The Ripple XRP price broke down from a long-term ascending support trend line in October 2022.

XRP also trades in a short-term corrective pattern and is approaching a confluence of support levels. Will it be enough to start a bounce?

Ripple Breaks Down From Long-Term Support

The weekly time frame technical analysis shows that the XRP price broke down from a long-term ascending support trend line last week. The trend line had existed for 450 days before the breakdown.

Last week’s close was the first below it since the trend line was first created in October 2022. Furthermore, it caused an XRP decrease below a pivotal horizontal support area.

XRP/USDT Weekly Chart. Source: TradingView

The weekly time frame Relative Strength Index (RSI) legitimizes the breakdown. When evaluating market conditions, traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The indicator fell below 50 (red circle) when the price broke down from the trend line.

What Are Analysts Saying?

Cryptocurrency traders and analysts on X positively view the future XRP trend.

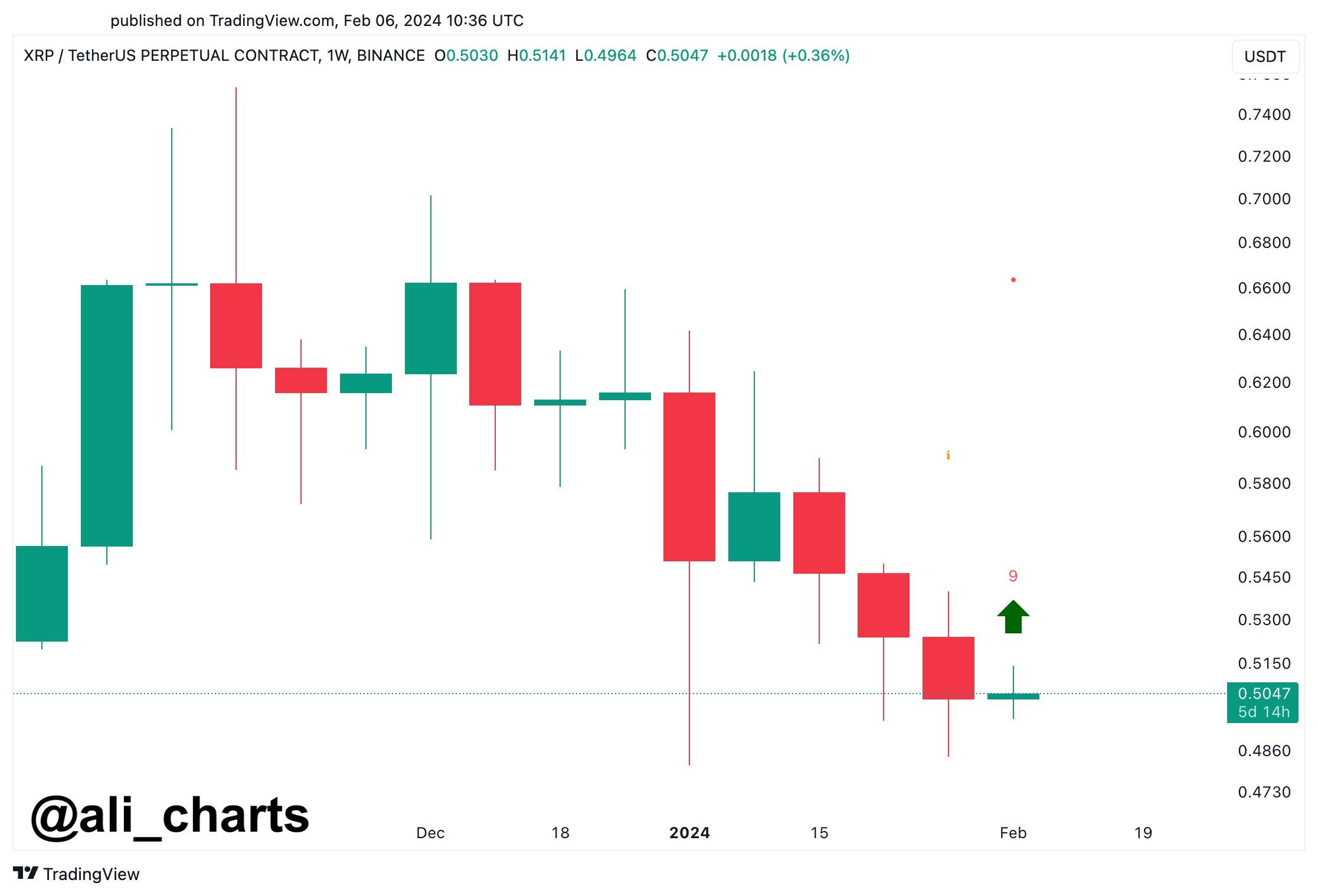

Global Head of News at BeInCrypto Ali Martinez uses the TD sequential indicator to predict the price will increase during the next four weeks.

XRP/USDT Weekly Chart. Source: X

CryptoGeek announced a collaboration between American Express and Ripple, tweeting:

BREAKING: American Express validates its collaboration with #Ripple, declaring the adoption of $XRP for payment transactions. Ripple Labs has officially acknowledged that American Express is leveraging $XRP within the RippleNet System.

Analyst Edward Farina believes the XRP price will be in the thousands since the IMF has already set it. He tweeted:

“The $XRP price has been already set by the IMF and it’s in the thousands.” The official price of gold is set twice a day: at 10:30am and 3pm GMT. This is called “Gold Fixing” and is decided by the LBMA. I could really see $XRP price set a long time ago by IMF or BIS.

XRP Price Prediction: Where Will Breakdown Lead To?

While the weekly time frame is decisively bearish, the daily one suggests the XRP price will reach a bottom soon. This is because the price is approaching a confluence of support levels.

XRP has fallen inside a descending parallel channel since November 2023. The price trades in its lower portion and is approaching a horizontal support area at $0.47, 7% below the current price. Since the area will soon coincide with the channel’s support trend line, it is a likely level for a bottom.

Additionally, the daily RSI generates a bullish divergence, which happens when a momentum increase accompanies a price decrease. This often leads to bullish trend reversals.

So, the most likely outlook suggests XRP will gradually fall by another 7% until it reaches the confluence of support levels and will bounce afterward.

XRP/USDT Daily Chart. Source: TradingView

Despite the bearish XRP price prediction, reclaiming the $0.55 horizontal area can trigger a 22% increase to the channel’s resistance trend line at $0.61.

For BeInCrypto‘s latest crypto market analysis, click here!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here