Everything is a drama. It’s a constant stream of feuds, arguments, and over-the-top meltdowns. There’s a copious amount of alcohol. And if there’s nothing exciting going on, they’ll manufacture some new drama, because we all get addicted to the dopamine rush.

As entertaining as it is to watch Teresa Giudice’s table flip, or the ongoing feud between Lisa Vanderpump and Kyle Richards, most of us would agree that stability is generally better than volatility.

Kids do better when they live in a safe, stable home than when their parents are raging alcoholics.

Relationships do better when both partners know what to predict, rather than manic-depressive outbreaks.

Economies do better when the value of the national currency is predictable, rather than hyperinflated.

And crypto projects do better when their token price is stable, not all over the map. Here’s why.

The Weird Thing About Token Investments

As long as I’ve been investing in this space, I only recently realized something important: your investments are denominated in the protocol’s token.

Let’s say we invest in ETH. Ethereum, of course, is like a massive computer that people pay money to use. Every time you use a dapp or buy an NFT on the Ethereum network, you pay a fee.

You don’t pay the fee in dollars, you pay it in ETH.

Now, our investing philosophy is that when you buy ETH, you’re also buying “shares” of the Ethereum “company.” If you believe in the long-term future of Ethereum, just buy and hold ETH, like you would invest in Apple or Tesla or any other tech company.

But if you’re holding ETH, you’re holding the native currency of the network.

This is the weird thing about crypto investments. When you buy shares of Apple, they’re denominated in dollars; you have a stable reference. If the price of $APPL goes up or down by 10%, it doesn’t suddenly get 10% more or less expensive to use your iPhone.

But when ETH goes up or down 10%, it does get more or less expensive to use the network.

Stop and think about this for a moment. I’ll wait.

Volatility Hurts Users

Because crypto investments often use the network’s own token, here’s why volatility is bad, again using ETH as an example.

Higher costs: When ETH price rises, this makes the network more expensive for users, which discourages adoption: it’s like using an ATM that may charge a $2 fee or a $20 fee, depending. And it’s not just the cost to use Ethereum, but every dapp built on top of it.

Uncertain rewards: Many DeFi protocols built on top of Ethereum offer rewards in their native token. But if the price of ETH drops significantly, it lowers the value of their token as well, which bleeds users from those protocols and dapps. (Remember, users = value.)

Devalued savings: Users also hold ETH as a store of value within the network (not as an investment, but to actually use the Ethereum computer). If the price crashes, their net worth goes down, eroding trust in the Ethereum network overall.

Volatility Hurts Investors

While short-term traders love volatility, long-term investors like us do not. Here’s why:

Volatility Risk: It is fun and rewarding to see the value of your ETH go up by 50% in a couple of weeks, but when it happens in reverse, investors cut their losses and sell in droves. Even if you have the stomach to ride it out, it is hard to keep your enthusiasm when you’ve lost 50%.

Market Correlation: Since ETH tends to move up and down with the price of bitcoin (and the wider crypto market), price may not have anything to do with how well Ethereum is doing as a “business.” Even if it’s gaining users and adoption, volatility can paint a different picture.

Future Value: This is the big one. The more volatile the price of ETH, the less predictable its potential fees, which affects everything: user growth, developer activity, the works. It’s like investing in AT&T, not knowing whether their phones will cost $40/month or $400/month.

I’ve used Ethereum as my example here, but the principle holds for every Layer-1 project where you’re investing in the token that runs the network. And it’s even more pronounced on Layer-2 projects, where you’re now investing in volatility on top of volatility.

I’m not saying that you shouldn’t invest in these protocols, but that long-term investors should root for stability.

Stability > Volatility

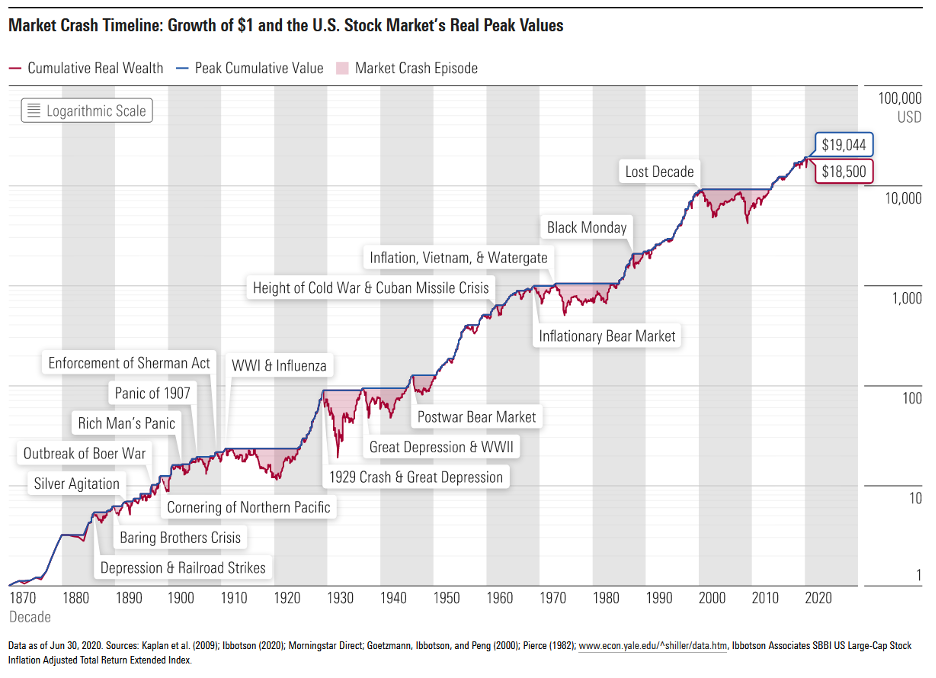

By saying that stability is better than volatility, I don’t mean that the price should never change. Ideally, we can see steady and (fairly) predictable growth, like, say, the U.S. stock market, whose volatility is smoothed out over time:

This is an ideal, of course. Nothing in nature is completely stable. We have hurricanes, floods, and fires. But long-term, there is an underlying stability that lets us predict the seasons will change and the sun will rise again tomorrow.

Let’s celebrate stability when it happens, because that is how people will trust crypto. That is how people will actually use it, for something other than speculation.

It won’t make great reality TV, but it will make a great investment.

Health, wealth, and happiness,

John Hargrave

Publisher, Bitcoin Market Journal

Read the full article here