XRP price has dropped 18.5% from its local high of $0.67 on Nov. 23, and it appears the cryptocurrency will suffer more selloffs in the coming weeks.

XRP technicals hint at extended correction

XRP (XRP) has failed to break above a descending trendline resistance since January 2018, and it fell short of logging a breakout above in November 2023 as well, illustrating psychological selling pressure around the line.

Each bearish rejection after testing the descending trendline resistance has historically resulted in a decline toward the ascending support trendline.

The downside target appears around $0.50, interestingly closer to XRP’s 50-week (the red wave) and 200-week (the blue wave) exponential moving averages (EMAs). Thus, XRP’s price risks declining by 20% before 2024 if this fractal plays out.

Potential XRP transfers to exchanges

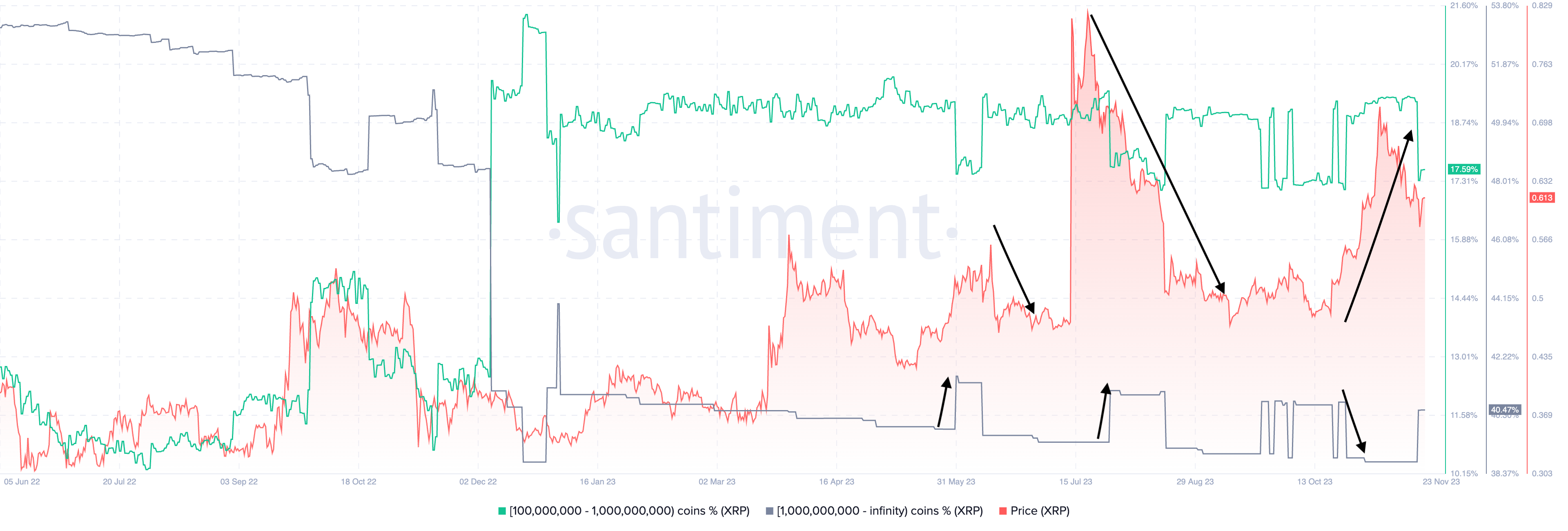

XRP’s bearish outlook picks more cues from the supply distribution data tracking its richest cohorts.

Notably, the XRP supply held by addresses with a balance between 1 billion and infinity tokens (the black wave) has risen 1.75% since Nov. 20.

A huge chunk of these addresses may belong to crypto exchanges, indicating that investors have been moving their XRP holdings to trading platforms for selling.

Historical data shows that the spikes in the 1 billion–infinity XRP token cohort precede both modest and huge price declines (the red wave). Conversely, a recent decline in the cohort’s supply, indicating exchange outflows, preceded XRP’s price rally from $0.55 up to $0.68.

