Solana’s (SOL) price has increased since January 23, breaking out from a corrective pattern yesterday.

The future SOL trend can be determined by the price movement this week. Will SOL break out or get rejected?

Solana Breaks Out From Corrective Pattern

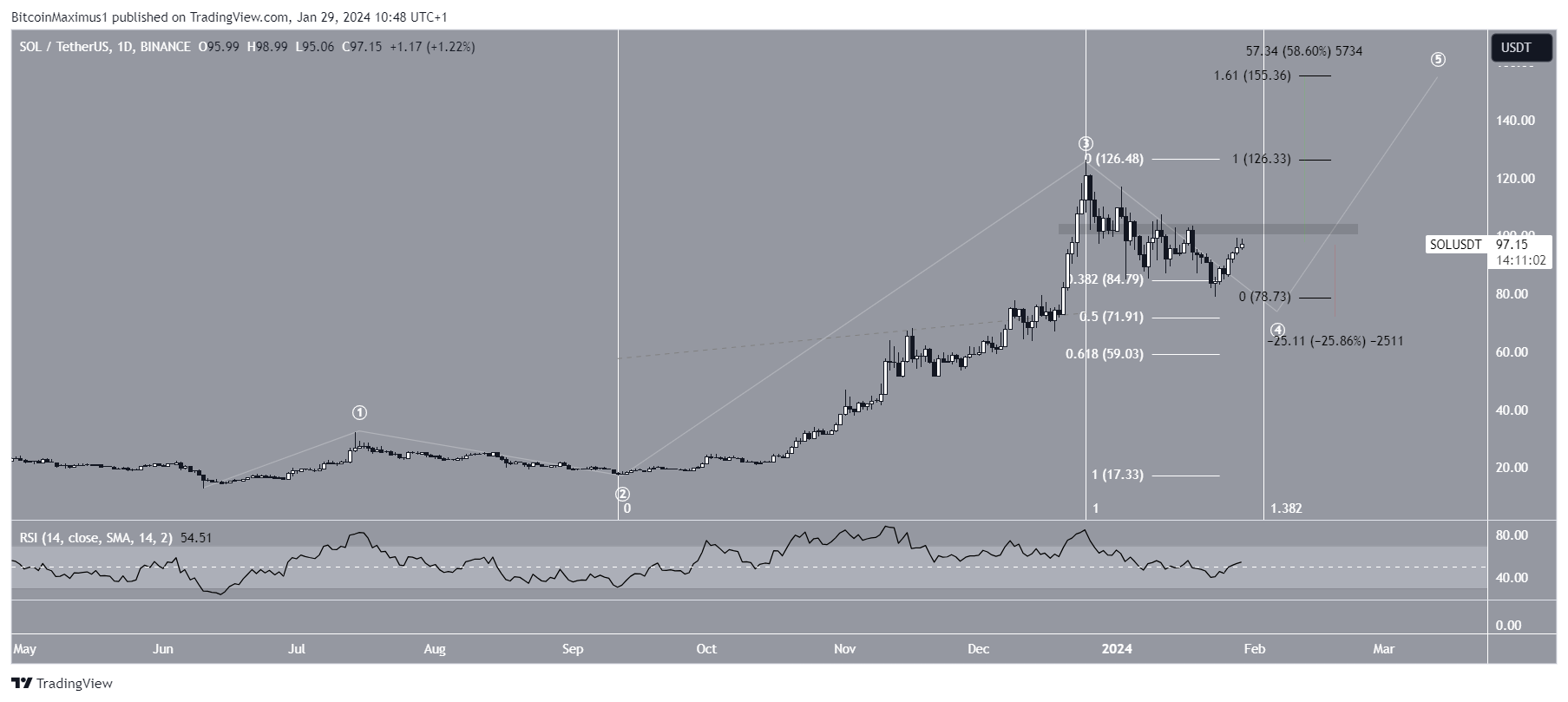

The technical analysis of the daily time frame shows that SOL has fallen since reaching its 2023 high of $126 on December 25. The decrease has been contained inside a descending parallel channel and led to a low of $78 on January 23, 2024.

SOL bounced afterward and has increased since. Yesterday, it broke out from the channel but has not increased significantly. The breakout occurred shortly after a decentralized exchange on Solana reached $250 million in trading volume.

SOL/USD Daily Chart. Source: TradingView

The daily RSI gives an interesting reading. The RSI is a momentum indicator traders use to evaluate whether a market is overbought or oversold and whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite.

Last week, the RSI fell below 50 (red circle) for the first time since the upward movement began in September 2023 (red icon). While the indicator has moved above 50, it has not confirmed the increase, which is crucial for the future trend.

What do Analysts Say?

Cryptocurrency traders and analysts on X are bullish on the future SOL trend.

Bluntz Capital said that SOL has completed sub-wave four, and the next upward move will take it to $150. He tweeted:

sol reclaimed breakdown range, move up to 150+ now basically confirmed. bears about to learn the true meaning of pain.

SOL/USDT Daily Chart. Source: X

Similar thoughts are given by CryptoMichNL, who tweeted:

#Solana is ready for upward continuation here. After the initial push upwards, there’s always a period of consolidation, and it seems it’s ended. A higher timeframe support test at $80 provided support. Looks likely we’ll be continuing towards $140.

SOL Price Prediction – When Will Price Break Through $100?

A closer look at the wave count and price action does not confirm the trend’s direction.

Technical analysts employ the Elliott Wave theory to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The wave count suggests that the SOL price is in wave four in a five-wave upward movement. However, it does not confirm whether wave four is complete or not.

The argument for completion is that the SOL price bounced at the 0.382 Fib retracement support level (green icon), a likely spot for wave four to end.

However, the argument against it shows that the correction has been extremely short timewise, failing to reach the 0.382 Fib length of wave two.

As outlined above, the daily RSI does not confirm if the bullish trend reversal has started. As a result, the reaction to the $100 resistance area will be key in determining the future SOL trend.

SOL/USDT Daily Chart. Source: TradingView

A breakout above $100 can trigger a 60% Solana price increase to the next resistance at $155, while a rejection will cause a 25% drop to complete wave four at the 0.5 Fib retracement support level at $72.

For BeInCrypto‘s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here