The cryptocurrency market remains in a consolidation range, struggling to decide which direction to follow. In this context, some cryptocurrencies maintain an increased open interest in short positions, creating short-squeeze opportunities for February.

A short squeeze happens when short-sellers are liquidated, facing a sudden price surge. These liquidations force traders to repurchase the cryptocurrency, driving the price to higher levels, triggering further liquidations, and potentially making it skyrocket.

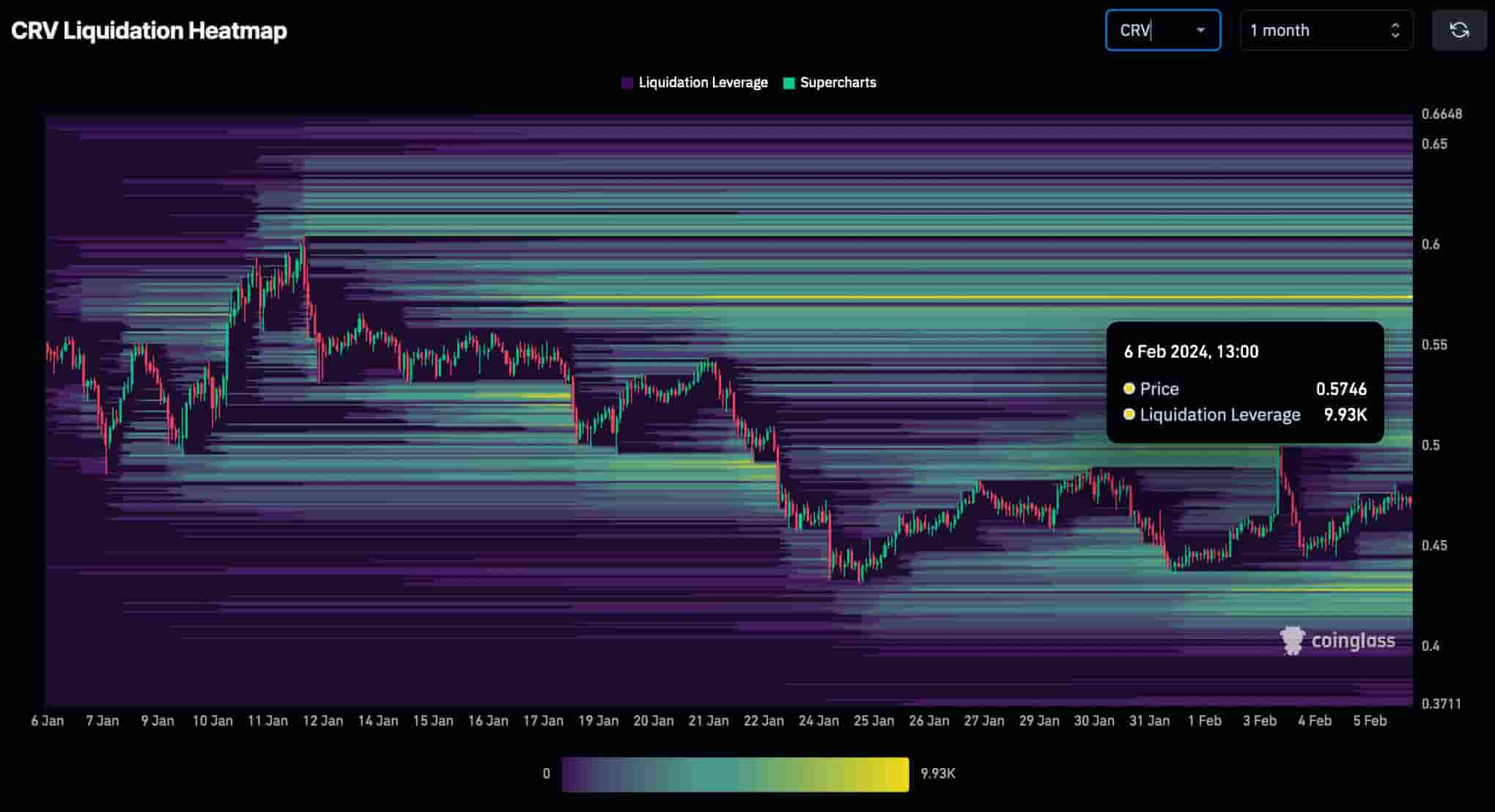

Looking for insights, Finbold gathered data from CoinGlass’s liquidation heatmap on February 6. In particular, we spotted cumulated short liquidations on Arbitrum (ARB) and Curve (CRV) in the monthly time frame.

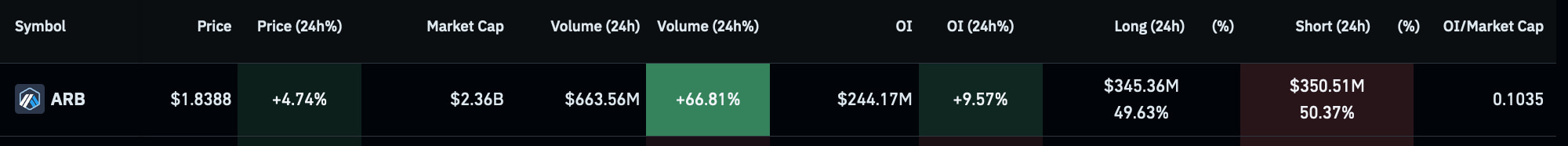

Short squeeze alert for Arbitrum (ARB) in February

First, Arbitrum has a heavy liquidity accumulation in the $2.4 price level. More specifically, there are $33,150 in short liquidations at $2.414, making it an appealing target for market makers.

Meanwhile, ARB is trading at $1.838 by press time, up 4.75% in the last 24 hours. This bullish price action could catalyze a short squeeze, liquidating the smaller targets until $2.4. Interestingly, such a movement would make Arbitrum skyrocket for over 30% gains in February.

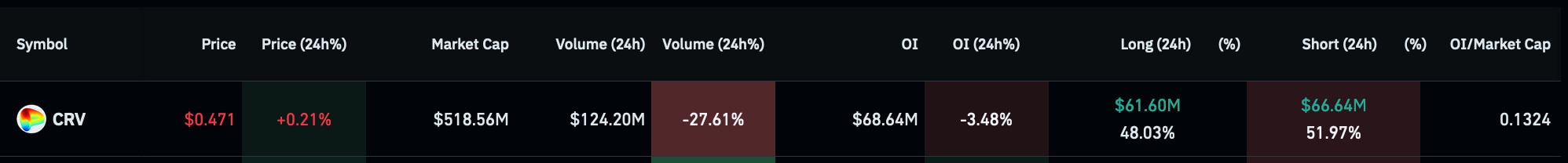

Can Curve (CRV) skyrocket in February?

Another likely candidate for a short-squeeze event is Curve DAO’s native token, CRV. It currently has $68.64 million in open interest, with a 0.1324 OI/Market Cap ratio, while trading at $0.471.

As for the liquidation heatmap, CRV has liquidity for both sides. In this context, the token may experience a brief movement downward before starting to skyrocket.

Additionally, the most relevant liquidations are at $0.573, but a drop from here could increase short positions and change this scenario for even higher prices, which already have some considerable liquidity.

However, a sentiment shift is still necessary for these short squeezes to happen. Cryptocurrencies are highly volatile assets in a market that changes daily. Thus, investors must trade cautiously, following the trends and adapting to each new development.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here