After XRP crossed the critical psychological level at $0.60 and continued upward, an even stronger bullish movement could be in the cards for the fifth-largest cryptocurrency by market capitalization, judging by the detailed analysis of its previous price behavior.

Indeed, the pseudonymous crypto market analyst Cryptoinsightuk observed that XRP had seen a “brilliant monthly close” above $0.59 and that its moving average convergence divergence (MACD) indicator was about to cross the 0 line, “bringing momentum back to the bulls,” the expert said on November 1.

Specifically, this crypto analyst has provided a possible target range between $0.8875 and $1.3617, the levels last witnessed on the digital asset’s charts in 2021, should the indicators continue to demonstrate positive signals for the price of the XRP token.

Is $1.69 possible?

Not only that, but the expert also explained that “the last time we had a monthly close in this price range, we went on to rally 180% in the following month,” and repeating this “would give us a price target of around $1.69 for XRP, smashing through our ‘Target Range.’”

As it happens, a similar situation did, indeed, occur in April 2021, when XRP gad climbed to the $1.60 price mark, increasing by around 180% or $1.03 in a matter of days from the previous price of $0.57, as the expert’s multi-year chart demonstrates.

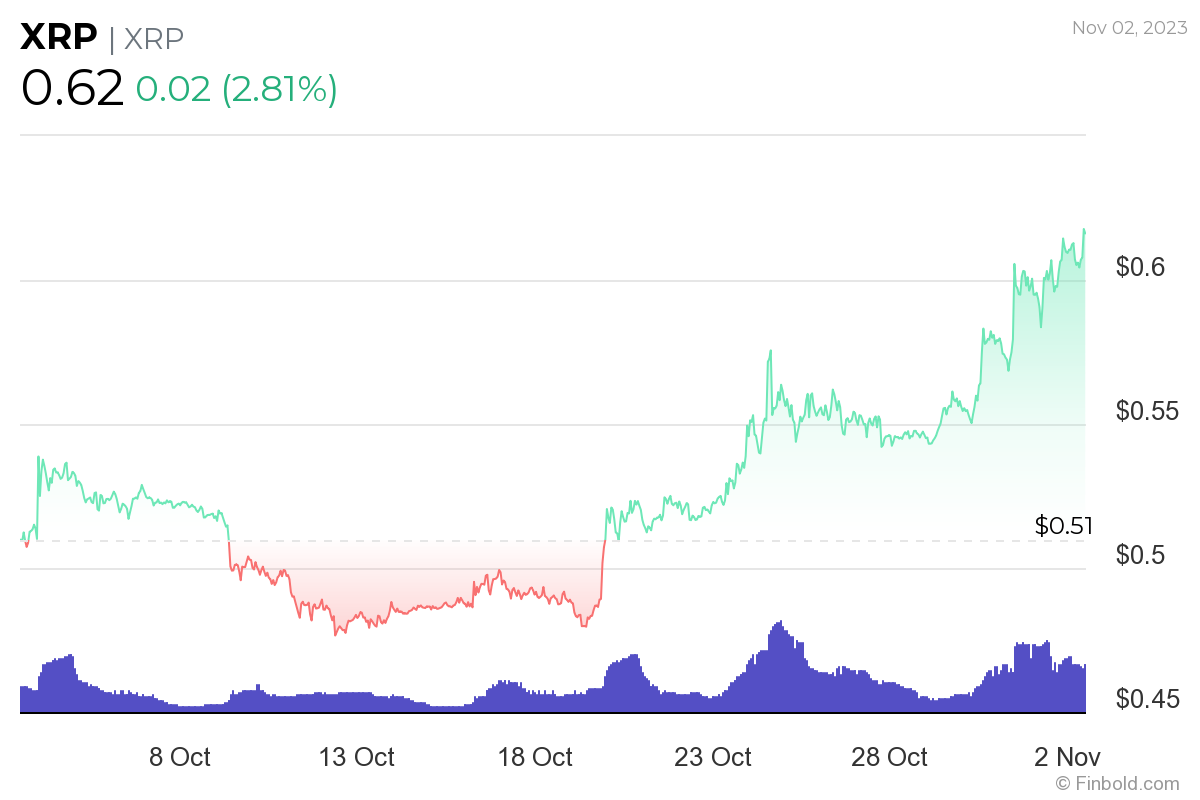

XRP price analysis

Meanwhile, XRP was at press time trading at the price of $0.617, which represents an increase of 2.81% in the last 24 hours, in addition to gaining 10.65% across the previous seven days and accumulating 21.21% over the past month, according to the latest data on November 2.

All things considered, XRP has demonstrated particular strength over the past weeks, and positive events around it, including the United States Securities and Exchange Commission (SEC) withdrawing from the case against the top executives of the blockchain company Ripple, could contribute to it.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here