Bitcoin slipped 12% from its all-time high of $108,353, erasing gains from the second week of December. As Christmas nears, crypto traders ponder whether the market will see a “Santa Claus” rally this year.

A CoinGecko report states that eight of ten times between 2014 and 2023, crypto markets rallied around the Christmas holidays. Bitcoin’s recent price decline has quashed hopes of a Santa rally this year, and declining institutional investment inflow has dampened the sentiment further.

Will crypto markets see a Santa rally in 2024?

A “Santa Claus” rally refers to price gains in crypto in the last five trading days of the year and the first two trading days of the following year, according to a CoinGecko report. The performance of the crypto market is, therefore, key during the one-week timeframe from December 27, 2024, to January 2, 2025.

Bitcoin’s decline from its all-time high has raised concerns among BTC traders, and hopes of a Santa Claus rally have dimmed this cycle. Between 2014 and 2023, crypto markets rallied post-Christmas.

Crypto markets experienced a pullback instead of a rally, three times out of ten in the past decade with a correction as steep as 12.12% pre-Christmas, during the ICO bubble of 2017.

As BTC hovers around $97,000 on Tuesday, December 24, a pre-Christmas rally seems unlikely. BTC could gain post-Christmas if there is a revival in institutional interest in the largest cryptocurrency.

Crypto’s total market capitalization, excluding Bitcoin, started its recovery this week. The daily chart shows bullish signs that support a thesis of gains in the market cap of altcoins, making it likely that alts observe a rally post-Christmas or within the first two trading days of 2025.

Bitcoin Q4 2024 price performance

Bitcoin quarterly returns data from Coinglass shows over 50% gains in Q4 both in 2024 and 2023, as of December 24. It’s important to note that the bull runs in 2020, 2017, and 2013 ended with nearly 480%, 215%, and 168% gains in BTC in Q4.

Bitcoin’s performance this quarter has been lackluster, and there is little evidence to support extended gains in the first two trading days of 2025. Institutional interest in BTC is slowing down, reducing capital inflows, and this is evident from net outflows of Bitcoin Spot ETFs.

With Bitcoin’s Q4 performance under the median of 54.80%, it is less likely that the token will retest its all-time high before the end of the year.

Top 50 altcoin performance

The altcoin season index on Blockchaincenter.net helps evaluate the performance of the top 50 altcoins over a period of 90 days.

The index reads 49 on a scale of 0 to 100, meaning the price performance of the top 50 altcoins is lagging behind when compared to Bitcoin’s yield for holders in the same time period.

While 49 means it is not the altcoin season yet, it shows nearly 50% of the altcoins have outperformed Bitcoin in the past 90 days.

Trump effect, South Korea and Asian influence this cycle

Bitcoin prices continue to decline, even as U.S. President-elect Donald Trump has appointed a third pro-crypto candidate. Trump nominated Stephen Miran to be Chair of his Council of Economic Advisers. Miran is a known crypto advocate and another pro-crypto appointment made by the incoming President.

Previously, Trump appointed pro-crypto candidate Paul Atkins to head the Securities and Exchange Commission and tech investor David Sacks as artificial intelligence and crypto czar. While these appointments are expected to steer crypto towards positive regulation in the U.S., Bitcoin price continues to slide.

Data from Statista shows that South Korea is estimated to be the third largest cryptocurrency market in the world and exchanges in Korea account for over 9% of the global trade volume as of 2021. The Korean Won ranks among the top 5 traded currencies against Bitcoin, per the data.

South Korea delayed its crypto taxation until 2027 and adopted a pro-crypto approach, paving way for positive developments in Asia and for Bitcoin traders in Korea.

Michael Saylor-led MicroStrategy’s blueprint to hold Bitcoin on its balance sheet has inspired a wave of adoption across Asia. Per an Asia Express report, Chinese selfie app developer Meitu invested in 31,000 ETH and 940 BTC in the spring of 2021. Japanese firm Metaplanet is accumulating BTC through the dips and now holds 1,142 BTC, as of December 19.

With large corporations adding Bitcoin to their balance sheet, Asia is in focus this cycle in driving BTC adoption and its institutionalization.

Key levels to watch over the holidays

Bitcoin derivatives traders are bullish on BTC gains across exchanges, Binance, OKX and Deribit. The long/short ratio exceeds 1 across the exchange platforms and BTC observed a spike in open interest, signaling higher relevance and demand among traders.

Over $38 million in Bitcoin short positions were liquidated in the past 24 hours, as bullish sentiment prevails.

