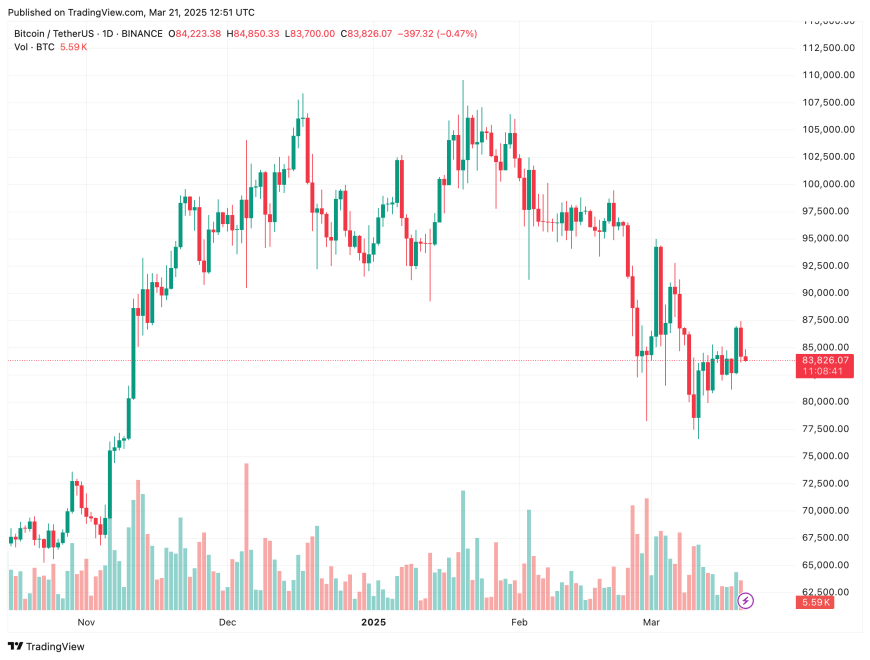

As Bitcoin (BTC) continues to trade in the low $80,000 range, a key macroeconomic development promises to benefit the leading cryptocurrency. If historical patterns hold true, then BTC may not be too far from another massive price rally.

Rise In M2 Money Supply To Benefit Bitcoin?

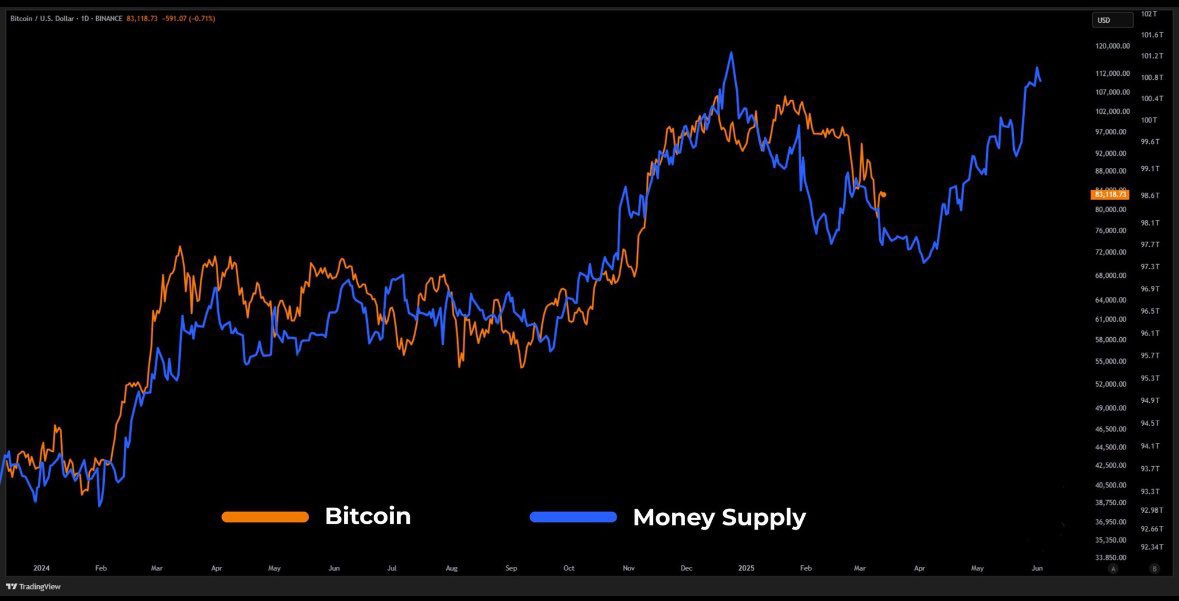

According to an X post by crypto analyst Master of Crypto, a rebound in global M2 money supply holds the potential to reignite BTC’s bullish momentum. The analyst explained that M2 – a leading indicator – often predicts significant shifts in Bitcoin’s price trajectory.

