A breakout has been brewing for Dogecoin price since the beginning of the year, however, the largest meme coin is yet to find an escape. Stuck within a narrow range from support at $0.075 and resistance at $0.088, DOGE trades at $0.0811 during the American session on Monday.

Can Dogecoin Breakout To $0.1?

Although activity in the ecosystem has noticeably slowed down since January, 60% of all Dogecoin addresses roughly 1.34 million are in profit or ‘in the money’ based on insights from blockchain analytics company, IntoTheBlock.

This emphasizes the likelihood of a bullish outcome while underscoring the importance of key support ranges, for instance, the region between $0.0772 and $0.0792, where 624k addresses bought 4.38 billion DOGE at an average price of $0.0787.

Dogecoin IOMAP chart | IntoTheBlock

Above the heavily congested support at $0.0787 is a relatively clear path that could lead Dogecoin price to $0.094. On the contrary, losing the same level of support might trigger another drop to $0.07, possibly to allow DOGE to sweep fresh liquidity as investors take advantage of the dips.

A deeper look into the network reveals a significant drop in both the transaction volume and whale transaction count. According to crypto analyst Ali, such a situation “typically indicates lower trading activity.”

Dogecoin price has probably failed to break out since the beginning of 2024 because “fewer people are buying, selling or transferring DOGE.” Some factors backing this trend could include reduced interest in trading or buying the meme coin and loss of confidence in Dogecoin’s ability to recover.

#Dogecoin is experiencing a decrease in transaction volume and whale transaction count, which typically indicates lower trading activity. This could be a sign that fewer people are buying, selling, or transferring #DOGE, possibly due to reduced interest or confidence in it! pic.twitter.com/SiKNxx4FhN

— Ali (@ali_charts) February 12, 2024

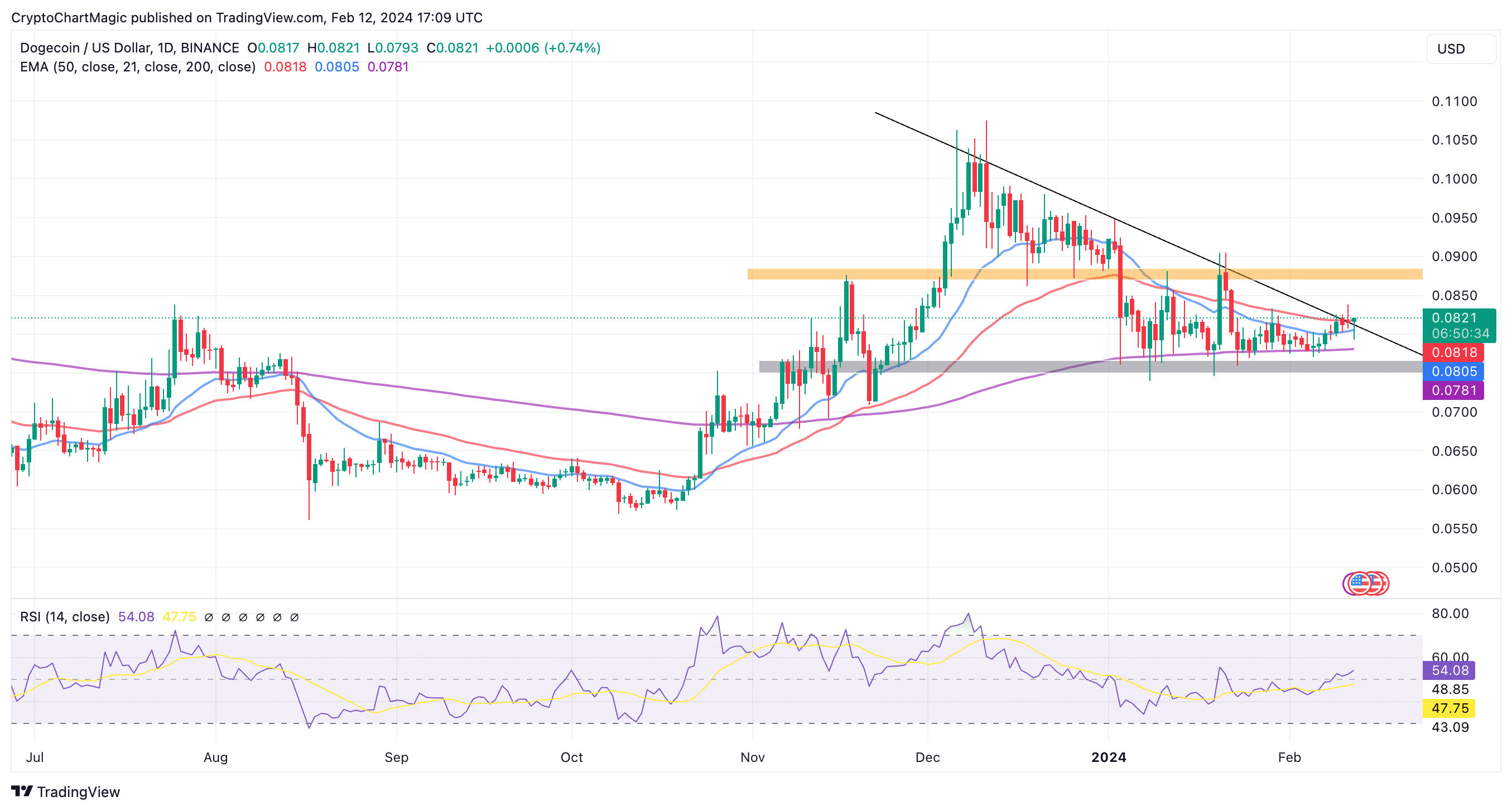

Backed into a tight corner on the daily chart, Dogecoin holds between support provided by the 50-day Exponential Moving Average (EMA) (the blue line on the chart) and resistance highlighted by the falling trendline in conjunction with the 50-day EMA (the red line on the chart).

Read also: Bitcoin Price Sets Sight On $50k, Signalling Pre-Halving Rally?

Albeit the Relative Strength Index (RSI) is moving higher in the neutral region at 53, Dogecoin is making no progress due to the lack of momentum to drive the price higher.

Dogecoin price chart | Tradingview

For traders, the trendline resistance, marked by the 50-day EMA is an area of great importance this week. Flipping this area into support will bring attention back to DOGE. If confidence in the uptrend builds up, it will not take long before Dogecoin rallies beyond the range high resistance at $0.088, bringing the target at $0.1 within reach.

Based on the current technical structure and macro environment, it is too early to assume a breakout above $0.1 is guaranteed in the short term. Investors should also be open to the idea of DOGE ranging in the sideways channel for much longer before climbing to higher levels.

Related Articles

- How Terra Classic (LUNC) Can Reclaim $0.00028 In February 2024 As Community Votes On Key Proposals?

- Solana Price Prediction: How SOL Could Swing From The Dips After A Bullish Week Above $104?

- Key Support Levels for Shiba Inu Coin to Ensure Bullish Stance

Read the full article here