Despite the temporary setback, Bitcoin (BTC) has briefly managed to break the barrier at $38,000 a couple of times in the last 24 hours, and further bullish advances seem more likely as the flagship decentralized finance (DeFi) asset approaches its halving event in 2024.

Specifically, Bitcoin has now traditionally demonstrated exceptionally bullish strength in the periods approaching the halving, as well as after the event itself, according to the historical analysis published by cryptocurrency market analyst Trader Tardigrade in an X poston November 30.

Indeed, considering these movements, the crypto trading analyst expects the maiden cryptocurrency to grow toward $50,000 as the halving approaches, after which it would pick up the pace and kick off a rally that could lead it to $250,000 or beyond, as demonstrated in the chart pattern analysis.

At the same time, another pseudonymous crypto specialist, Crypto Tony, has observed that Bitcoin was making a “slow grind up right now” but that “$39,000 – $40,000 target really is in reach over next few days,” as long as the largest digital asset by market capitalization holds this uptrend.

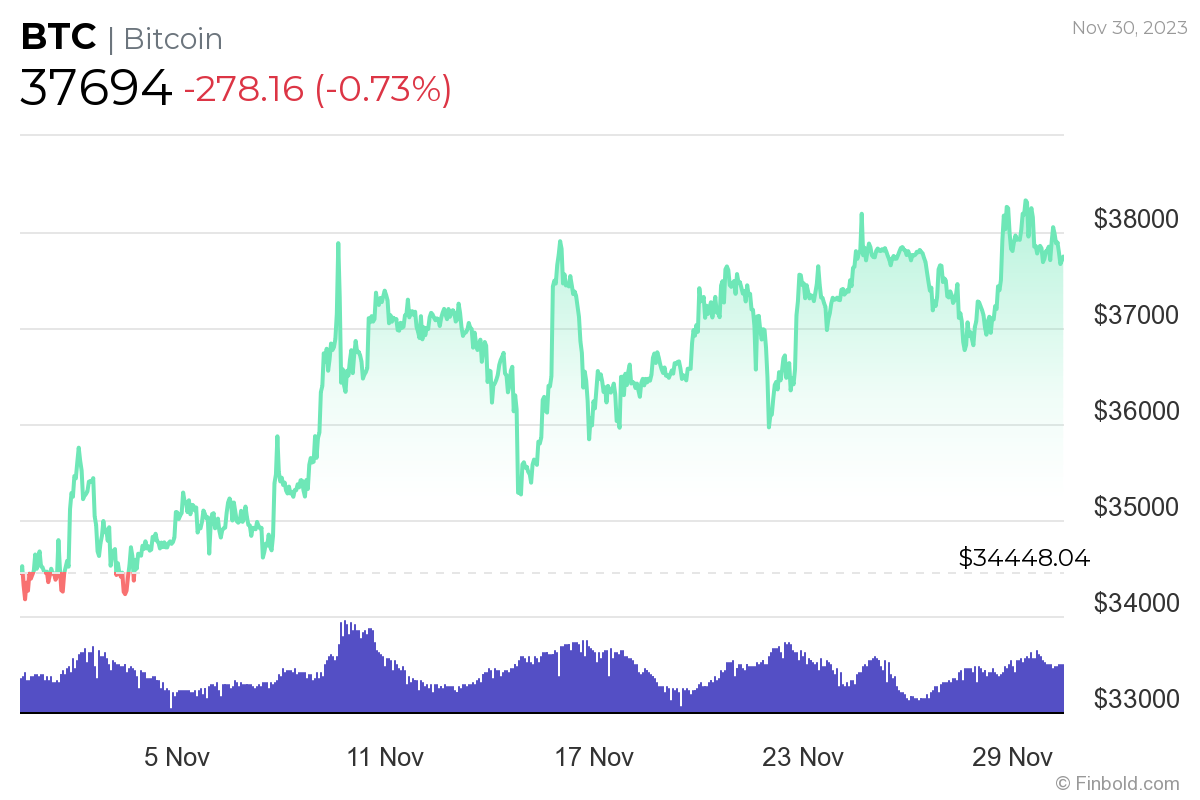

Bitcoin price analysis

As things stand, Bitcoin is currently changing hands at the price of $37,694, down 0.73% on the day but still recording a 0.64% gain on its weekly chart and advancing 9.42% across the past month, according to the most recent information retrieved on November 30.

All things considered, multiple indicators suggest that Bitcoin has a very bright future ahead, and not just due to the upcoming halving event, but also taking into account the possibility of the United States Securities and Exchange Commission (SEC) approving the first spot Bitcoin exchange-traded fund (ETF).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here