Electric Capital, a prominent venture capital firm focusing on crypto and blockchain technologies, has recently released its comprehensive developer report for the year 2023. The report, based on the analysis of a staggering 485 million code commits across 818,000 open-source repositories, provides valuable insights into the trends shaping the crypto and blockchain development landscape.

Despite an overall 24% decrease in the number of cryptocurrency developers, the report highlights a notable surge in a core group of experienced developers with over two years of experience in the field. Those with a crypto background exceeding 1 year also experienced a notable 16% year-over-year growth, constituting a substantial 63% of the total monthly active developers.

In stark contrast, newcomers who entered the crypto domain within the last 12 months witnessed a significant decline, plummeting by -52% year-over-year. This decline in the overall number of developers can be primarily attributed to the substantial influx of new developers in 2022, coupled with a subsequent increase in turnover within the community.

One of the most significant findings of the report is the evident shift towards multi-chain development. The trend of developers endorsing multiple blockchain platforms has seen a substantial rise, with 30% of developers now supporting more than one chain. This marks a tenfold increase from the 3% recorded in 2015. Furthermore, developers backing three or more chains have reached an all-time high in 2023, constituting 17% of the overall developer community.

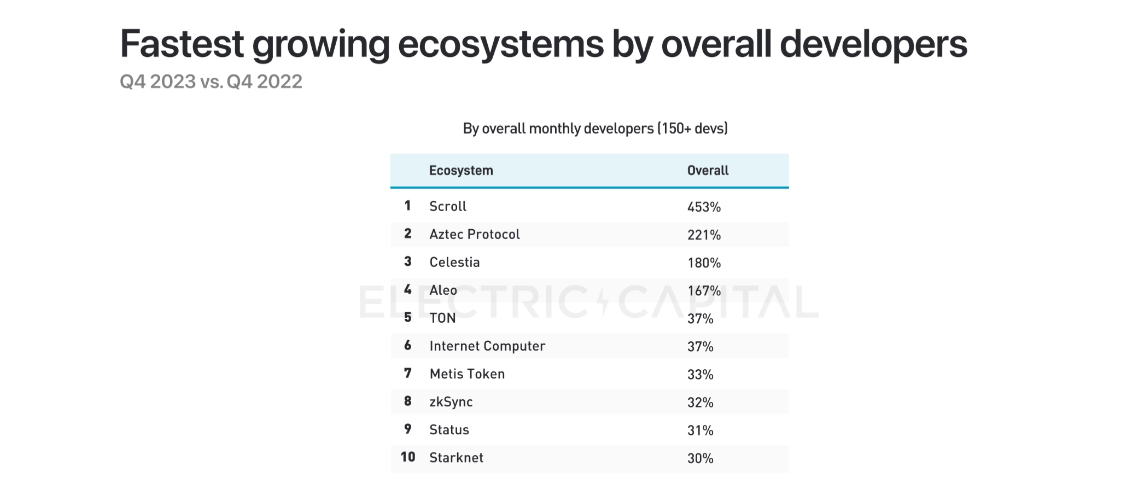

The Fastest Growing Crypto Ecosystems

The 2023 crypto developer report identifies the top ten fastest-growing ecosystems by overall developers, shedding light on projects that have experienced remarkable growth. The list includes Scroll, Aztec Protocol, Celestia, Aleo, TON, Internet Computer, Metis Token, zkSync, Status, and Starknet.

