period, it appears Bitcoin holders are not planning on offloading inventory at these price levels or any time soon,” Reflexivity Research said in a note to clients.

These metrics, however, may not paint an accurate picture once the financialization of bitcoin through alternative investment vehicles like spot-based exchange-traded funds (ETFs) and cash-settled futures gathers pace.

For instance, in the ETF case, an issuer, with the help of the authorized participant, will pool the cryptocurrency and move it to custody, where it sits idle (inactive). However, investors will still take bullish/bearish trades on an exchange through the ETF units.

We may earn a commission from partner links. Commissions do not affect our journalists’ opinions or evaluations. For more, see our Ethics Policy.

Read the full article here