With the recent surge in Bitcoins (BTC) price, altcoins are starting to show signs of promise and exhibit small gains, but whether a potential spot Bitcoin ETF approval will positively impact their price remains to be seen.

Looking at the historical performance of altcoins and their respective accumulation and retest phases, certain parallels can be drawn that indicate that a potential surge in their price might be on the horizon, as per crypto analyst Jelle post on X on January 9.

“Looks like altcoins are ready for takeoff, with the ETFs right around the corner.

We’re in for a ride. Main altcoin holdings: SOL, INJ & TIA,” the expert noted.

With the central altcoin holdings being based in Solana (SOL), Injective (INJ), and Celestia (TIA), Finbold has decided to delve deeper into their recent performance.

Solana (SOL)

The recent rally from BTC hasn’t left behind Solana, as it has managed to rake in notable gains in just one day.

On the hourly chart, Solana exhibits indications of the potential formation of a bull flag. A conclusive breach above the $110 resistance level is identified as a potential catalyst for a substantial upward movement, per crypto expert Ali Martinez’s post on January 9.

Should this pattern persist, there is a possibility of witnessing Solana progressing towards a noteworthy target of $163.

At the time of press, the current price of Solana stands at $101.56. This reflects an 8.40% increase in the last 24 hours, a -10.99% decrease over the preceding seven days, and a notable gain of 41.97% over the past month.

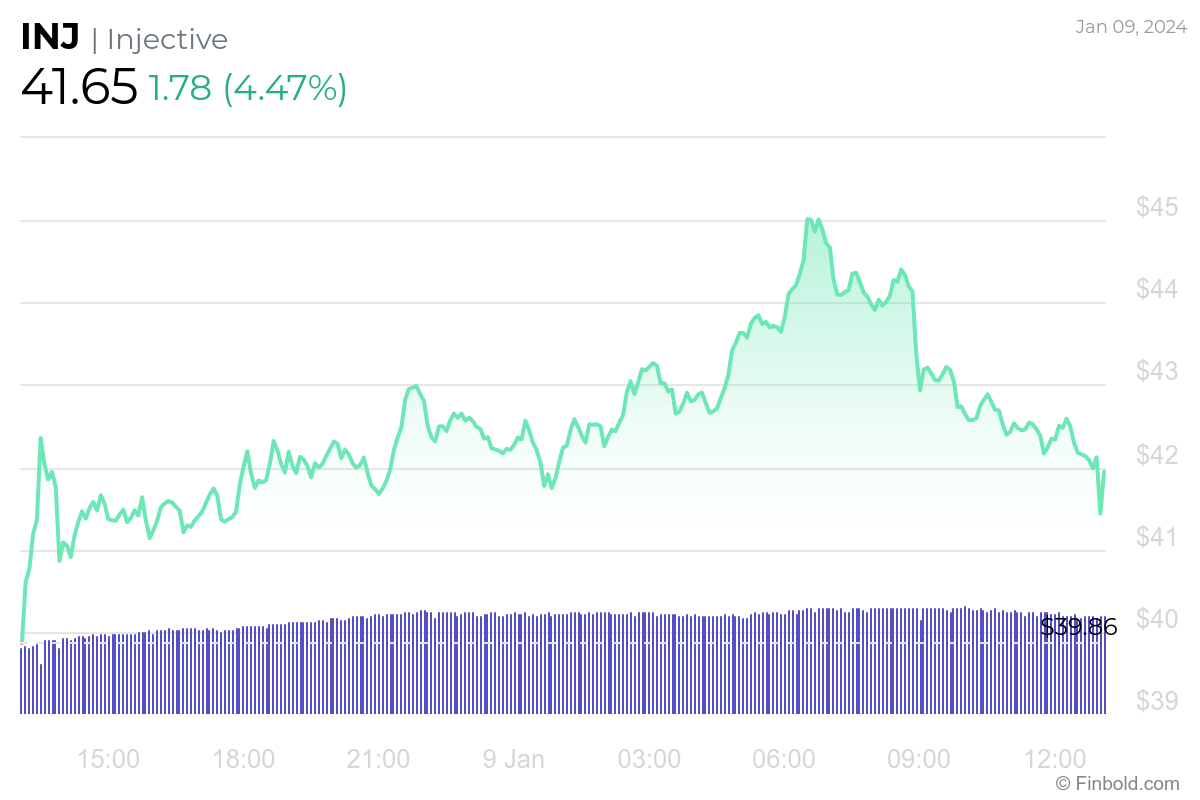

Injective (INJ)

Injective is poised to unveil the Volan upgrade, a significant development that brings new capabilities and improvements to its ecosystem.

This upgrade encompasses features such as IBC Cross-Chain Expansion, providing increased interoperability, enhanced scaling to support growing demands, and adding an RWA Module for expanded functionality.

After experiencing considerable success in 2023, introducing the Volan upgrade is expected to enhance the appeal of Injective even further. This upgrade positions Injective as a platform responsive to market needs and committed to continuous innovation and growth, per a post from crypto investor Lark Davies on January 8.

Celestia (TIA)

Celestia’s price exhibited an ascending parallel channel trend since November, with both resistance and support trend lines consistently validated. However, a rejection occurred at the channel’s resistance trend line on December 16, resulting in a subsequent downward movement and a channel breakdown on December 25.

TIA reached a low of $9.36 on January 3. Subsequently, the price swiftly recovered, surpassing the channel’s support trend line and recently attaining a new all-time high. Prompting positive comments due to its potential price range from crypto analyst Georgie1Trader on January 5.

Currently, this digital asset is trading at $15.88, after an increase of 14.14% in the previous day and gains of 17.16% from the last week, topping off a strong month of gains that came up to 69.71%, according to the latest data on January 9.

Whether these current strong performers will continue their hot streaks and even experience bigger gains with the ongoing speculations of a spot Bitcoin ETF approval or their rally will cease remains to be seen.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here