Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

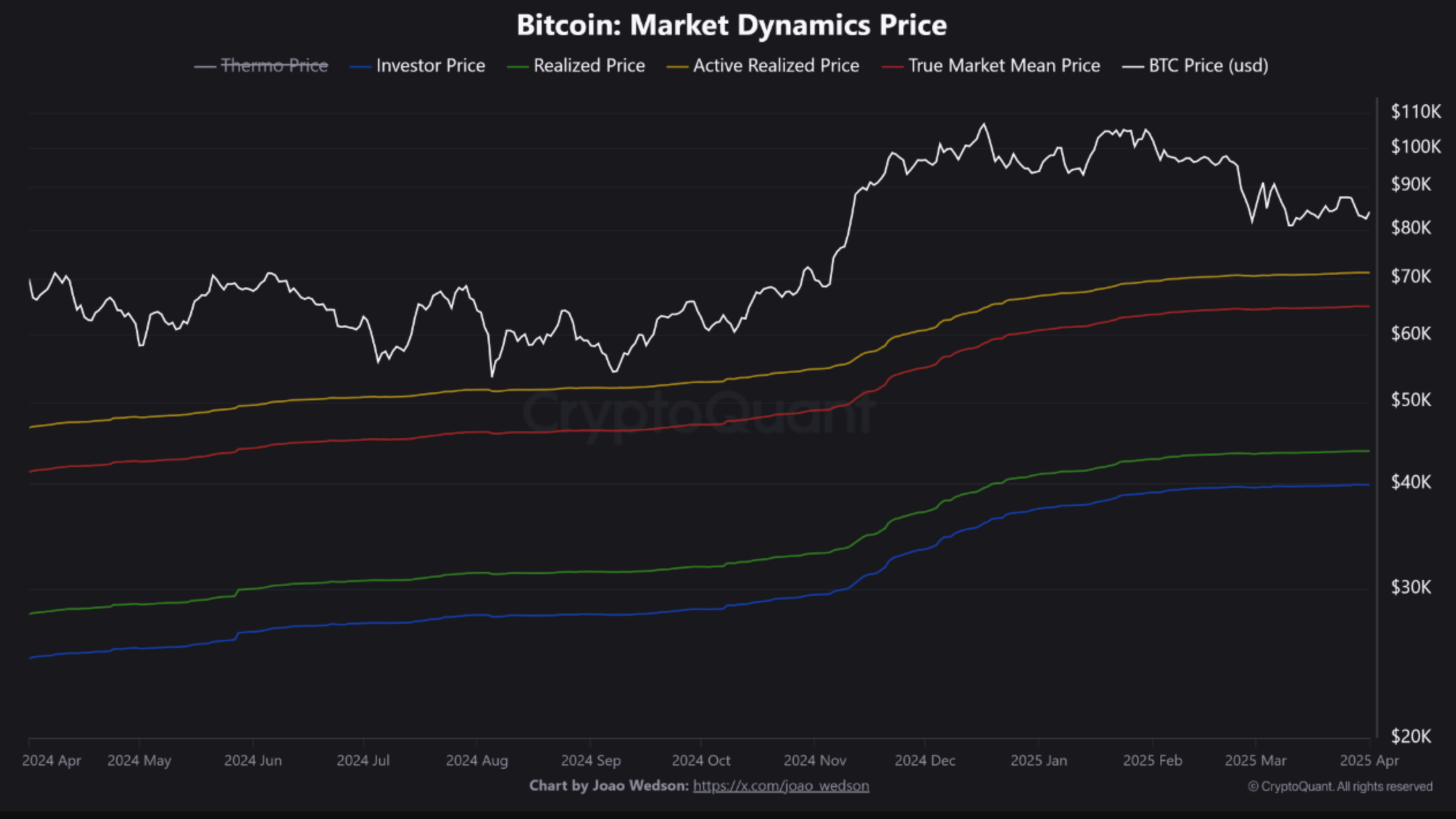

In a CryptoQuant Quicktake post published today, contributor BorisVest highlighted a key demand zone for Bitcoin (BTC) that could offer investors an opportunity for ‘substantial gains.’ The analyst used the Active Realized Price (ARP) and the True Market Mean Price (TMMP) to identify this critical zone.