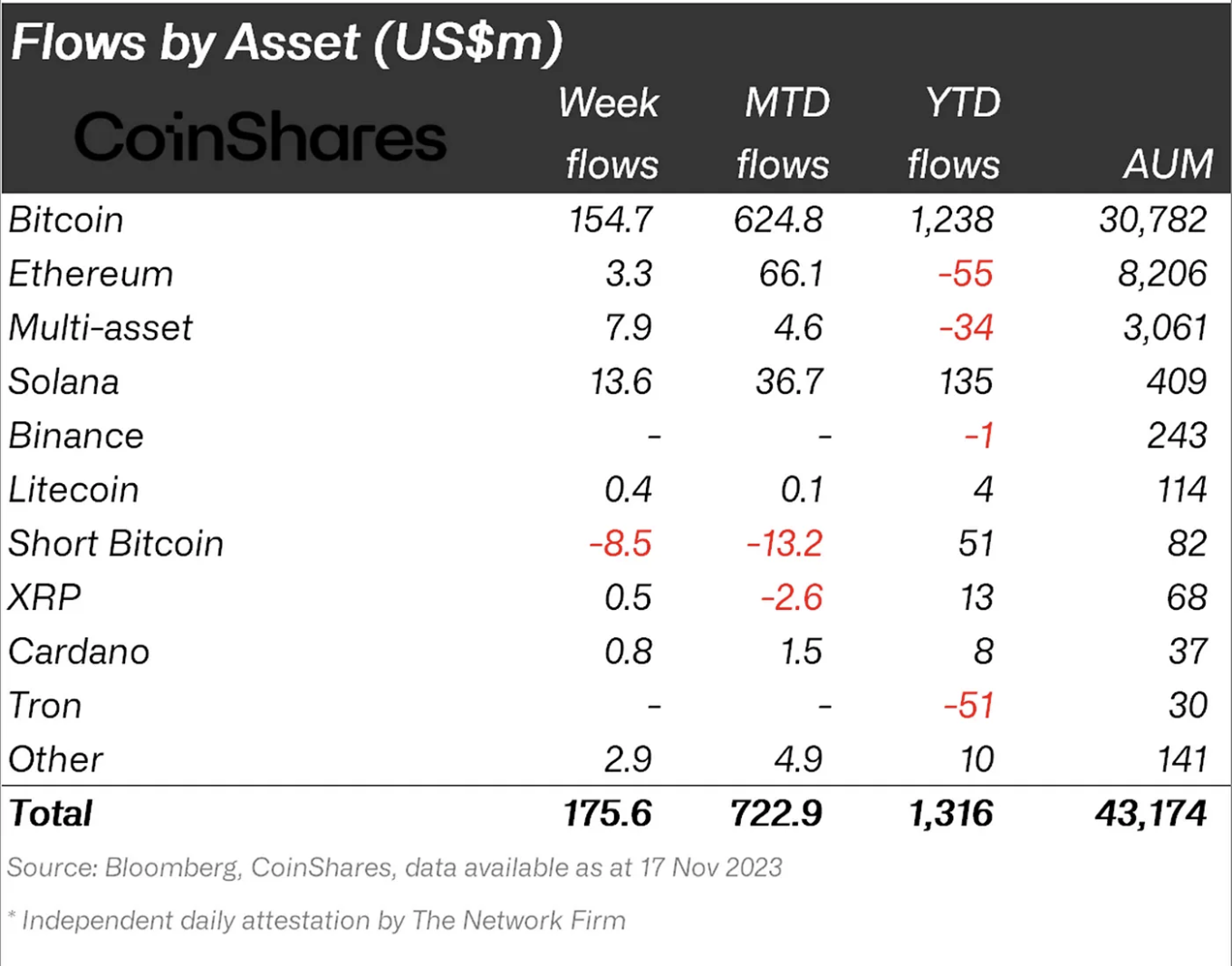

In addition, XRP fund data shows derisking behavior among institutional investors. In November, XRP-related investment vehicles witnessed outflows worth $2.6 million, according to CoinShares.

Interestingly, other cryptocurrencies experienced inflows in the same period, with Bitcoin (BTC) leading the chart.

Is the XRP bull run over?

XRP price has soared in 2023, generating 80% returns for its investors as of Nov. 23. Its partial legal win against the U.S. Securities and Exchange Commission and the spot Bitcoin ETF euphoria have contributed the most to its yearly gains.

Related: Why is XRP price up today?

As a result, the ongoing XRP price decline appears like a bull market correction. In other words, some investors are selling XRP near its local price tops to secure profits, but its overall uptrend is still intact.

Trade analysts anticipate XRP to resume its bull trend, with Muro saying that it would rise to $0.80 next, up 30% from current price levels.

Just like ETH and SOL, broke out, ready to go, with or without retest of the consolidation low pic.twitter.com/92pIeOZZP7

— Muro (@MuroCrypto) November 23, 2023

CryptoBull expects XRP to reach $4.20 in 2024, citing the cryptocurrency’s past breakouts after months of consolidation inside triangle patterns.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here