Crypto to buy: With the increasing possibility of an uptrend resuming, bullish traders can look for long opportunities in Bitcoin (BTC), Ethereum (ETH), and Celestia (TIA). The cryptocurrency market has been trading in a bullish trend, with a rally for the best crypto to buy before the Bitcoin Halving. This period marks a pivotal time for investors as major digital currencies like Bitcoin and Ethereum show strong upward movements and emerging coins like Celestia gain significant attention.

1. Bitcoin (BTC)

Bitcoin, the leading cryptocurrency, has been showing remarkable growth since late last week. After breaking free from the deep dive below $40,000, it has been consistently closing at higher prices. BTC has marked a 10% increase, maintaining its bullish streak for the past week. As discussions around ETFs gain traction, this optimism has fueled Bitcoin’s climb, pushing it past the crucial $43,000 support mark.

Bitcoin trades at around $43,419, up 4% in the last 24 hours, indicating robust buying interest. The dominance of BTC in the market is evident at 51%, with a massive market capitalization of approximately $853 billion.

Bitcoin Price Chart, Source: TradingView

The Moving Average Convergence Divergence (MACD) points to a bullish trend. If Bitcoin sustains above its current support level, a rally towards $50,000 seems plausible before BTC halving. However, if the momentum falters at the $45,000 mark, a bearish downturn to $40,000 could occur.

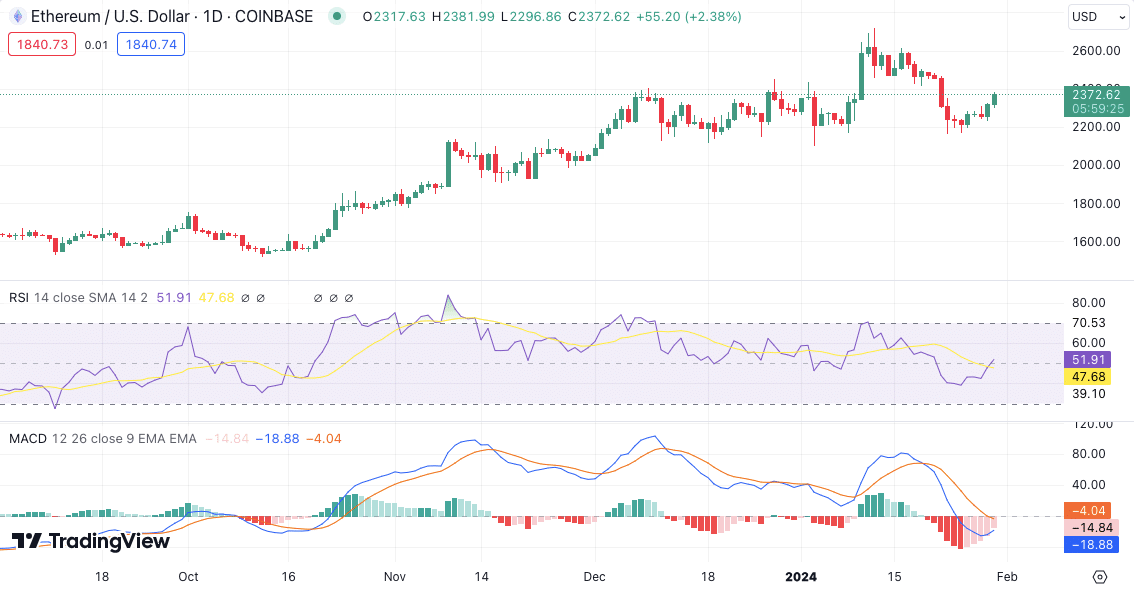

2. Ethereum (ETH)

Ethereum’s journey over the past year has been within a substantial ascending channel. Recently, it tested the upper boundary of this channel near the $2,750 resistance level but faced rejection. The price of ETH has now slipped below the $2,400 support, currently trading around with a gain of 3.77% in the past day.