Buying Bitcoin Here Could Be Profitable

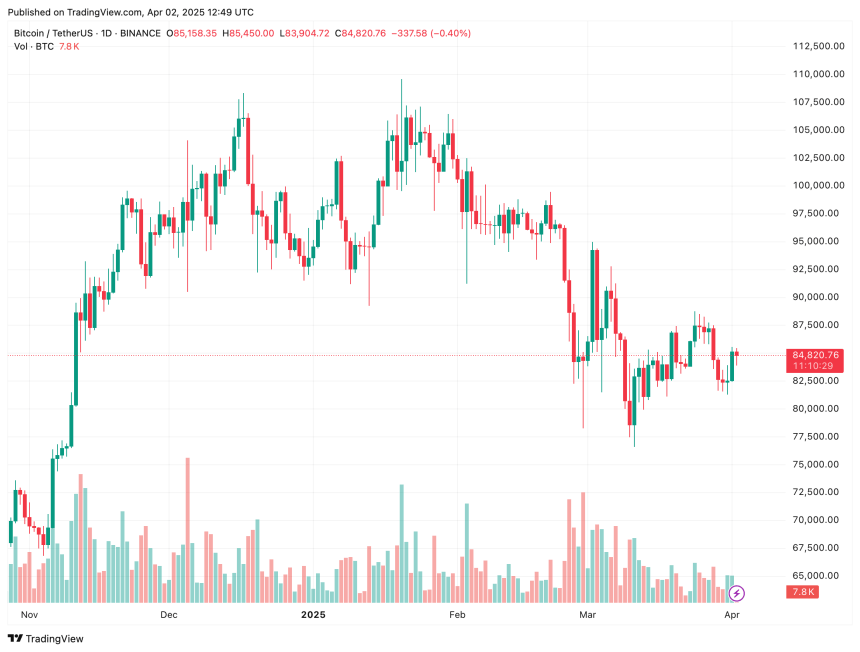

Bitcoin is currently trading approximately 10% higher than its recent local bottom of nearly $77,000, recorded on March 10. However, uncertainty in the market has increased due to US President Donald Trump’s looming trade tariffs, with some analysts predicting that the top cryptocurrency could experience further downside before a trend reversal occurs.

Related Reading

Amid this backdrop, CryptoQuant contributor BorisVest noted that, based on market dynamics, BTC’s ARP is currently hovering around $71,000 – representing almost a 20% pullback from its current price in the mid-$80,000 range.

For the uninitiated, Bitcoin’s ARP is a metric that calculates the average acquisition price of all actively traded BTC, filtering out dormant coins. It helps identify market sentiment by showing the cost basis of active investors, providing insights into potential support or resistance levels.

Additionally, BorisVest pointed out that BTC’s TMMP currently has a key support level at $65,000. The analyst stated:

If we define the area between the Active Realized Price and the True Market Mean Price as a zone, we can expect that in the near future, if the price declines, it should meet significant demand in this range.

In essence, BTC’s current major demand zone lies between $71,000 and $65,000. Purchasing BTC within this range could provide investors with a favorable risk-reward ratio, potentially leading to substantial gains.

Analyst Points Out Key Resistance Levels

In contrast to BorisVest’s analysis, prominent crypto analyst Ali Martinez identified two key resistance levels for Bitcoin. Martinez stated:

Bitcoin BTC faces the 200-day MA at $86,200 and the 50-day MA at $88,300 as key resistance ahead! A break above these levels could shift momentum back to the bulls.

Moving-average (MA) based resistance levels often function as key psychological and technical price barriers. Market traders typically place their sell orders around these levels, leading to price reversal or consolidation.

Related Reading

Martinez’s analysis aligns with that of fellow crypto analyst Rekt Capital, who noted that despite BTC breaking its daily Relative Strength Index (RSI) downtrend, it may still face significant resistance ahead.

That said, a bullish trend reversal may be on the horizon for BTC. Recent reports suggest that Trump may soften his stance on reciprocal tariffs, potentially enabling a relief rally for risk-on assets like BTC. At press time, BTC is trading at $84,820, up 1.5% in the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant, X, and TradingView.com

Read the full article here