For the uninitiated, M2 money supply is a measure of the total money circulating in an economy, including cash, checking deposits, savings accounts, and other liquid assets. It’s a key indicator of liquidity, influencing inflation, economic growth, and financial markets, including emerging assets like Bitcoin.

Master of Crypto noted that historically, M2 movements tend to predict BTC’s price momentum with a 70-day lag. The analyst added:

Recently, as M2 began to rebound before BTC, it’s now fully recovered and poised to hit new peaks suggesting BTC might do the same. Analysts have insights on why this upcoming BTC rally could surpass all previous ones.

Fellow analyst James echoed these views, highlighting that BTC may experience another price rally after a brief period of dip and consolidation.

Crypto analyst The M2 Guy provided further insight, suggesting that if the 70-day lag holds, BTC’s next rally could start around March 24. He added that an alternative scenario – based on a 107-day lag – points to April 30 as the potential breakout date.

Technicals Point Toward BTC Take-Off

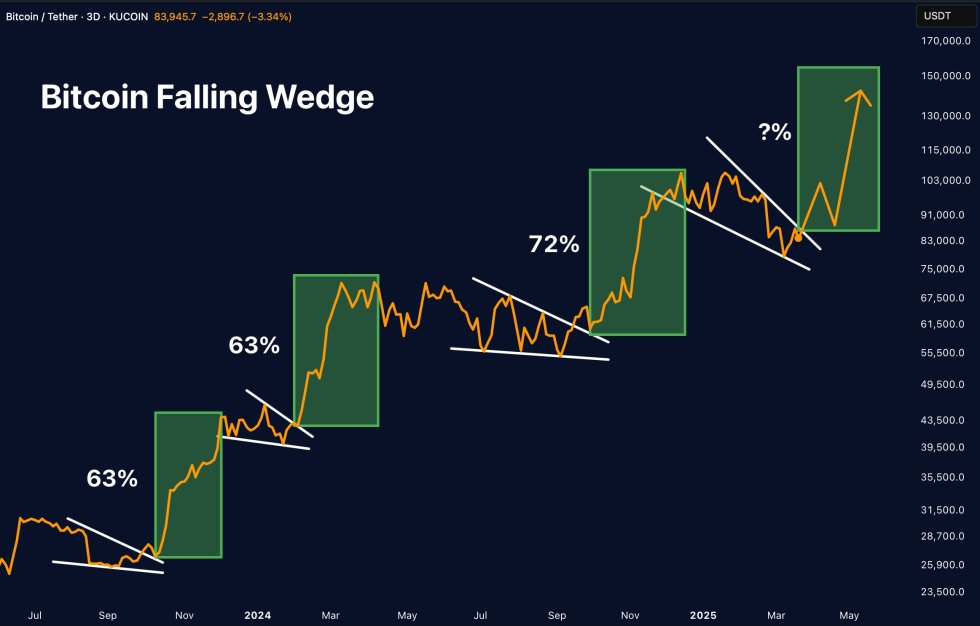

Crypto trader Merlijn The Trader identified a possible breakout from a falling wedge pattern – a historically bullish formation for Bitcoin. On average, BTC has delivered 66% returns following a breakout from this pattern on the three-day chart. A similar move now could propel BTC to new all-time highs (ATH).

Moreover, Merlijn noted that BTC is also tracking a megaphone pattern. However, he cautioned that Bitcoin must hold above $72,000 for this bullish structure to remain intact.

Crypto expert Burak Kesmeci pointed out that a recovery in the U.S. stock market may be crucial for Bitcoin’s next surge. He emphasized the strong correlation between cryptocurrencies and traditional equities, suggesting BTC could struggle if stocks remain weak.

Meanwhile, well-known American gold advocate Peter Schiff issued a bearish warning. He argued that BTC isn’t out of the woods yet – predicting a potential “catastrophic drop” if the NASDAQ enters a bear market. At press time, BTC trades at $83,826, down 1.7% in the past 24 hours.

Featured Image from Unsplash.com, charts from X and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Read the full article here