Dogecoin Price Prediction: The current downtrend in Dogecoin price can be traced using a descending resistance trendline. This decrease can be largely attributed to the widespread uncertainties surrounding the approval of a Bitcoin spot ETF. During this period, DOGE experienced a significant drop of 24%, declining from a high of $0.107 to a current price of $0.813. An examination of the Daily timeframe indicates that this decline has evolved into a pattern that could signal a potential further decline for DOGE.

Dogecoin Price Nearing a Decisive Breakout

- The DOGE price correction to 61.8 Fibonacci Retracement level started reflecting weakness in buyers’ conviction

- A bullish breakout from the flag pattern would indicate the end of the correction trendline

- The 24-hour trading volume in Dogecoin is $2.58 Billion, indicating a 58% gain.

Dogecoin Price| TradingView Chart

Analyzing the daily timeframe chart, it’s evident that the Dogecoin (DOGE) price is adhering to two key trendlines despite the prevailing market conditions. The first is a descending trendline that delineates the current correction phase by providing dynamic resistance.

The second is a neckline support of a renowned bullish reversal pattern, the Head and Shoulders. This pattern typically observed at market peaks, suggests an imminent trend reversal and a possible extended drop in the asset’s value.

Therefore, if the general market sentiment remains mired in uncertainty, Dogecoin might see a bearish departure from these trendlines. Such a breakdown would likely amplify selling pressure, potentially leading to a 24% drop in this memecoin’s value, reaching a significant support level of around $0.058.

Conversely, if the introduction of a Spot Bitcoin ETF starts projecting a positive influence on Bitcoin, the broader altcoin market, including Dogecoin, might also benefit. This scenario could result in Dogecoin breaking above the resistance trendline, invalidating the bearish scenario.

In this case, DOGE value could potentially rise by about 35%, reaching approximately $0.11.

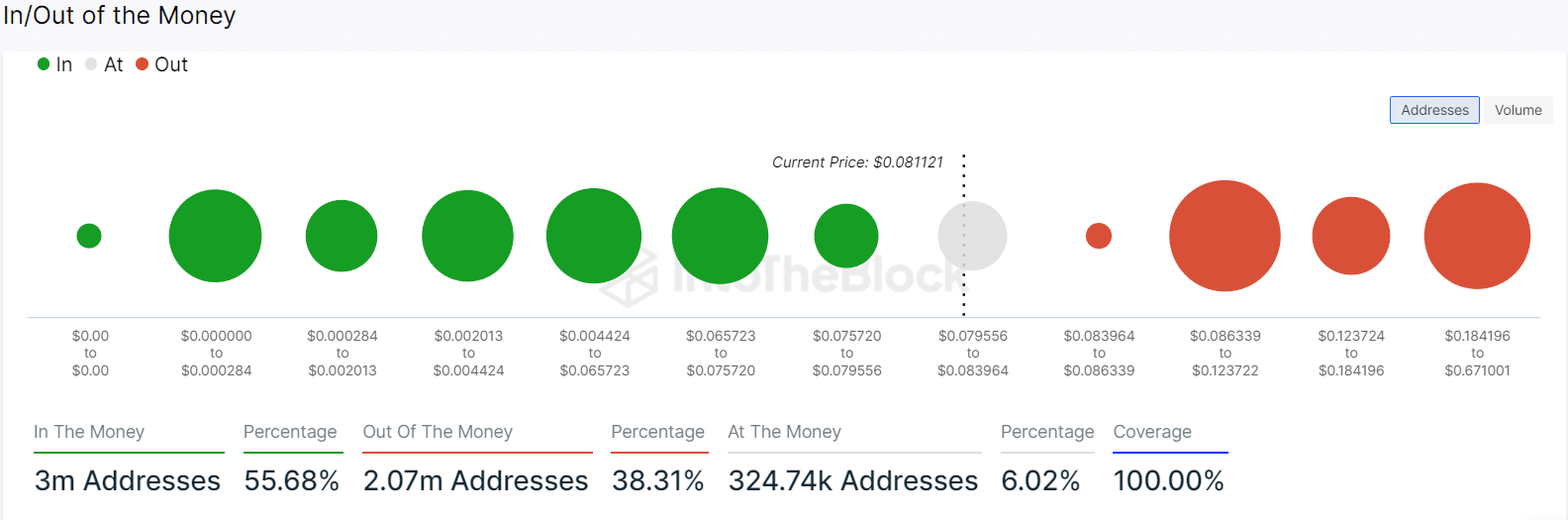

Dogecoin- Global In/Out of the Money (GIOM)

Intotheblock| Dogecoin Global In/Out of the Money (GIOM)

The Global In/Out of the Money (GIOM) metric for Dogecoin provides a more positive outlook. Currently, 55.68% of DOGE holders are ‘in the money’ (profiting), while 38.81% are ‘out of the money’ (incurring losses). This distribution indicates a relatively stable base of investors, which could support a bullish trend for Dogecoin in the future. However, a potential collapse following the Head & Shoulders pattern could place half of these addresses at a loss, increasing the likelihood of panic-selling

- Relative Strength Index: The daily RSI slope below 50% reflects the sellers having a firm grip over this asset.

- Exponential Moving Average: The coin price resonating between a narrow range of 50-and-200-day EMA indicates volatile market sentiment.

Related Article:

- Crypto Price Prediction For January 14: ETH, XTZ, SUI

- Which Top Altcoins To Buy January 15: HNT, XRP, LDO

- Bitcoin ETF Sparks Debate Between Legitimacy and Investment Purism

Read the full article here