Key levels to watch during the holidays:

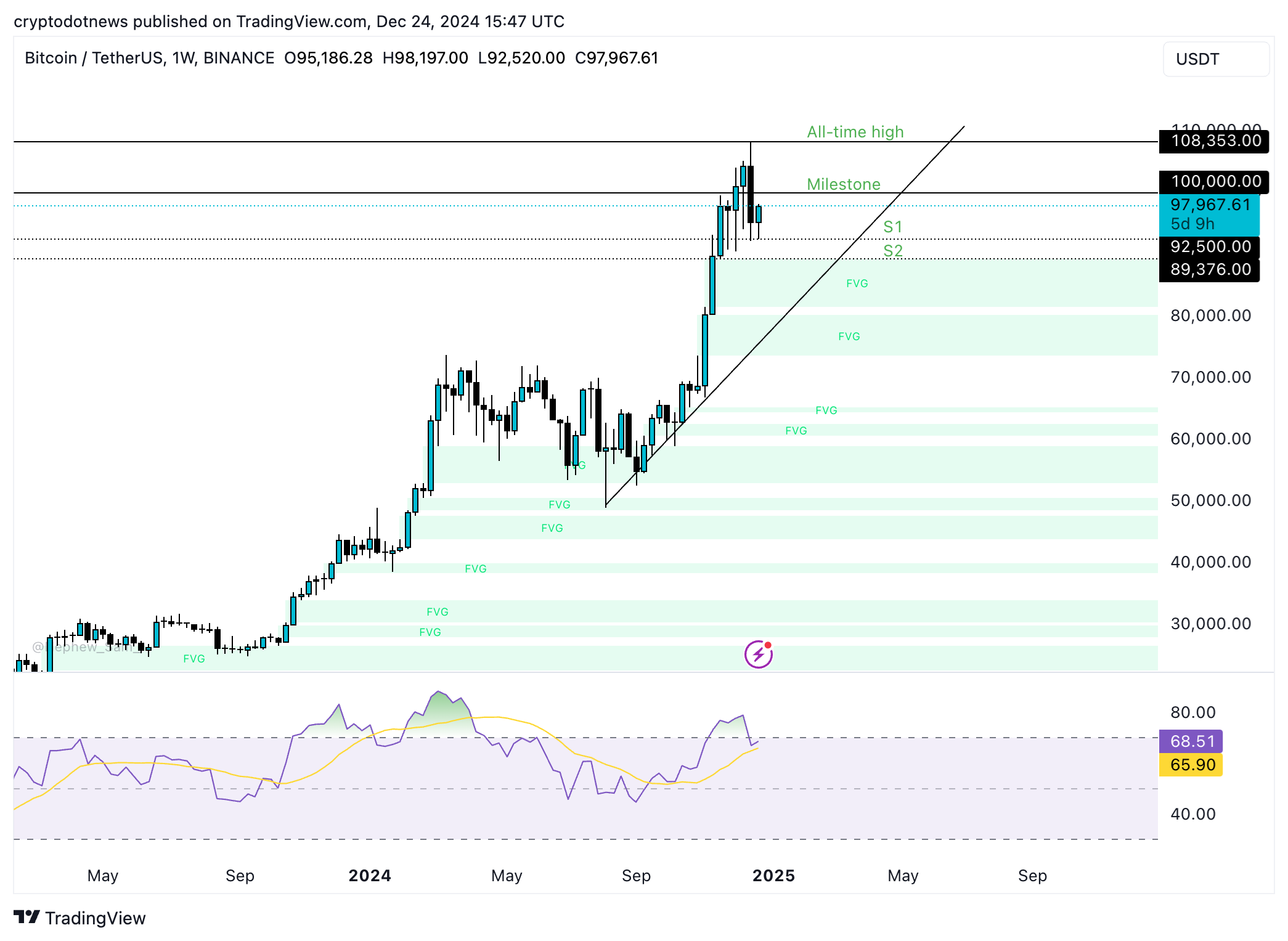

- Support at $89,376 and $92,500: A daily candlestick close below the $89,376 level could trigger a breakdown of key supports and signal that sellers are ready to pull BTC to the lower boundary of the imbalance zone on the weekly price chart at $81,500. This could result in cascading liquidations and a steep sell-off in crypto.

- Resistance at the $100,000 milestone: A daily candlestick close above this level brings the new all-time high above $108,000 back in play as the target. BTC could extend its gains and retest its all-time high, determining the cycle top.

Irrespective of the current sentiment among traders, Bitcoin remains highly volatile, and the key levels provide guidance as traders navigate holiday-induced volatility in the crypto market.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Read the full article here