The Bitcoin network recently underwent a difficulty adjustment, leading to a further increase in the mining difficulty. The adjustment also marked the sixth consecutive rise in BTC mining difficulty as it reached a record high. With this becoming a trend, it could affect the price of the flagship cryptocurrency, Bitcoin.

The Latest Bitcoin Difficulty Adjustment

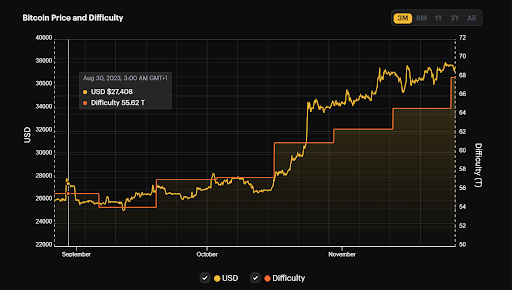

The latest adjustment took place at block 818,496, with the current Bitcoin mining difficulty standing at an all-time high of 67.96T. The network saw a mining difficulty increase of 3.40% in the last 24 hours alone. This follows a rising trend in the Bitcoin mining difficulty average that dates back to the last 90 days.

The network has seen an overall 22.18% increase in the last 90 days. In the last 30 days, it has seen an 11.35% increase, while there has been a 5.07% in the last 7 days.

Bitcoin difficulty basically measures the amount of computational power needed to mine the next Bitcoin block. These adjustments are usually made to keep block generation in line with the set block time of 10 minutes.

The increase in the mining difficulty usually occurs as more hashing power is added to the network to ensure that the block times are consistent. Whenever this happens, miners are also known to earn lesser rewards since there is an increase in the total network hashrate. Basically, this helps the network function optimally while avoiding any form of inflation in terms of miners’ rewards.

BTC price begins another upward move | Source: BTCUSD on Tradingview.com

How This Affects Bitcoin’s Price

Interestingly, there seems to be a correlation between BTC’s price and its difficulty. Bitcoin’s price has continued to climb alongside the increase in the network’s difficulty. In line with this, there is the projection that the BTC orice could hit $40,000 if the network difficulty were to rise to 72 T. This correlation could stem from the level of activity on the network.

Source: Hashrateindex

More liquidity (causing an increase in price) is flowing into the Bitcoin ecosystem, and more miners are looking to take advantage of this. This could explain why the network difficulty keeps increasing significantly. It is also worth mentioning that the network’s hashrate has also increased exponentially.

Interestingly, daily transaction fees on the network surged recently, surpassing fees on the Ethereum network at some point (an uncommon phenomenon). All this potentially signals that another rally could be on the horizon for the foremost cryptocurrency.

However, going by the correlation between BTC’s price and the network’s difficulty, the road to $40,000 might not be soon. There is expected to be a decrease in the Bitcoin mining difficulty at the next adjustment estimated to take place on December 10.

At the time of writing, BTC is trading at around $37,300, down by over 1% in the last 24 hours according to data from CoinMarketCap.

Featured image from Business Today, chart from Tradingview.com

Read the full article here