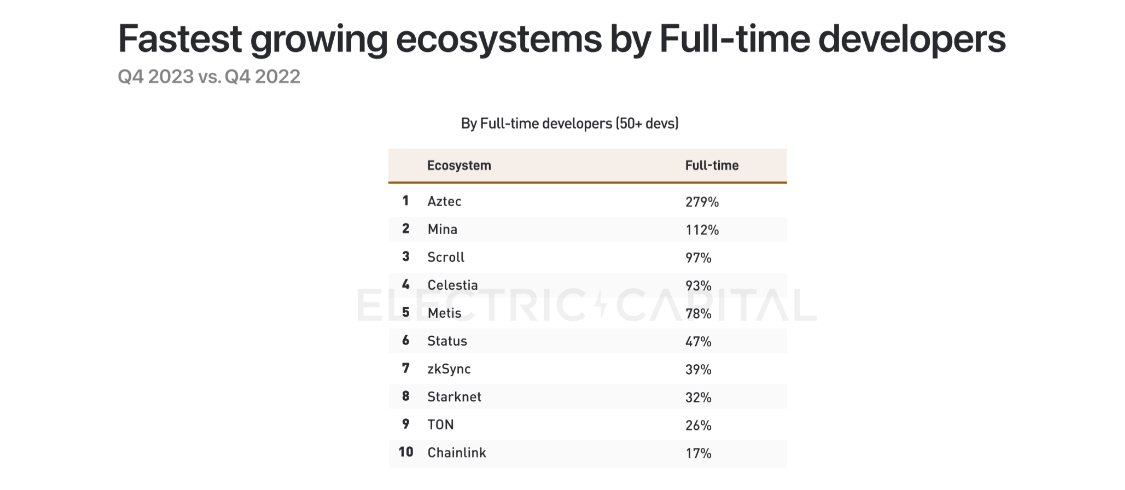

The report also categorizes ecosystems based on full-time developers, emphasizing projects that have garnered dedicated and consistent developer support. The top ten in this category are Aztec, Mina, Scroll, Celestia, Metis, Status, zkSync, Starknet, TON, and Chainlink.

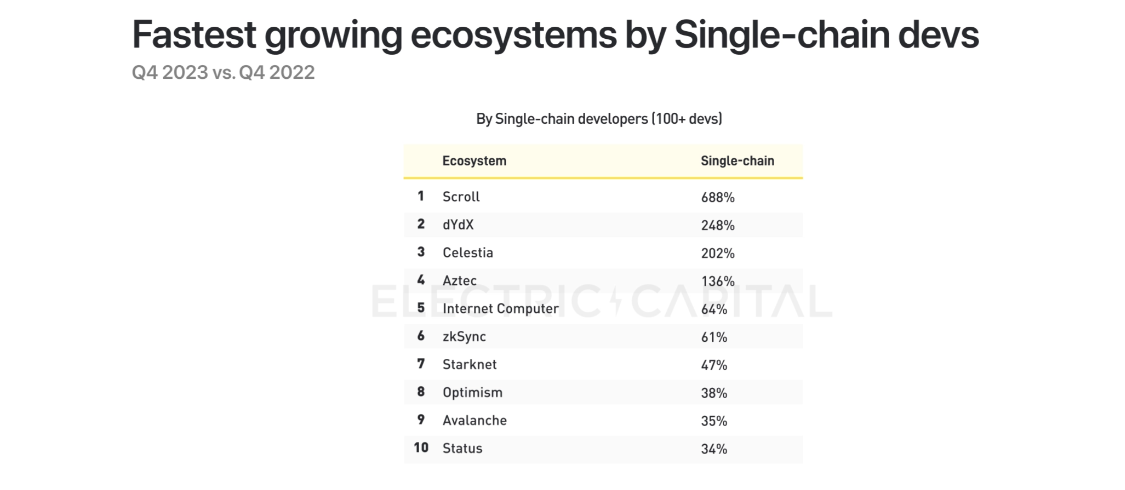

A closer look at ecosystems by single-chain developers reveals insights into projects that have gained traction within specific blockchain communities. The top ten in this category include Scroll, dYdX, Celestia, Aztec, Internet Computer, zkSync, Starknet, Optimism, Avalanche, and Status.

This observation indicates a resilient and committed community within the crypto space. Moreover, it suggests that these ecosystems are actively used and have identifiable use cases, indicating potential growth for their native tokens over time. This aligns with findings from a recent Pantera Capital report, which noted that in market cycles, Bitcoin consistently outperformed altcoins in phase 1. In phase 2, altcoins substantially outperformed Bitcoin.

The report emphasized that one of the highest sources of alpha historically stems from a well-timed rotation from Bitcoin into altcoins as phase 2 commences. Moreover, the Pantera Capital report stressed that altcoins with underlying protocols demonstrating product-market fit, generating real revenues, and boasting strong unit economics are poised to perform exceptionally well in the upcoming cycle.

As the crypto and blockchain industry continues to evolve, Electric Capital’s developer report provides valuable insights for investors, developers, and enthusiasts, guiding them in understanding the trends and discovering the best crypto to buy now. Despite an overall decrease in cryptocurrency developers, the emergence of a robust core group and the steady growth of experienced developers indicate the resilience of the crypto community.

Read the full article here