Ethereum Price Chart, Source: TradingView

The market is consolidating, hovering between the $2,100 and $2,400 levels. A break above this range could repeat Ethereum testing the upper channel boundary, leading to a strong buy. Conversely, a dip below $2,100 might see prices falling towards or under $2,000. The MACD’s green histogram suggests increasing buying pressure but failing to surpass the $2,500 level leaves the future uncertain.

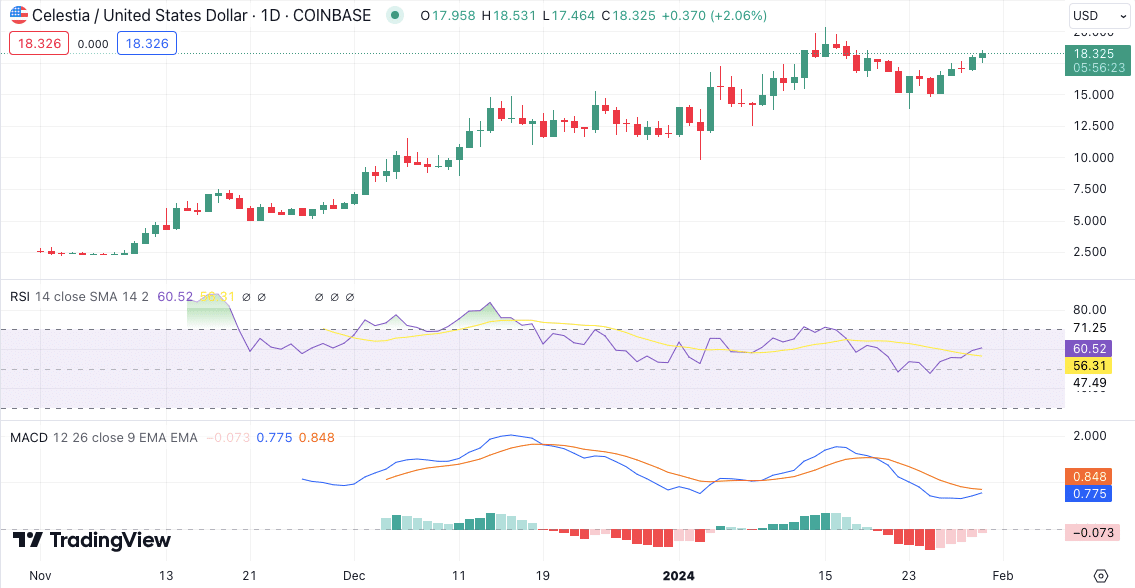

3. Celestia Shows Bullish Patterns

Celestia’s value has fluctuated between $12.30 and $16.30 over the past month. In the last 24 hours, TIA has climbed 4.44% to $18.32, continuing a positive trajectory with a 14% gain over the week. It is near its all-time high of $20.16, surging over 700% since its inception.

Celestia Price Chart, Source: TradingView

Celestia’s chart shows an ascending triangle pattern, indicating a strong bullish trend. This pattern, formed by a flat upper trendline and a rising lower trendline, suggests potential for further gains. If TIA breaks the resistance, it may aim for $19 and $20. However, a reversal could send it down to support levels at $16, $15, and $13.

Market Outlook and Opportunities

The cryptocurrency market remains a field of dynamic change, presenting various opportunities for investors. While Bitcoin shows signs of a continued bull run, Ethereum’s higher-level resistance adds an element of uncertainty. Celestia, on the other hand, offers a fresh perspective with its bullish pattern. As the market evolves, these cryptocurrencies provide a mixture of stability and growth potential for interested traders.

Related Articles

- 3 Best Crypto To Buy Today 30 Jan: BTC, SOL, MANTA

- Crypto Price Prediction For January 30: BTC, AVAX, SUI

- 7 Reasons To Buy Solana (SOL) This Year

Read the full article here