Amid the ongoing relief rally in the cryptocurrency market, the Solana price has shown remarkable resilience, maintaining its position above the psychologically significant level of $80. This resurgence in buying interest has propelled the value of this altcoin value by 23% in just a week, leading to its current trading price of $97.3. This article will explore the potential factors that could sustain this recovery, potentially catalyzing a substantial reversal in the foreseeable future.

Constructive Pullback Set SOL for Higher Recovery

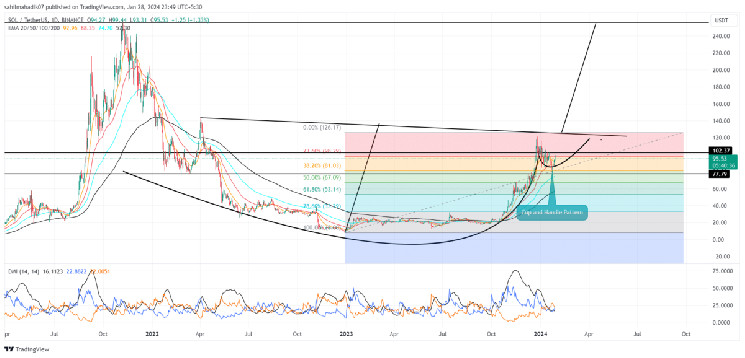

- The SOL price reversal from the 38.2% Fibonacci retracement level hints the last correction assisted buyers to replenish the bullish momentum.

- The rising 100 and 200-day EMA reflect the long-term trend in remain bullish

- The 24-hour trading volume on the Solana coin is $2.1 Billion, indicating a 60% gain.

Solana Price| TradingView Chart

Amidst a broader market downturn, especially following challenges with the Bitcoin ETF, the Solana price underwent a significant correction, plummeting from $126 to a recent low of $79. After this sharp 37.5% decline, the coin found solid support at the confluence of $80 and the 38.2% Fibonacci retracement level.

With the crypto market showing renewed recovery, as evidenced by the Bitcoin price rise above $42,000, the SOL coin managed to rebound from the aforementioned support levels. If the current bullish trend persists, it’s expected that buyers will target the immediate resistance at $102, corresponding with the 50% Fibonacci retracement of the recent correction.

A breakthrough above this resistance could propel the SOL price further, potentially revisiting the $126 level. Analysis of the daily time frame chart indicates that such a rally could complete a “Cup and Handle” pattern, a bullish reversal pattern typically observed at the end of major bear markets, suggesting a significant trend reversal for Solana.

Is Solana Price Ready For Uptrend?

The nearly two-year formation of the “Cup and Handle” pattern on Solana’s chart hints at a long-term bullish impact on its price. A breakout above the $126 neckline resistance could mark an early sign of a trend reversal, indicating the asset’s exit from a key accumulation phase. With sustained buying, the post-breakout rally might aim for an initial target around the $256 mark.

- Exponential Moving Average: The recent jump above the 20 and 50-day EMA indicates the recovery trend is returning to SOL price.

- Directional Moving Index: A potential bullish crossover between the DI+ and DI- could accelerate the bullish momentum in the market.

Read the full article here